Investor and memecoin analyst Murad Mahmudov’s memecoin supercycle theory has gained traction among traders.

The theory, in short, states that a confluence of factors will create an essentially unending supercycle for meme-centric cryptocurrencies.

But unlike other crypto market narratives with complex technical explanations and mechanics, memecoins appear to rely solely on community, emotion and the promise of wealth.

Despite the lack of memecoin fundamentals, traders are drawn to the sense of camaraderie and the promise of rapid gains.

Kyle Kemper, who has developed political memecoins such as Make America Healthy Again (MAHA), argues that the memecoin supercycle doesn’t signal the death of fundamental analysis but rather a shift in the metrics used.

“Critical analysis of projects, teams and missions is being replaced by factors like how strong a project’s key opinion leader (KOL) game is, along with volume and chart performance,” he told Cointelegraph.

The apparent success of the memecoin supercycle theory among crypto traders indicates a deviation of their preferences.

“Memecoin investors are looking for 24-hour or less returns, whereas a typical venture capital firm has a seven-year outlook.”

Basel Ismail, CEO of investment analytics platform Blockcircle, attributes the rise of memecoins to the increasing maturity of crypto traders, stating that many traders have experienced at least one market cycle, gaining valuable lessons from their experiences.

Ismail believes veteran crypto traders have realized that most tokens marketed as providing technical solutions — so-called utility coins — lack real intrinsic value and utility beyond speculative price movements. Mahmudov covered this matter during a presentation at Token2049, quoting an X user who argued:

“Nearly all of the tech in crypto is a smoke screen designed to sell you a token that does nothing.”

Ismail believes most utility token valuations stem from their meme component, estimating that around 70% of a utility token’s value is driven by speculation.

Recent: 5 reasons why Trump’s World Liberty Financial token crashed and burned

He said that traders, shaped by past experiences, are wary of being “burned again” after witnessing crypto projects with supposedly solid technological foundations soar 100x in three months, only to collapse by 99% in the same period.

“Right now, traders are acting like sheep. They’re just shifting their attention and their capital toward memes.”

Memecoins are also fueled by a “very strong sentiment that is anti-venture capitalism and anti-private equity,” said Ismail.

He explained that investors have felt misled by venture capitalists, who often release locked tokens on centralized exchanges, dumping them on unsuspecting retail investors.

“Memecoins fundamentally don’t try to deceive you and lie and try to make false promises and uncompleted expectations. People value that.”

The love for memes combined with the power of mimetics has created a social and psychological phenomenon where people want to unite with like-minded people. “We are all congregating, sharing joint beliefs,” said Ismail.

