Coinbase has seen weekly trading volumes tap the highest levels in two years during the fourth quarter of 2024, according to a report by cryptocurrency researcher Kaiko.

The surge in trading volumes — spurred by pro-crypto US President Donald Trump’s November election win — is a bullish indicator ahead of the crypto exchange’s quarterly earnings report scheduled for Feb. 13.

Shares of Coinbase’s stock, COIN, are up roughly 40% since Trump’s Nov. 5 win in the US presidential race, according to data from Google Finance.

The exchange’s increased trading volume largely comes from institutions as Coinbase continues to grapple with a drought in retail investor activity, the researcher said.

“[R]etail traders — the highest fee payers — have not returned in force, with their share of volume shrinking to just 18%, down from 40% in 2021,” Kaiko said.

Several other major players in crypto are reporting earnings on the week of Feb. 10, including Bitcoin miners Hive Digital and Hut 8, as well as exchanges CME Group and Robinhood.

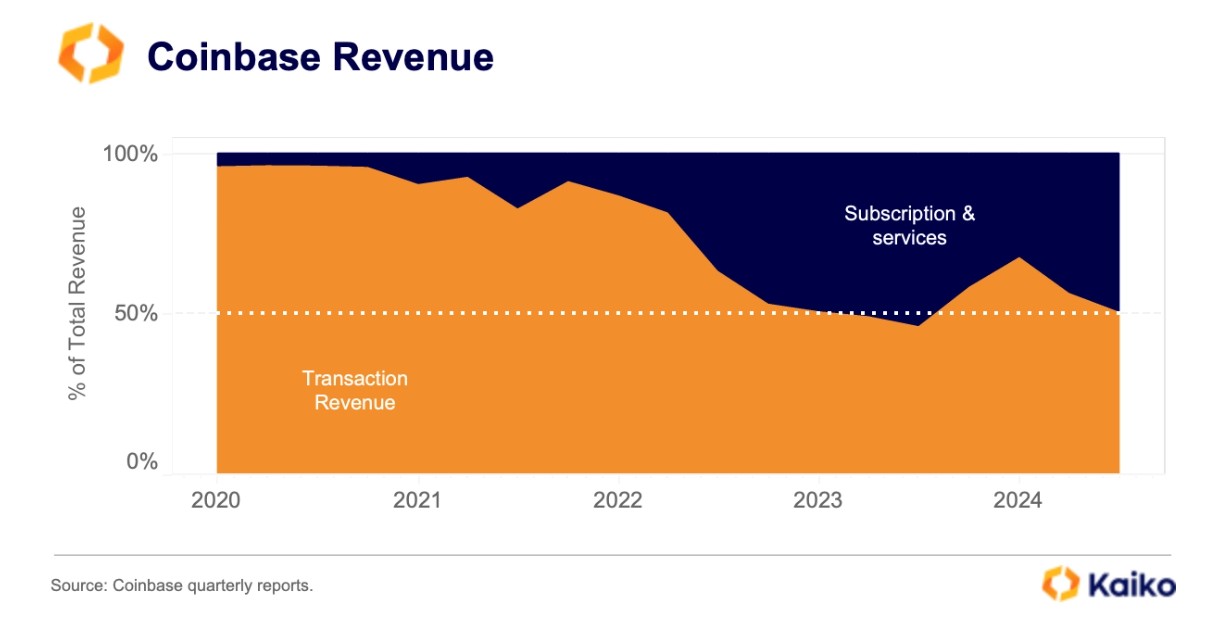

Coinbase has increased revenues from subscriptions and services. Source: Kaiko

Related: Investors see crypto markets peaking in H2 2025: Survey

Growth in new revenue streams

The paucity of retail trading has been a drag on Coinbase’s revenue, even as the exchange diversifies its income streams beyond trading, the researcher noted.

In 2024, Coinbase significantly increased revenues from subscriptions and services, but the exchange “remains a trading platform at its core, with trading still accounting for […] more than 50% of revenue,” according to Kaiko.

Additionally, “subscriptions and services are inherently tied to activity in the underlying crypto market and do not act as diversifiers to protect against market drawdowns and trading lulls,” Kaiko said.

Coinbase’s retail volumes and take rate. Source: Kaiko

Post-election euphoria

The resurgence in trading volumes reflects renewed enthusiasm for crypto as an asset class following Trump’s November election win. Trump has promised to make America “the world’s crypto capital”.

On Nov. 5, Galaxy Digital, a cryptocurrency trading firm, clocked the biggest trading day of the year as Trump’s victory in the US presidential race sparked a surge of interest in crypto.

Coinbase, which supported Trump during the presidential race, is especially well positioned to benefit.

“We see Coinbase as a beneficiary of the election results as the firm has been struggling with regulatory pressure from the SEC,” the US’s top financial regulator, Michale Miller, an equities researcher at Morningstar Inc., said in a November research note.

“With the incoming Donald Trump administration expected to be more favorable to the cryptocurrency industry, the firm’s staking business will face less regulatory pressure,” Miller said.

Coinbase operates the second-largest Ether (ETH) staking business after Lido, a decentralized finance (DeFi) protocol. It saw a net outflow of nearly 1.3 million ETH in Q4, Kaiko said.

Magazine: How crypto laws are changing across the world in 2025