Aug. 15, 2024, marks the 53rd anniversary of the “Nixon Shock,” the day that United States President Richard Nixon eliminated the gold standard for the US dollar. At the time, Nixon claimed that taking the dollar off the gold standard was “temporary” and would “stabilize” the dollar.

However, the effects of this decision have proven to be profound, and economists still debate its benefits and costs today.

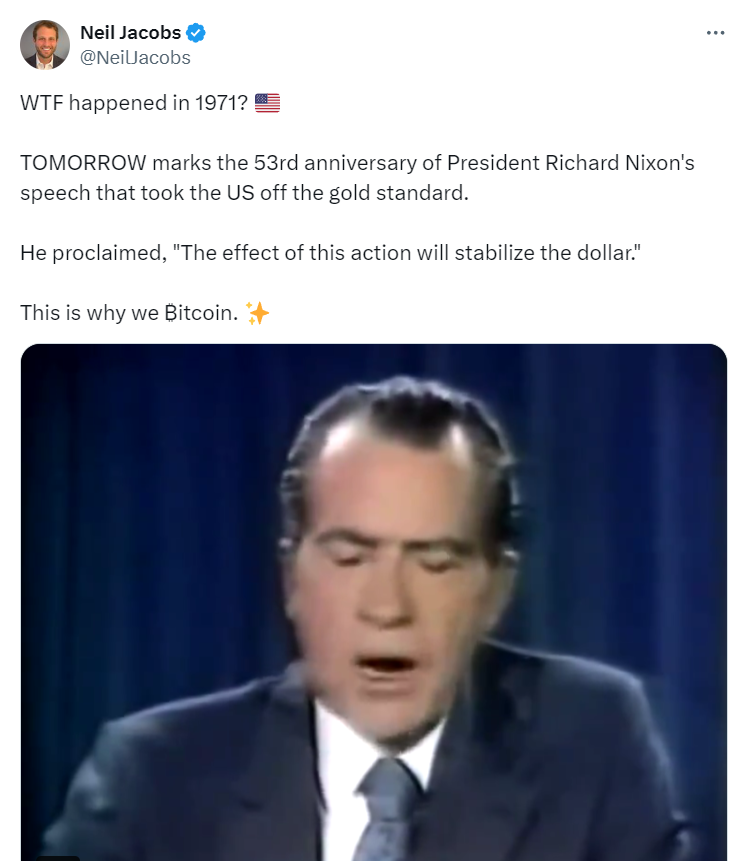

On Aug. 14, Niel Jacobs, head of brand management at Bitcoin savings platform Swan Bitcoin, reminded readers of the event’s continuing importance and argued that Bitcoin should be used as money. He stated, “TOMORROW marks the 53rd anniversary of President Richard Nixon’s speech that took the US off the gold standard.”

Noting that Nixon promised his action would “stabilize the dollar,” which has lost 98.5% of its gold value since that day, Jacobs stated, “This is why we ₿itcoin.”

The website WTF Happened in 1971, which was referenced in Jacobs’ post, chronicles the effects of the Nixon shock since the day it occurred. Citing data from the Economic Policy Institute, it claims that the relationship between wages and productivity was severed when the gold standard was ended.

Before 1971, productivity gains were passed down to workers in the form of higher wages. But after the gold standard was ended, the majority of productivity gains went into the hands of shareholders, causing the standard of living of workers in the U.S. to stagnate.

According to the site, stagnation forced families to send both parents to work since the only way to increase income was to work more. It also led to a host of other problems, the website claims, including a more than doubling of the amount of time it takes to save to buy a house, an increase in income inequality, rising prices for electricity, food and fruit, and other social ills.

The website was created by 3D graphics designer Ben Prentice, known as Mrcoolbp on X, and Bitcoin podcaster Colin, who co-hosts The Bitcoin Echo Chamber and is known on X as Heavily Armed Clown.

In contrast to the negative effects cited by Prentice and Colin, the original Nixon speech promised that the dollar would only be off the gold standard “temporarily” and that this policy would reduce inflation, not increase it.

Related: Trump floats paying off $35T national debt using Bitcoin

Nixon claimed that “international speculators” had been “waging an all-out war on the American dollar.” These speculators “thrive on crises” and “help to create them,” he stated. To fight against the speculators, he had given an order to “suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

Contrary to those who stated that ending the gold standard would cause massive inflation, Nixon claimed that “The effect of this action […] will be to stabilize the dollar.” He acknowledged that foreign goods might rise in price, but claimed that “if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today.”

In addition, Nixon claimed that he was against inflation and was determined to stop it. Inflation “robs every American, every one of you,” Nixon stated. “The 20 million who are retired and living on fixed incomes–they are particularly hard hit.”

To stop inflation, Nixon would take “decisive action that will break the vicious circle of spiraling prices and costs,” including not only ending the gold standard but also imposing temporary wage and price controls.

Despite this promise, the prices of nearly all US manufactured goods have soared since Nixon’s speech. According to automobile price data platform CJ Pony Parts, the cost of a 1971 Mustang Fastback was $3,006 when it launched. Adjusted for inflation the price would now be $22,595.

Prentice and Colin argue that this inflation has been a disaster. “Inflation is the source of most problems society faces today,” Prentice stated in a July 19, 2019 Post to X. “Real costs decline, prices rise, but wages don’t. This illusory phenomenon has disrupted all exchange, entrepreneurship, workers, savers, and borrowers; it’s corrupted our lives and culture.”

In a conversation with Cointelegraph in September 2020, Prentice claimed that returning to a gold standard will not solve these problems. Gold “failed as money,” he stated, “because we had to come up with paper in the first place to scale it and we know how many problems come with paper.” Instead, Prentice advocated for the use of Bitcoin as money. “We believe that Bitcoin is inevitable and it is the best money that has ever existed,” he stated.

Related: WTF happened in 1971 (and why the f**k it matters so much right now)

Despite the data presented in WTF Happened in 1971, most economists still consider the end of the gold standard to have been a benefit to the US and the world. In a Chicago Booth poll in 2012, a group of economists was asked whether they agreed or disagreed with the statement “If the US replaced its discretionary monetary policy regime with a gold standard, defining a ‘dollar’ as a specific number of ounces of gold, the price-stability and employment outcomes would be better for the average American.” 93% of the participants stated that they either “disagreed” or “strongly disagreed” with the statement.

As of today, it’s been 53 years since Nixon made his controversial decision to end the US dollar gold standard. But now that blockchain technology exists, will we still be using fiat currency in another 53 years? It seems that only time will tell. But in the meantime, this August 15 event will likely continue to be debated by economists, investors, and workers, as they continue to be affected by it.