Multisignature wallet and digital assets platform Safe is gearing up to launch a blockchain transaction processor network next year, allowing instant crosschain payments before funds leave a user’s account.

Safe co-founder Lukas Schor told Cointelegraph at Token2049 last month that its decentralized transaction processor network, Safenet — announced on Dec. 3 — took inspiration from VisaNet, the payment network powering Visa.

VisaNet offers worldwide payment processing, allowing instant transactions with a payment guarantee for the merchant until the funds go through a series of checks and are sent days later.

“We want the same experience in crypto as well, with the same speed, so we don’t want to wait for transactions even to be mined,” Schor said. “When you do crosschain, it just takes too long. We want to scale that.”

❇️ SAY GM TO SAFENET ❇️

We are here to move the world’s GDP onchain.

🌐 https://t.co/WkBM6O26hN pic.twitter.com/8duPs9Gb62

— Safe (@safe) December 3, 2024

According to Schor, Safenet is not a blockchain but a connecting layer for existing networks that allows users to interact with any blockchain through a single account.

Schor said the network is powered by processors, and at its slated launch in the first quarter of 2025, there will be one processor supporting crosschain accounts and liquidity functions.

“There’s also a lot of security processes happening within Visa we want to replicate, like fraud checks or compliance checks,” Schor said.

Safenet can temporarily reserve assets on a user account through smart account resource locks and allow processors to execute transactions, debiting the user with a cryptographic execution proof.

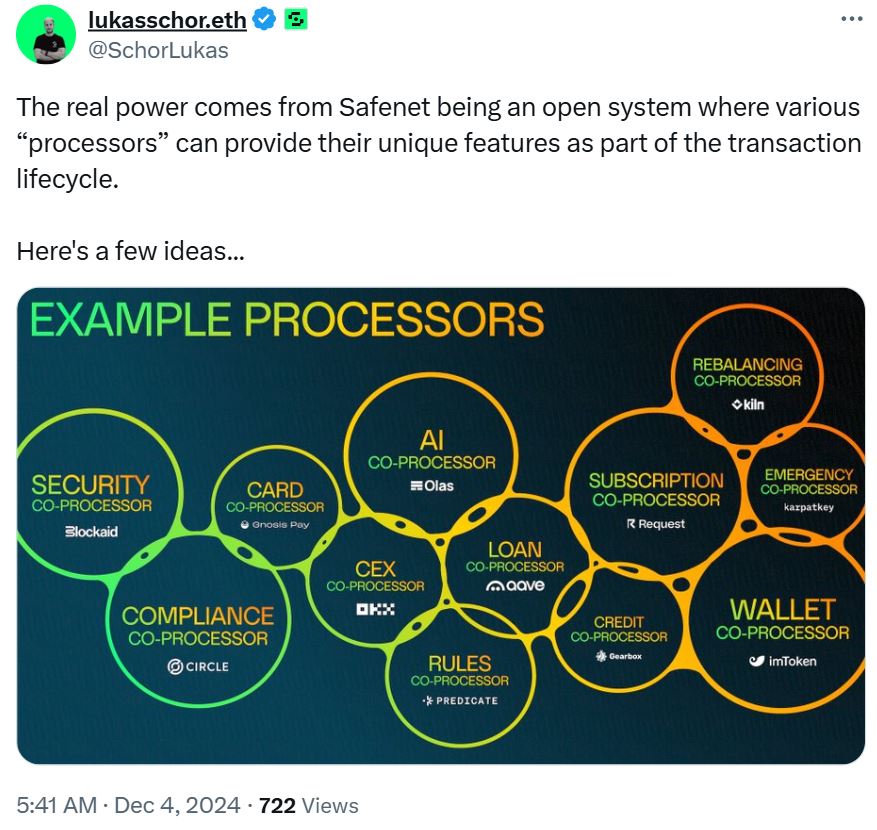

Schor said the open system allows more processors to join as part of the transaction lifecycle and offer services including security, compliance, automation and subscriptions. It connects an onchain balance to offchain services and required liquidity.

Underpinned by the SAFE Token, there will also be incentives in the ecosystem. Validators can earn a portion of the fees as rewards for validating transactions and staking.

Source: Lukas Schor

Schor said one use case could be under-collateralized loans.

Related: Adapt or die: Venture capital vs. crypto, blockchain, DAOs and Web3

“If you have a processor that may be more like a trusted processor, with some direct user relationship with this processor, that they could actually front you money, and they can — they don’t need anything over collateralized,” he said.

Schor said users could also enter into arrangements similar to how mortgages work with banks in the traditional financial system.

A user is given the money they need for a purchase, with an asset for collateral to guarantee they will make repayments.

“Say I want to benefit from the upside of a CryptoPunk. I don’t have enough money to buy a CryptoPunk. I’ve got 20% for the down payment, and the processor could front me this,” Schor said.

Safenet plans to go live in 2025, with an alpha version in Q1, a validator network launch is slated for Q2 and version 1 of the protocol is tipped to go live in either Q3 or Q4 2025 with a co-processor’s open liquidy network.

Magazine: 5 incredible use cases for Based Agents and Near’s AI Assistant