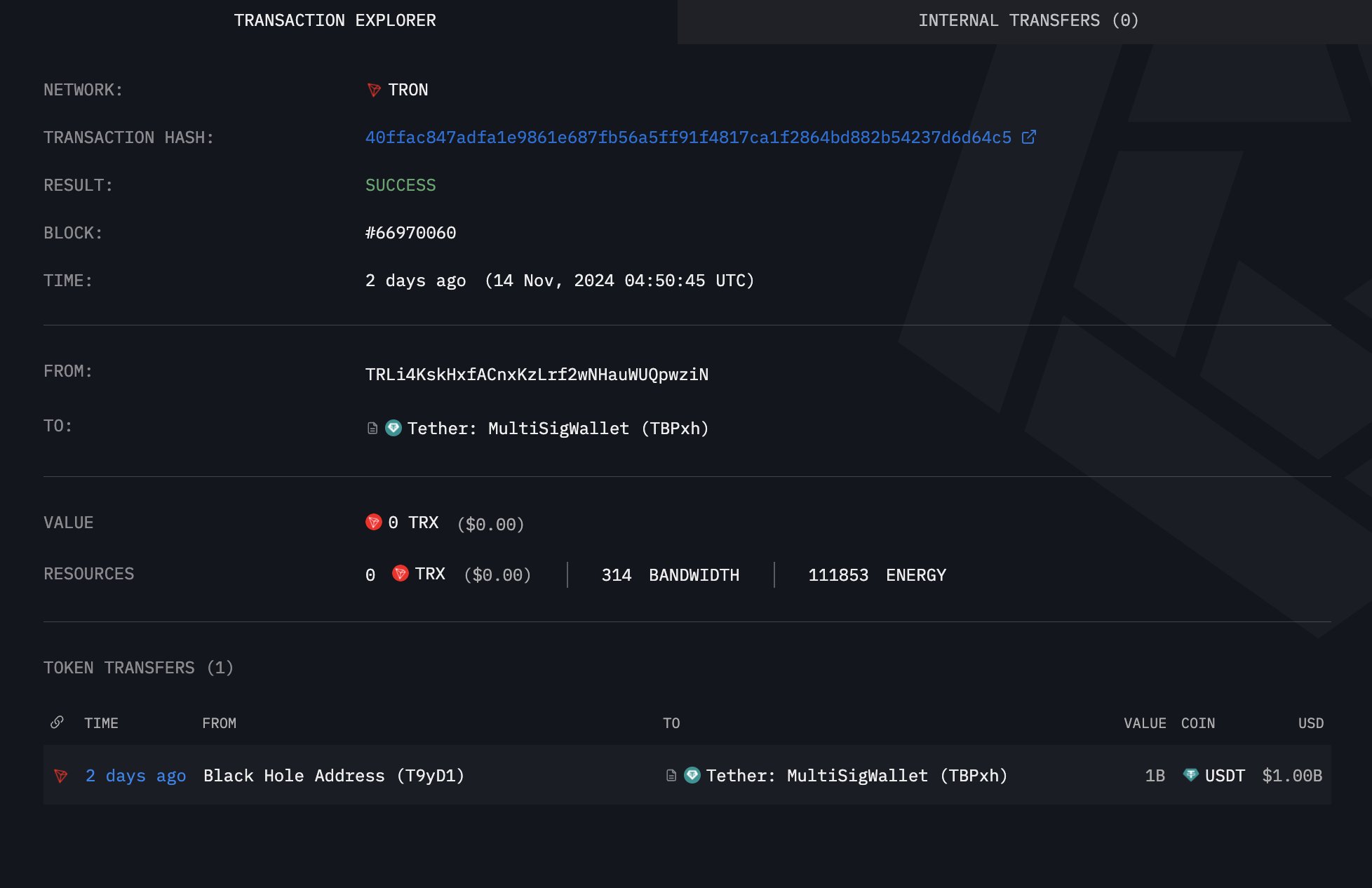

Tether minted $1 billion in USDt (USDT) stablecoins on the Tron network and paid no fees for the large transaction, according to data from onchain analytics firm Arkham Intelligence.

The analytics platform highlighted the Nov. 14 transaction from a “black hole address” on Tron to Tether’s multisignature wallet beginning with the characters “TBPxh.”

Onchain records also show that almost immediately after the 1 billion USDT was sent to Tether’s multisignature wallet, the funds were transferred to the stablecoin firm’s treasury, and this transaction likewise featured zero fees.

Tether minted 1 billion USDT with no network fees. Source: Arkham Intelligence

The Tron network’s comparatively low fees have made the blockchain ecosystem attractive for stablecoin firms and ideal for recipients in developing countries, where excessive network fees can significantly erode the value of a payment or remittance.

Related: Tether swaps more than 2 billion USDT to the Ethereum network

USDT supply on the Tron network

According to Tether’s transparency page, the total amount of USDT authorized on the Tron network is $62.7 billion, compared with the Ethereum network’s $62.9 billion.

Despite the Ethereum ecosystem being much larger than Tron’s, the alternative layer-1 blockchain has nearly the same amount of USDT circulating. This high volume of stablecoin activity on the Tron network was the primary driver behind the network’s $577 million in revenue during Q3 2024.

USDT supply by blockchain network. Source: Tether

In August 2024, the Tron network became the blockchain ecosystem with the second-largest market share of stablecoins. At that time, Tron had 37.9% of the total stablecoin market share and the Ethereum network boasted an impressive 55.7% share of issued stablecoins.

During that same month, Tether minted an additional 1 billion USDT on the Tron blockchain. Following the stablecoin mint, Tether CEO Paolo Ardoino explained that the additional USDT was meant to “replenish” the supply and clarified that the tokens were authorized but not issued.

These authorized, but not issued, USDT tokens remain in the company’s inventory until a new issuance request is made and the tokens are issued to trade on the open market.

Digital asset traders use stablecoin supply as a proxy to gauge market sentiment and investor interest. If the level of newly minted stablecoins rises, this is a bullish sign that traders are speculating on price movements. In contrast, a reduced supply would indicate lower interest and lower market activity.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom