On Oct. 24, a filing by Microsoft Corp. (MSFT) with the United States Securities and Exchange Commission (SEC) revealed an unexpected item on the agenda for its upcoming annual shareholder meeting on Dec. 10.

Alongside routine votes—such as the election of directors, the ratification of its independent auditor, and reports on AI misinformation—one proposal stood out: an “Assessment of Investment in Bitcoin.” Interestingly, Microsoft’s board recommended shareholders vote against it.

Microsoft’s cash position and the potential Bitcoin price impact

As of its second-quarter 2024 financial report, Microsoft held $76 billion in cash and equivalents. If shareholders pushed the company to allocate even 10% of that to Bitcoin, it would represent a massive $7.6 billion investment.

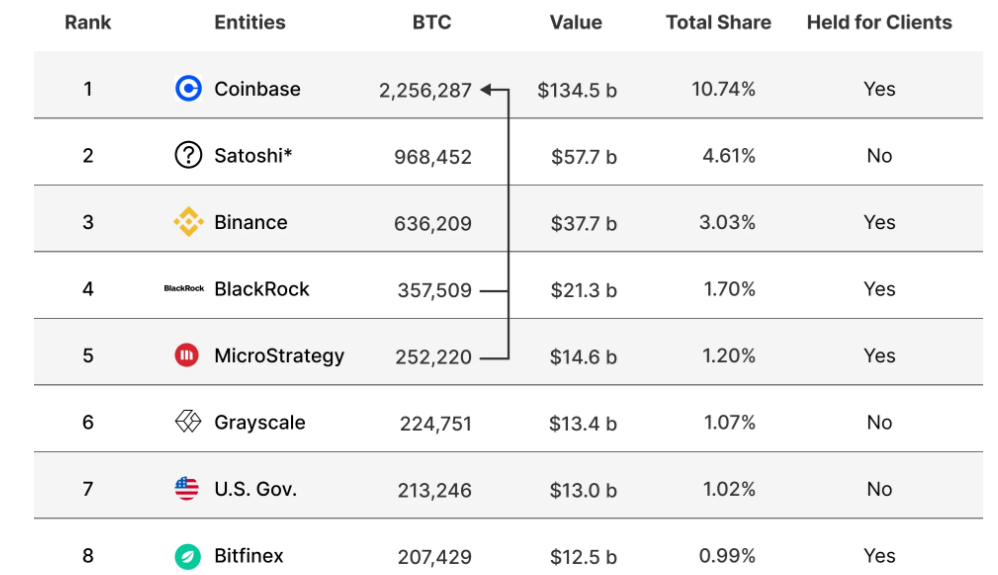

Top Bitcoin holders. Source: River

At an average price of $73,000 per Bitcoin, this would translate to 104,109 BTC—nearly eleven times the amount held by Tesla, which currently amounts to 9,720 BTC. While this figure would be substantial, it would still trail behind MicroStrategy’s aggressive accumulation strategy, which has resulted in holdings of 252,220 BTC.

However, with Bitcoin supply dwindling—over 80% of all BTC hasn’t moved in more than six months, and the balance of BTC on exchanges has fallen to its lowest levels in over 4 years—a Microsoft acquisition of this magnitude could create a supply shock.

Whether this will become a reality depends on how shareholders vote in December, but even the possibility has already sent ripples through both corporate and crypto sector circles.

How US shareholder votes work

In US public companies like Microsoft, shareholders vote on important decisions at annual meetings. Votes on special proposals, like the one for Bitcoin investment, are typically non-binding, but they serve as a gauge of shareholder sentiment and can pressure the company to act accordingly if enough support is garnered.

A large shareholder can compel a company to consult all shareholders on specific issues, as per SEC regulations for public companies. However, the board has advised voting against the Bitcoin proposal, likely reflecting caution around volatility and regulatory uncertainty. Still, the growing demand for Bitcoin from institutional investors cannot be ignored.

Related: Bitcoin whale accumulation hits 670K all-time high amid BTC’s v-shaped bounce

Reid Hoffman, LinkedIn founder and a Microsoft board member, expressed his favorable views on Bitcoin in a Yahoo Finance interview. Hoffman referred to Bitcoin as a digital store of value and emphasized its role in reshaping the future of financial systems. Hoffman is known for being an early investor in Xapo, a key Bitcoin custody services provider.

If Microsoft decides to invest in Bitcoin, several methods are available. The company could directly purchase Bitcoin on regular exchanges, similar to how Tesla acquired its holdings.

Another option is buying shares of a Bitcoin spot ETF, which provides indirect exposure, with added liquidity and regulatory clarity, avoiding direct custody risks associated with holding physical assets. This structure also facilitates easier buying and selling, which can improve capital efficiency.

Microsoft could also consider using leverage, including the use of derivatives, like call options, to strategically increase its market exposure without deploying large upfront capital. This enables speculation on price movements, potentially amplifying returns. However, it introduces additional risk due to the leveraged nature of such positions.

Ultimately, Microsoft is unlikely to invest in Bitcoin soon, but shareholder pressure highlights Bitcoin’s appeal, potentially encouraging other companies to explore it.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.