Ether (ETH) price is down 5.2% between Sept. 3 and Sept. 4 after a strong rejection at the $2,550 resistance, marking eight days since ETH last closed above that level.

Traders are now concerned that Ether may underperform even if the broader crypto bull market resumes, as incentives for fixed income in the US are expected to decrease. So, exactly what is putting pressure on Ether’s price?

Will Ether drop if the tech stock bubble pops?

Some market participants may attribute the lackluster performance of cryptocurrencies to traditional financial market conditions, but Ether is also facing its own set of challenges, including lower network fees, appealing staking rewards, and weak demand for its recently launched spot exchange-traded fund (ETF) products. Therefore, it’s worth exploring whether these factors will continue to drive Ether’s price down in the future.

From a macroeconomic perspective, there is uncertainty surrounding the outcome of the upcoming US Federal Reserve decision to cut interest rates, which is expected to begin in September. Esther George, former Kansas City Fed president, mentioned that there is still hope for inflation to reach 2%, but the Fed’s credibility could be questioned, especially if the job market weakens, according to Yahoo Finance.

Additionally, Philadelphia Fed president Patrick Harker stated that the Fed’s interest rate cuts could become more aggressive if the labor market deteriorates. Typically, a more expansionary monetary policy favors risk-on markets, but if investors fear a recession is looming, demand for safe-haven assets surges, causing traders to seek shelter in safer investments, which could negatively affect Ether’s price.

Traders are particularly concerned about the tech sector, especially after Nvidia shares lost a record $279 billion in market capitalization on Sept. 3. The chipmaker experienced a 14% decline over three days following two cautious research reports on the growth of the artificial intelligence sector. Furthermore, Nvidia was subpoenaed on Nov. 3 as part of a US Department of Justice antitrust investigation.

However, multiple factors unique to Ether could justify its potential underperformance relative to the broader crypto sector. For example, reduced activity on Ethereum’s base layer has led to lower fees, posing a threat to the network’s sustainability. Some might argue that this reflects the successful adoption of layer-2 scaling solutions, but it still represents a risk in terms of long-term incentives.

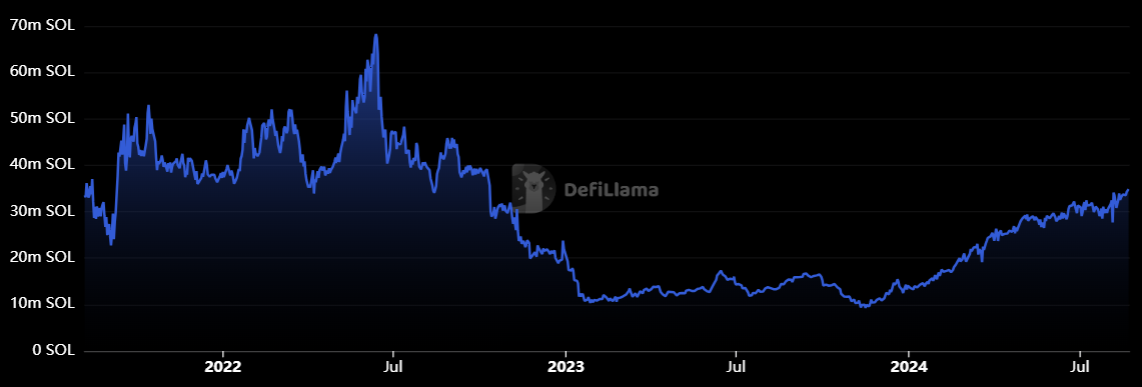

Ethereum network weekly fees, USD. Source: DefiLlama

In the week ending Aug. 31, Ethereum network fees dropped to their lowest level in over four years, reaching $3.1 million, according to DefiLlama. This 88% decline over four weeks has led to criticism of Ethereum’s compensation model. One such critique, posted by cygaar, a contributor to AbstractChain, blames the “essentially free” cost of data availability for rollups for this downturn.

Cygaar also highlights the relatively low demand for layer-2 solutions due to the lack of “interesting consumer-facing applications” that could help restore a healthy level of fees. The analysis questions whether researchers overestimated the demand for rollups and if gas costs would be necessary for long-term network security.

Declining Ethereum network fees and weak spot Ether ETF flows

Besides the decline in network fees, Ether is also struggling with its spot ETF products, which saw $47 million in net outflows on Sept. 3 alone. In fact, these instruments have recorded $475 million in outflows since their US market debut on July 23. The lack of investor interest is concerning, especially since institutional demand was considered a key part of Ether’s appeal.

Related: ETH restaking surge driven by a decrease in annual staking rates — P2P.org

Contributing further to Ether’s price decline is the relatively low 3.2% staking reward, particularly when factoring in the current 0.7% annualized inflation rate, according to StakingRewards. The yield is lower than that of most US government bonds, and the failure to deliver on the ‘ultrasound money’ narrative promoted by some analysts may have disappointed investors.

Ultimately, there’s no indication that the factors weighing on Ether’s price—such as declining network fees and low demand for its spot ETF products—will reverse anytime soon. While this doesn’t guarantee that Ether’s price will stay below $2,550, it does suggest that ETH is unlikely to outperform the broader crypto market in the near term.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.