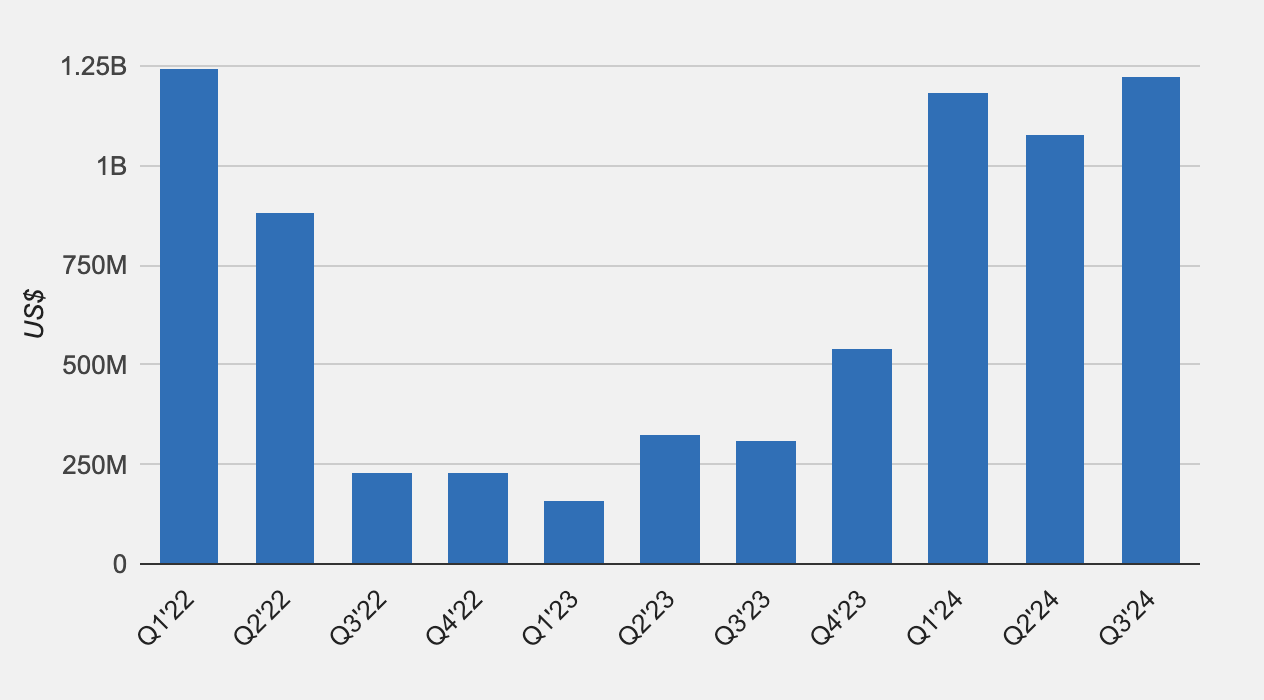

Publicly traded mining companies spent a combined$3.6 billion on plant, property, and equipment (PP&E) upgrades — including new mining hardware — measured on a year-to-date basis.

According to TheMinerMag, 16 mining companies collectively raised over $5 billion so far in 2024, with Q3 representing the period with the highest amount of PP&E spending since Q1 2022.

Spending on mining hardware made up the bulk of PP&E spending. Since 2023, public mining companies spent a combined $2 billion on hardware upgrades.

TheMinerMag also noted mining companies’ shift from equity financing to debt financing. MARA, formerly known as Marathon Digital, became the latest mining company to embrace this strategy with its 0% convertible note offering, which the firm used to purchase 6,474 Bitcoin (BTC) for its corporate treasury.

Net spending on PP&E. Source: TheMinerMag

Related: Load variability is key to AI energy infrastructure — TeraWulf CTO

Mining companies’ PP&E spending in November 2024

Bitfarms signed a miner hosting agreement with Stronghold on Nov. 1, which included provisions to host an additional 10,000 Bitcoin mining units at its facility in Pennsylvania.

Around the same time, CleanSpark — a company focused on renewable Bitcoin mining — announced plans to build 400 megawatts of mining infrastructure following its acquisition of mining company GRIID in October 2024.

On Nov. 11, Hive Digital purchased 6,500 application-specific integrated circuits (ASICs) for the company’s upcoming Paraguay facility, which is currently under construction.

ASIC hardware giant Bitmain comes under fire

Chip designer Xiamen Sophgo — a China-based company with links to Bitmain — recently came under investigation by United States officials for allegedly using the same computer chips found in Huawei’s Ascend 910B AI processor.

For context, Huawei, a China-based technology company and mobile device manufacturer, came under US sanctions in 2020. The company was accused of threatening US national security by using backdoors in its technology that could be exploited by the Chinese government to spy on US citizens and access sensitive data.

Bitmain releases a statement distancing itself from media claims of a business relationship with Huawei. Source: Bitmain

Following the controversy, Xiamen Sophgo and Bitmain released statements denying claims of having a business relationship with Huawei and violating US sanctions.

Despite the statements, a shipment of Bitmain Antminers — ASIC devices used to mine crypto — remains frozen at US ports by the Customs and Border Protection Agency.

The customs agency is allegedly demanding a $200,000 fee to clear the shipment — sparking fear, uncertainty, and doubt that sanctions and geopolitical tensions could create a supply crunch on the backordered and sorely needed mining hardware in the future.

Magazine: Bitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express