Cardano’s (ADA) price rallied by 9% over the weekend after The Artificial Superintelligence Alliance (ASI) announced that their native token, FET, has been deployed on the Cardano blockchain.

This led to renewed interest in the ecosystem, and other on-chain ADA metrics also witnessed significant activity.

SingularityNET, Fetch.ai, Ocenal Protocol’s ‘ASI’ token launches on Cardano

On Sept. 7, the ASI alliance announced the deployment of its native token, FET, on the Cardano blockchain, emphasizing the ADA network’s security speed and low transaction costs as its primary reasons.

FET, which will be rebranded as the ASI ticker, is now a native Cardano token (CNT), which offers improved functionality and integration with the ADA ecosystem.

Both ADA and FET rallied collectively after the announcement, wth an 8.39% and 6.85% gain, respectively, since Sept. 7.

Ben Goertzel, CEO of SingularityNET, praised Cardano’s infrastructure, explaining that its “mathematical elegance” will play a key role in advancing Artificial General Intelligence.

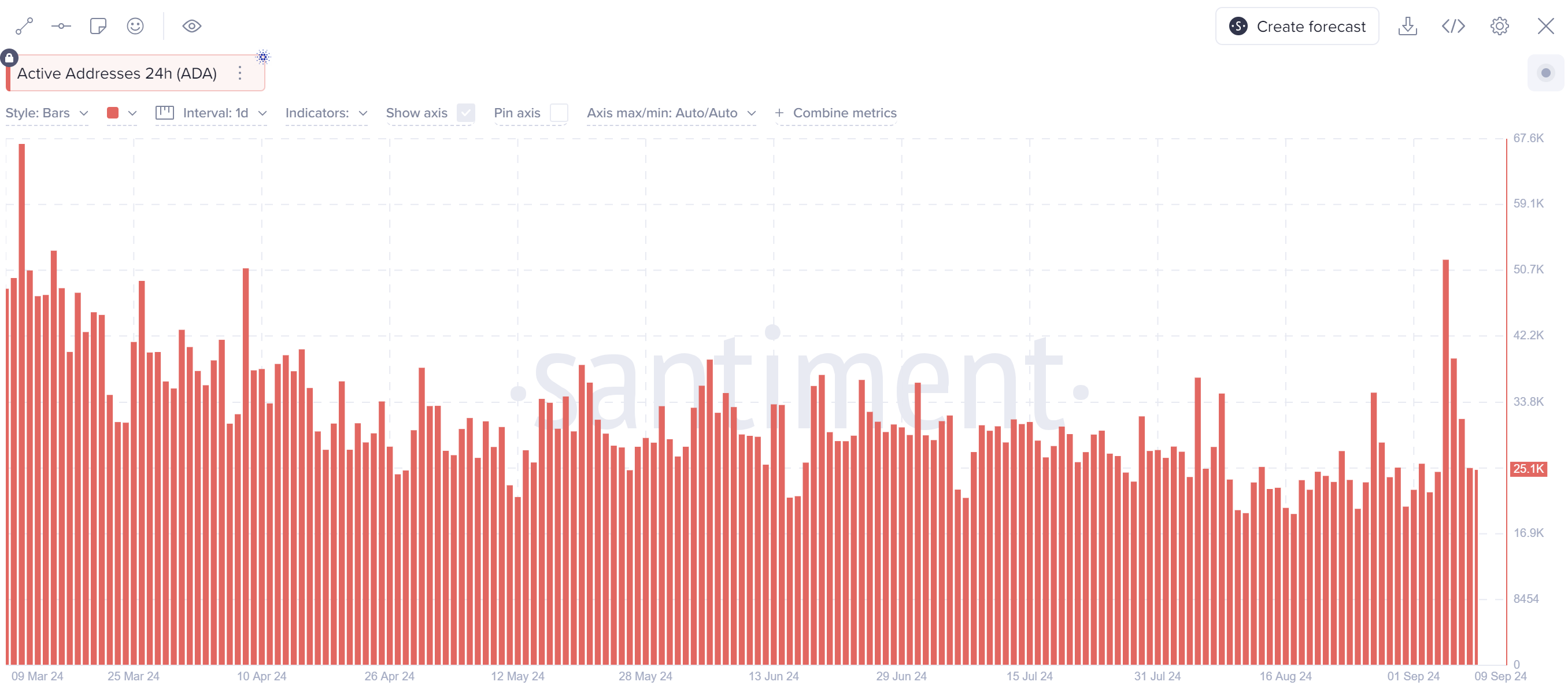

Cardano active addresses hit a 5-month high

The announcement created a domino effect for Cardano, as ADA active addresses reached a 5-month high on Sept. 7. Data from Santiment, an analytics platform, highlights that active addresses reached 52,077 on Sept. 7, the highest since March, 2024.

Cardano active addresses. Source: Santiment

The rise in ADA active addresses occurred before the rally, possibly helping ADA develop a short-term bullish sentiment.

Meanwhile, after a period of negative funding, the funding rate turned green over the weekend, which means long bets possibly dominated the price action.

Cardano open interest, funding rate chart. Source: Velo.xyz

However, it is important to note that ADA open interest has remained constant over the past month without a significant rise or decline.

