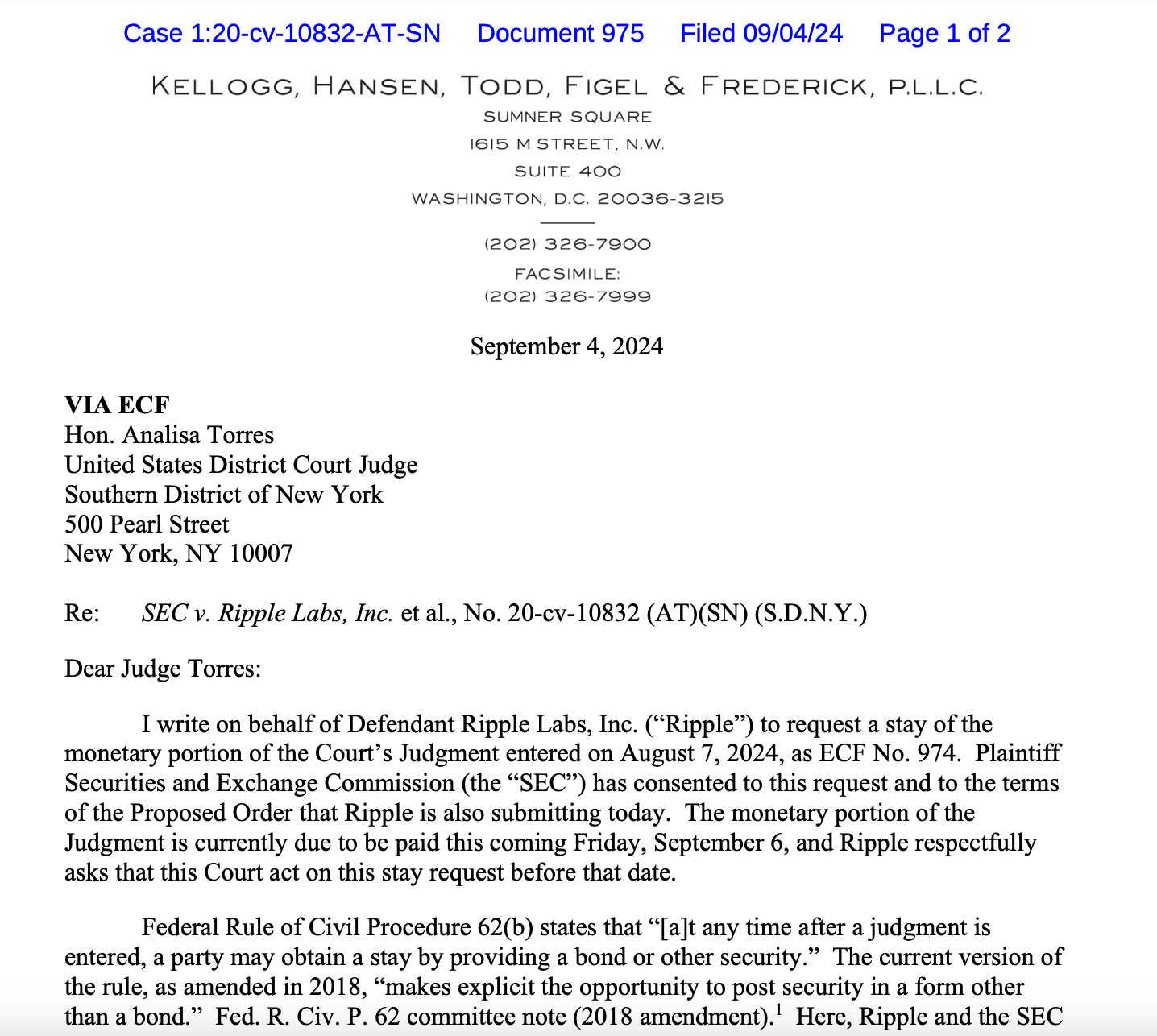

The legal team defending Ripple Labs against a case filed by the United States Securities and Exchange Commission (SEC) has requested to stay the monetary portion of an Aug. 7 judgment requiring the firm to pay $125 million.

In a Sept. 4 filing in the US District Court for the Southern District of New York, Ripple’s lawyers said the SEC had agreed to a request to delay payment of the judgment after Sept. 6. The legal team proposed that Ripple place 111% of the judgment amount — roughly $139 million — into a bank account until 30 days “after the time to appeal expires or the resolution of any appeal.”

Source: SDNY

The filing appeared to be laying the groundwork for a potential appeal by the SEC, as executives at Ripple lauded the Aug. 7 judgment at the time. Ripple CEO Brad Garlinghouse called the decision a “victory for Ripple,” and chief legal officer Stuart Alderoty said the company would “respect the $125 million fine.”

Pending court approval

At the time of publication, Judge Analisa Torres, overseeing the SEC v. Ripple case, had not signed off on the request. Any appeal would likely mean Ripple’s case with the SEC was not yet finished after being first filed in December 2020. Under court guidelines, either side has 60 days to file an appeal “if the United States or an officer or agency of the United States is a party.”

Related: Ripple lawyer slams SEC use of ‘crypto asset security’

At the time of publication, Judge Analisa Torres, overseeing the SEC v. Ripple case, had not signed off on the request. Any appeal would likely mean Ripple’s case with the SEC was not yet finished after being first filed in December 2020.

The SEC complaint alleged that Ripple used XRP as an unregistered security to raise funds, initially targeting Garlinghouse and Ripple executive chair Chris Larsen. In July 2023, Judge Torres ruled that the XRP token was not a security regarding programmatic sales on exchanges.

The price of XRP was $0.56 at the time of publication, having risen roughly 0.15% in the last 30 days.

Magazine: Godzilla vs. Kong: SEC faces fierce battle against crypto’s legal firepower