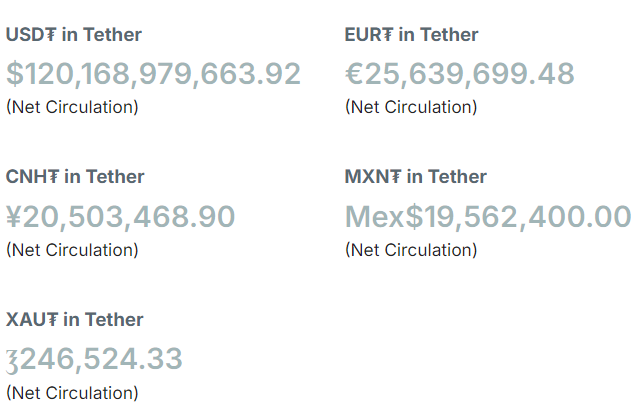

Tether’s United States dollar-denominated stablecoin has surpassed the record $120 billion market capitalization for the first time, signaling a potential crypto rally.

Tether’s USDt (USDT), the world’s largest stablecoin, surpassed the $120 billion mark on Oct. 20, according to the firm’s website, which offers live updates of the stablecoin’s supply.

Tether Tokens in circulation. Source: Tether.to

Stablecoins are the main on-ramp between the world of fiat currencies and digital assets. A growing stablecoin supply is often used as a signal to predict an upcoming bull rally, as it suggests that investors are loading up on stablecoins before investing in cryptocurrencies.

The growing USDT supply could help catalyze the next Bitcoin (BTC) rally. In August, Tether minted $1.3 billion of USDT in five days after the Bitcoin price bottomed at a five-month low of above $49,500 on Aug. 5.

By Aug. 9, the $1.3 billion USDT helped Bitcoin stage an over 21% recovery to trade at $60,271 from the Aug. 5 market bottom.

Related: Crypto trader profits $9M in 3 days, hits 3,000x return on investment

Can $120 billion USDT catalyze the “Uptober” Bitcoin rally?

Tether’s growing stablecoin supply could catalyze the next “Uptober” rally (crypto slang for October) because the month is historically bullish for the Bitcoin price.

Looking at Tether’s treasury flows, a significant portion is being sent to some of the largest centralized exchanges (CEXs), signaling incoming buying pressure from investors.

Arkham Intelligence data shows that during the past 48 hours, Tether’s treasury sent over $66 million worth of stablecoins to Binance and over $20 million worth of USDT to the Kraken exchange.

Tether treasury outflows. Source: Arkham Intelligence

Conversely, a lack of stablecoin inflows often leads to a crypto market correction. On Aug. 12, Bitcoin price fell below the $60,000 psychological mark, staging a near 4% correction as institutions temporarily stopped buying USDT.

Related: Bitcoin ETF liquidity set to surge after SEC options approval — QCP

Can Bitcoin stage a breakout before the end of October?

Based on historical chart patterns, some analysts expected a three-month Bitcoin rally to $92,000 after September’s downtrend.

October is historically the second-best month for Bitcoin price, with average returns of 21%, second to November, which averages over 46% monthly returns for Bitcoin, according to CoinGlass data.

Bitcoin monthly returns percentage. Source: CoinGlass

During the previous Bitcoin halving year in 2020, the price rose over 27% in October and over 42% in November in a six-month rally that lasted until March 2021.

To confirm a potential breakout from its current crab walk, Bitcoin needs to close the week above $68,700, according to popular crypto analyst Rekt Capital.

BTC/USD, 1-week chart. Source: Rekt Capital

Growing Bitcoin exchange-traded fund (ETF) inflows could contribute to Bitcoin’s potential breakout. Bitcoin ETFs surpassed the record $20 billion milestone in total net flows on Oct. 17, just 10 months after launching.

In contrast, it took gold-based ETFs nearly five years to cross this same $20 billion milestone.

Magazine: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer, X Hall of Flame