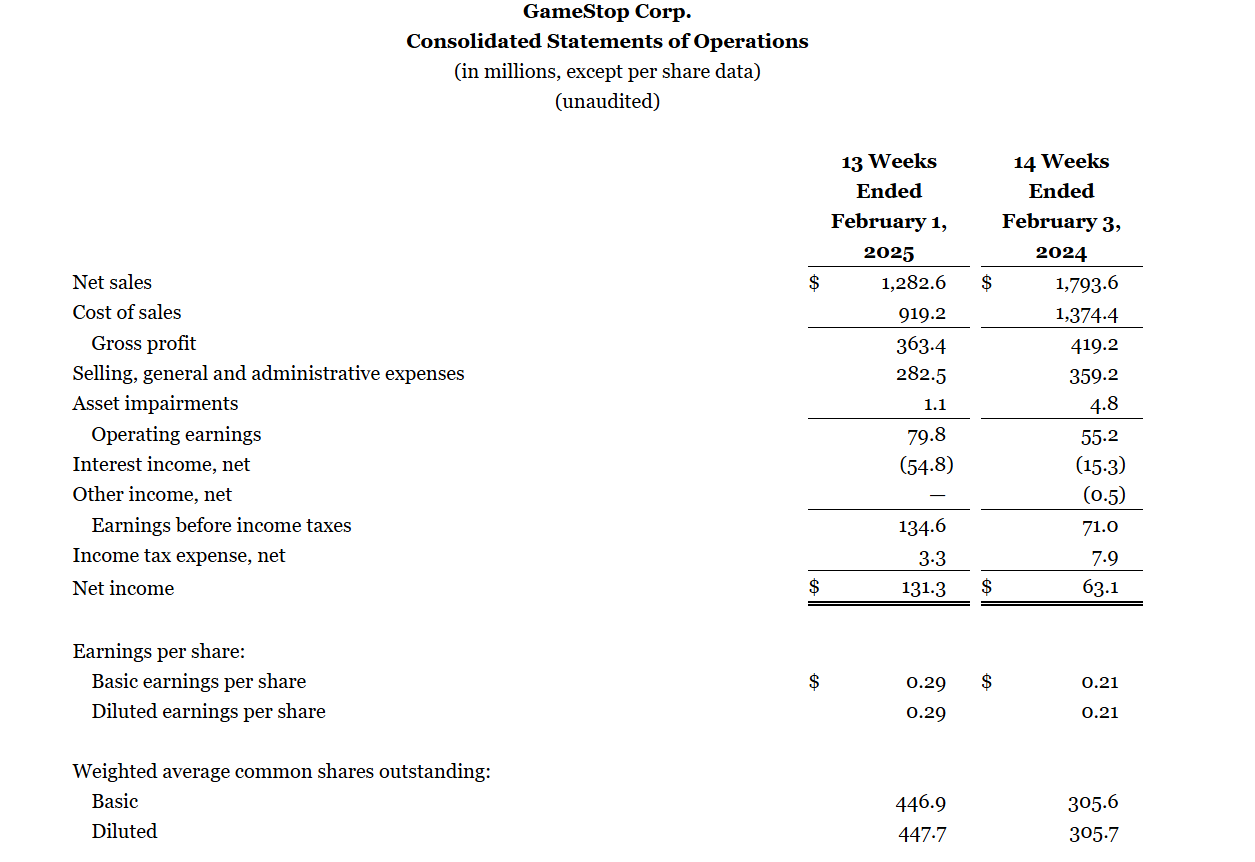

Ismail noted that while the motivation may seem superficial to some, the strength of a shared ideal within a community of investors is significant. He cited the unprecedented phenomena of the AMC and GameStop stock runs. “They rally the troops, bringing a young, vibrant and energetic community together around an ideal or philosophy that they can make a long-lasting impact.”

Source: Akshay Agrawal

The memecoin supercycle is super unsustainable

Despite the apparent success of the memecoin supercycle, some doubt its long-term sustainability. Jameson Lopp, co-founder of crypto custodian Casa, told Cointelegraph he believes the memecoin frenzy is unlikely to last and may be misguided.

Pseudonymous crypto market analyst and trader Crypto Rand explained that the memecoin economy thrives on hype, driven by impulsive traders chasing a quick buck. This mindset fuels extreme volatility and rapid liquidation cascades.

Crypto Rand told Cointelegraph that the success of memecoins lies in their marketing and hype, comparing them to clothing trends that come and go in a blink.

97% of memecoins have died since 2024. Source: Chainplay

Crypto Rand said he sometimes drops money into memecoins, stating that it has the same value as a bet on a soccer match or the US elections.

“Memecoins can hardly be an ‘investment’ rather than quick trades.”

Angel Versetti, founder and owner of the Dogecoin Foundation, criticized Mahmudov’s supercycle theory, telling Cointelegraph it’s based on investors growing irrational due to collective mental and hormonal shifts.

He concluded that “the state of investors in the memecoin financial markets is basically indicating a mental illness.”

Slide where Murad Mahmudov references collective mental and hormonal well-being. Source: Token2049

For Versetti, a market model that bases its growth on “a greater level of delusion” among market participants “doesn’t sound like a sustainable economic model.”

Since memecoins do not intend to create any utility, they can only keep growing “purely due to the growing delusion of investors,” he said.

Versetti explained that initial coin offerings went through a similar process, where an investor would have a 1% chance of succeeding, but at least some “attempted to have a vision and build something.”

He pointed out how some legit products have emerged from the ICO explosion, such as Tezos (XTZ), Cosmos (ATOM), Chainlink (LINK), BNB (BNB) and Basic Attention Token (BAT), among others.

Lopp believes that in the long run, the market will sort out this type of delusional investing, as “projects that are building castles in the clouds are doomed to revert to their true value of zero.”

Source: Jameson Lopp

Lopp advocates for projects that offer a solution or a token that can be useful for any activity, especially if the project desires a sustainable life cycle.

“Projects that focus on delivering actual utility and value rather than zero-sum games will do just fine by ignoring the hype and continuing to build toward their goals,” he said.

Kapil Dhiman, CEO of quantum-resistant digital ledger Quranium, told Cointelegraph, “Utility tokens are not just speculative instruments but essential components of decentralized ecosystems.”

He said, “Without this strong technological foundation, the entire blockchain industry risks stagnation. […] Memecoins, driven by speculative frenzy, may generate quick profits, but they cannot sustain the long-term growth and credibility of the space.”

Mahmudov has a lot to gain from the memecoin hype

Observers have also pointed out that Mahmudov stands to profit personally from the proliferation of his memecoin narrative.

“Some folks will happily delude themselves that they’re going to magically get rich for one reason or another,” said Lopp, “Often it’s because someone who has an actual plan to get rich needs them to believe a narrative.”

Recent: Trump based memecoins could thrive after election no matter what

On Oct. 9, onchain investigator ZachXBT claimed that Mahmudov allegedly holds $24 million in memecoins.

This may suggest he’s putting his money where his mouth is, but it also shows he has much to gain from the memecoin supercycle narrative taking off.

Onchain analytics platform Lookonchain reported that Mahmudov made $23.6 million in just four months thanks to the surge of memecoin SPX6900 (SPX).

#SPX6900 also known as $SPX has the most insane core group of diamondhanded believers in the entire crypto landscape.

We don’t plan on selling even a cent for a very, very long time.

Join this Emerging Memetic Movement that will become the Biggest Memecoin in World History. pic.twitter.com/HtkyR27pTd

— Murad 💹🧲 (@MustStopMurad) October 16, 2024

Lopp said that the success of memecoins reflects the nature of permissionless systems, where people will inevitably do foolish or even scammy things.