Bitcoin (BTC) fell 8% between Sept. 4 and Sept. 6, breaking below the $54,000 support for the first time in over a month. The correction accelerated after US labor market data was released, though negative momentum had already been building due to ongoing outflows from spot Bitcoin exchange-traded funds (ETFs).

Traders are now considering whether additional factors contributed to this recent price weakness and how likely it is that Bitcoin will revisit sub-$50,000 levels.

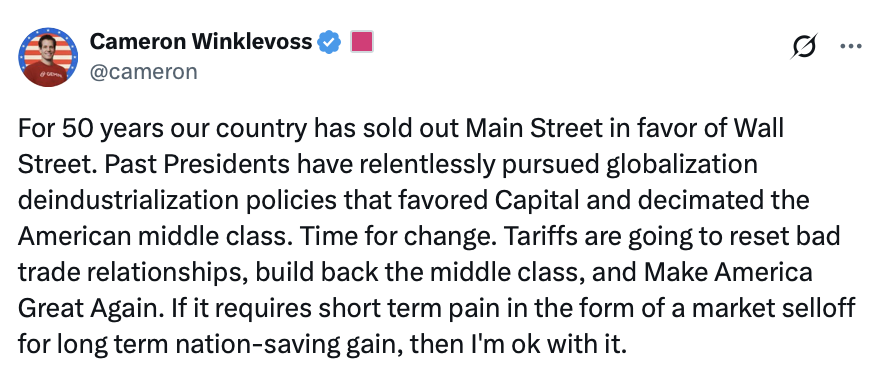

US jobs data and fear of “tech bubble” impact on Bitcoin price

It’s essential to assess how weaker-than-expected US nonfarm payroll data impacts the Federal Reserve’s (Fed) strategy of lowering interest rates without causing a recession. Sonu Varghese, global macro strategist at Carson Group, told CNBC that “payroll data indicate risks are rising as the labor market is clearly softening, and the Fed needs to step in to cut off tail risks.”

S&P 500 (left) vs. Bitcoin/USD (right). Source: TradingView

Despite this, there is no consensus on whether the Sept. 6 labor data increases the probability of a broader stock market correction. However, the CME FedWatch tool suggests that the odds of a 0.50% rate cut in September have risen. The S&P 500 is on track for a 4% weekly drop, potentially marking its worst five-day performance of 2024, mainly driven by tech sector losses.

Emily Roland, co-chief investment strategist at John Hancock Investment Management, commented, “The market’s oscillating between this idea of is bad news bad news, or is bad news good news, and the sense that it may revive hopes that the Fed moves more aggressively than markets anticipate.” In short, traders are concerned about recession risks but optimistic about a potential shift to a less restrictive monetary policy.

Zach Pandl, head of research at Grayscale Investments, is more bullish. He noted, “The August jobs report hit the sweet spot for Bitcoin: the labor market has slowed, which will allow the Fed to cut rates, but there are no signs of recession.” Pandl also mentioned that the US presidential elections in November and “large US budget deficits” create a favorable environment for Bitcoin’s institutional adoption.

In light of the short-term uncertainty in traditional markets, especially the tech sector and artificial intelligence investments, it’s clear why investors have been reluctant to increase their Bitcoin positions, despite the recent price drop. Additionally, Warren Buffett’s conglomerate, Berkshire Hathaway, reducing its stake in Bank of America has only added to the bearish sentiment.

The latest seven-day record of net outflows from US-listed spot Bitcoin ETFs has sparked questions among traders. They are now speculating whether the current price action reflects moves by savvy investors anticipating further volatility, increasing the possibility of turmoil in risk markets. Some suggest that fears of a “tech bubble” are driving the demand for short-term government bonds, while others point to stress in the commercial real estate sector.

Related: Arthur Hayes sees sub-$50K BTC price as Bitcoin risks ‘stark’ trend shift

Regulatory actions and fear of sell-off from the Bitcoin mining sector

Regardless of what is causing traders to become more risk-averse, the yield on US Treasury two-year notes has dropped to its lowest level in two years. Investors are willing to accept lower returns in exchange for the safety of these bonds.

Adding to the bearish tone is the recent negative ruling in Coinbase’s attempt to dismiss a class action lawsuit brought by its shareholders. The plaintiffs allege that the exchange misled investors about the risk of regulatory action and potential asset losses. While the ruling may not directly impact Bitcoin’s price, it reduces the incentive for institutional investors to enter the market.

Bitcoin miners’ net position change, BTC. Source: Glassnode

Bitcoin investors are also concerned that miners may be forced to sell some of their holdings. According to Glassnode data, miners have been accumulating Bitcoin since Aug. 15, but as the price remains below $60,000, sell pressure from miners could build. In short, both macroeconomic factors and regulatory issues, combined with the fear of a miner sell-off, are contributing to the bearish sentiment surrounding Bitcoin.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.