This may indicate that the price is being dictated by a small group of futures traders, which means if they flip bias, ADA can potentially have a bearish trend continuation.

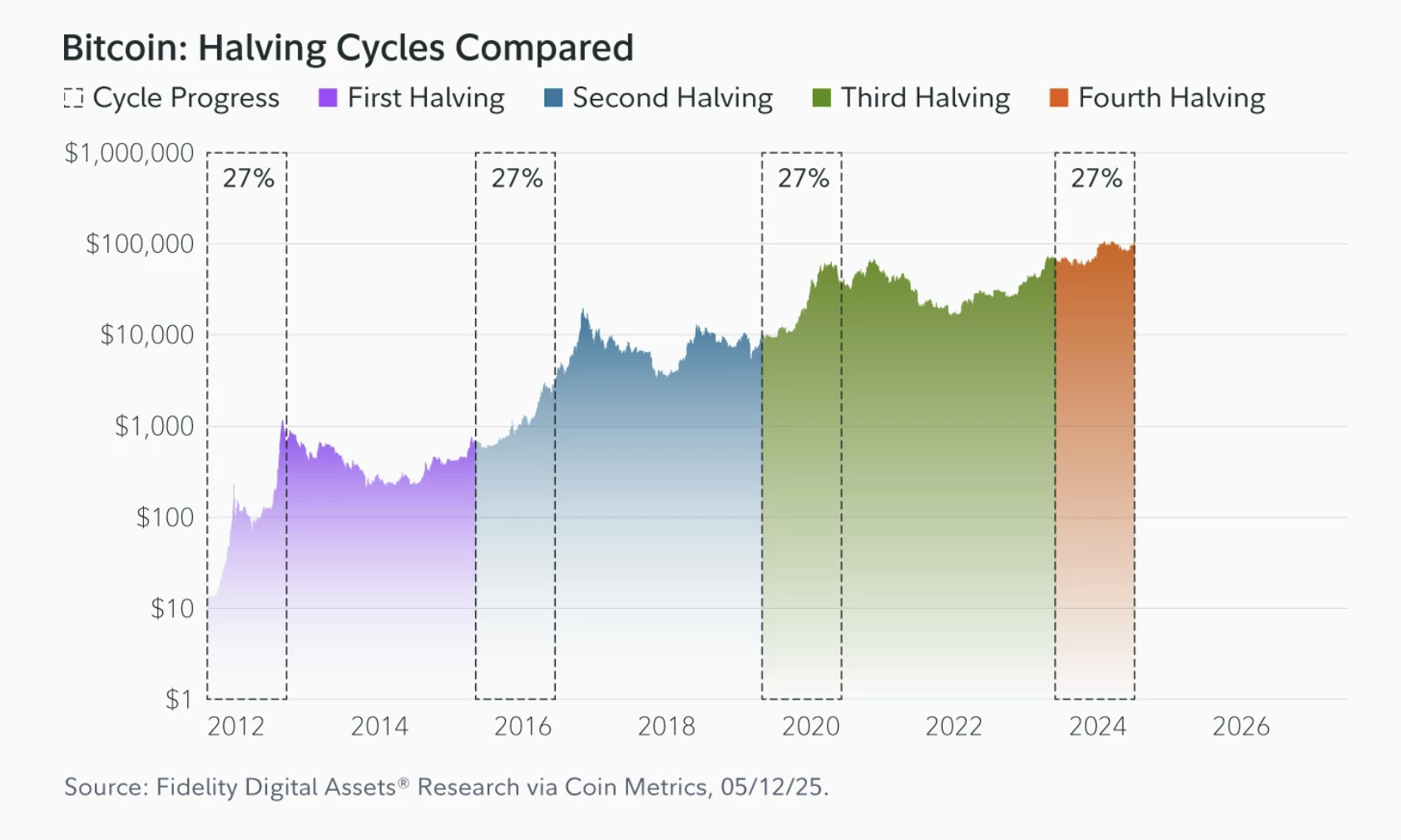

ADA shares a high correlation index with BTC

Another possible reason why ADA rallied over the past few days is its high correlation to Bitcoin (BTC) price. Bitcoin managed to close above $54,000 on the weekly candle, and is currently trading above $55,000.

Data indicates Bitcoin and Cardano share a high 90-day rolling correlation index of 0.74. The correlation has risen by more than 10% since the beginning of August.

Cardano-Bitcoin correlation chart. Source: blockchaincenter.net

While BTC’s returns are only 3% over the weekend, it has provided ADA with a bullish base to build on from its ASI collaboration news.

Cardano price eyes 18% rally to $0.40

ADA price rallied to as high as $0.35 on Sept. 9. On both the 1-hour and 4-hour charts, ADA has successfully undergone a break of structure (BOS) of the current bearish trend.

On the 1-hourly chart, ADA has managed to retain a price position above the 200-day EMA level after a bullish double-bottom pattern was formed. However, ADA currently faces resistance from the same indicator on the 4-hour chart.

Cardano 1-hour, 4-hour chart, Source: Trading View

ADA price could potentially retest local highs at $0.40 over the next few days if it’s able to breach the 200-day EMA level on the 4-hour chart as well.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.