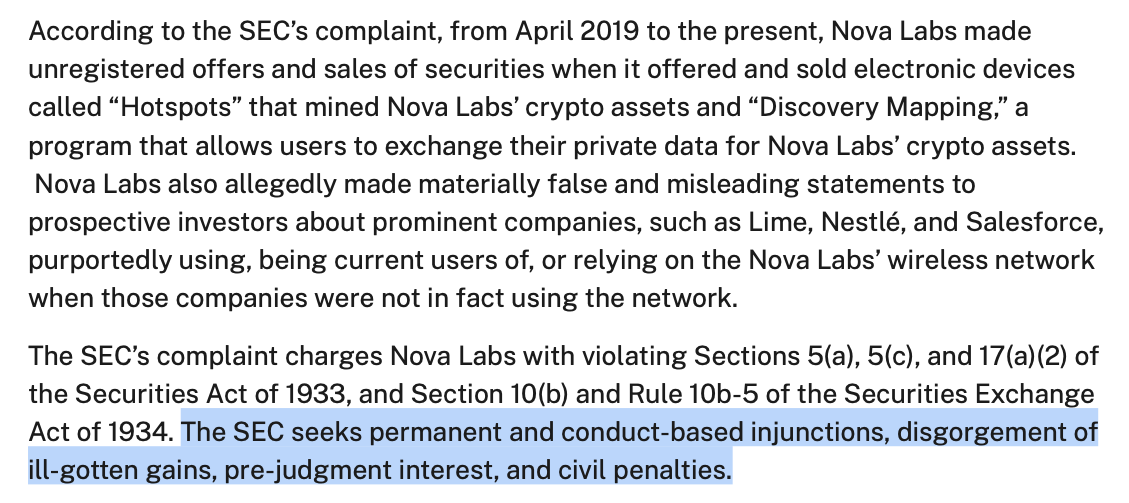

The United States Securities and Exchange Commission (SEC) has filed a lawsuit against Nova Labs, the firm behind the open-source Helium Network, just days before SEC chair and known crypto critic Gary Gensler steps down as chair on Jan. 20.

The SEC alleges that the company sold unregistered investment products, including those that mine cryptocurrency and a program that allowed users to trade their personal data for crypto assets.

Nova Labs hit with lawsuit just days before Gensler set to step down

In a statement on Jan. 17, the SEC alleged that Nova Labs sold unregistered securities by offering electronic devices called “Hotspots,” which mine the company’s cryptocurrency, Helium (HNT), as well as a program called “Discovery Mapping,” where users could trade their private data for crypto.

The term “unregistered securities” is well-known to the crypto industry, with several similar lawsuits arising over the years under Gensler’s leadership at the SEC.

Despite Ripple Lab’s major victory for the industry in July 2023, when it was ruled that XRP (XRP) did not qualify as an unregistered security sale in relation to programmatic sales on digital asset exchanges, the SEC was quick to dispute the decision and filed an appeal.

Meanwhile, the SEC also accused Nova Labs of making false claims to potential investors, saying major companies like micro-mobility company Lime, food and beverage giant Nestlé, and cloud computing software firm Salesforce were using or depending on its wireless network when they allegedly were not.

SEC may drop certain crypto cases in 2025

However, with new leadership taking over at the SEC on Jan. 20, the agency may reportedly consider dropping certain crypto enforcement cases.

Related: SEC charges Digital Currency Group for misleading investors

According to a Jan. 15 Reuters report citing “people briefed on the matter,” the SEC may review its existing court cases against crypto firms in the first few days after Trump’s inauguration.

The report suggests the commission could freeze litigation that does not involve fraud allegations, hinting at cases alleging securities law violations only.

Magazine: Sex robots, agent contracts a hitman, artificial vaginas: AI Eye goes wild