The US Department of Justice (DOJ) is poised to auction off $6.5 billion worth of Bitcoin (BTC) seized from Silk Road. The decision follows a Dec. 30 court ruling, concluding a protracted legal battle over ownership of this BTC.

US government could sell more BTC before Trump

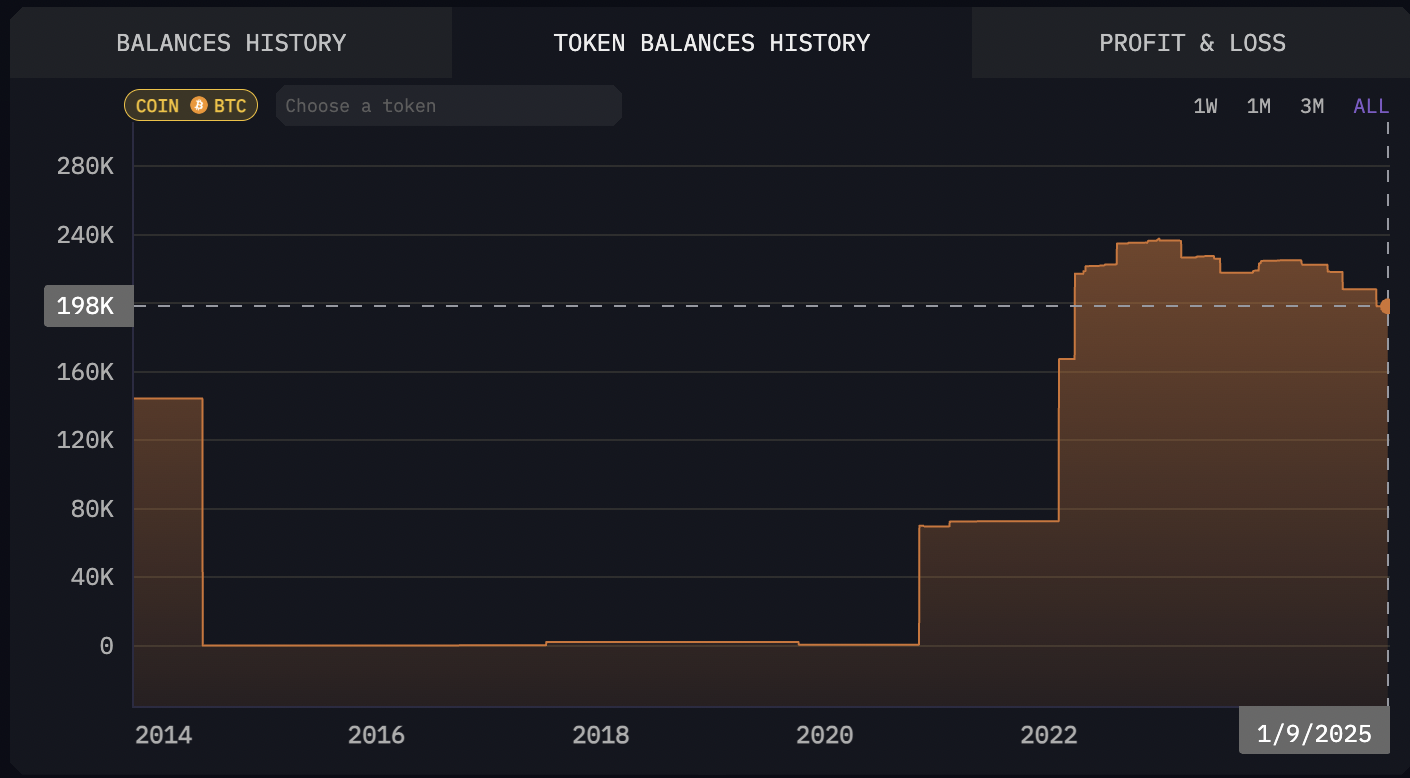

As of Jan. 9, the US government was holding 198,000 BTC, worth around $18.5 billion, according to data resource Arkham Intelligence. The $6.5 billion is part of the same reserves.

US government’s Bitcoin balance history. Source: Arkham Intelligence

Some analysts speculate that the outgoing Joe Biden administration may sell all government-held Bitcoin in a politically motivated decision ahead of Donald Trump’s upcoming presidency.

Fox Business contributor Jason Williams claimed the Biden administration is instructing the DOJ to offload thousands of Bitcoin during a bull market, fully aware that the incoming Trump administration may buy it back at higher prices.

“This is a blatant perversion of the government’s fiduciary responsibility,” Williams stated, adding:

“We’re selling Bitcoin for approximately $94,000. What price will Trump have to pay to buy them back? Higher.”

Can DOJ sell-off crash Bitcoin price?

Bitcoin’s price dropped 2.78% after the ruling. The decline occurred amid market concerns that the DOJ’s potential Bitcoin auction could put additional downward pressure on BTC prices.

BTC/USD daily price chart. Source: TradingView

However, history shows that US government Bitcoin auctions have had little lasting impact on BTC prices.

For example, between March 2023 and now, the US government’s Bitcoin holdings have dropped from 236,000 BTC to 198,000 BTC — a reduction of approximately 38,000 BTC, valued at around $3.54 billion at current prices.

Despite this sell-off, Bitcoin’s price surged 375% during the same period, fueled by strong demand for newly launched spot Bitcoin exchange-traded funds (ETFs) and growing optimism surrounding Trump’s electoral pledge to include Bitcoin in the US strategic reserves.

Related: Bitcoin whales have scooped up 34K BTC since December dump: Analyst

Glassnode co-founders Jan Happel and Yann Allemann clarified how the US government handles Bitcoin sales.

They noted that once the Bitcoin is forfeited, the DOJ transfers it to the US Marshals Service, which manages sales through public auctions. These auctions are transparent and do not involve selling Bitcoin directly on cryptocurrency exchanges.

Direct sales on exchanges could flood the market with supply, creating steep price drops, whereas auctions minimize this risk.

US gov’t misses out on $17.9B in Bitcoin profits

The US government has already missed out on some large profits through its previous Bitcoin sales.

The government has seized and sold approximately 195,092 BTC over the years, generating roughly $366.5 million in revenue from these auctions. However, at current prices, the cumulative value of the sold Bitcoin would be worth an estimated $18.25 billion.

Tracker for sales of US-government-seized BTC. Source: Jlopp.github

That means the government missed out on potential gains of nearly $17.9 billion, highlighting the significant opportunity cost of liquidating its holdings early.

“Last year, $379B entered the market based on realized cap—roughly $1B per day,” said Ki Young Ju, the founder and CEO of data platform CryptoQuant, adding:

“The US govt selling $6.5B could be absorbed in just a week. Do not panic.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.