European banks and financial institutions may be significantly underestimating the demand for cryptocurrency services, with fewer than one in five offering digital asset products, according to a new survey by crypto investment platform Bitpanda.

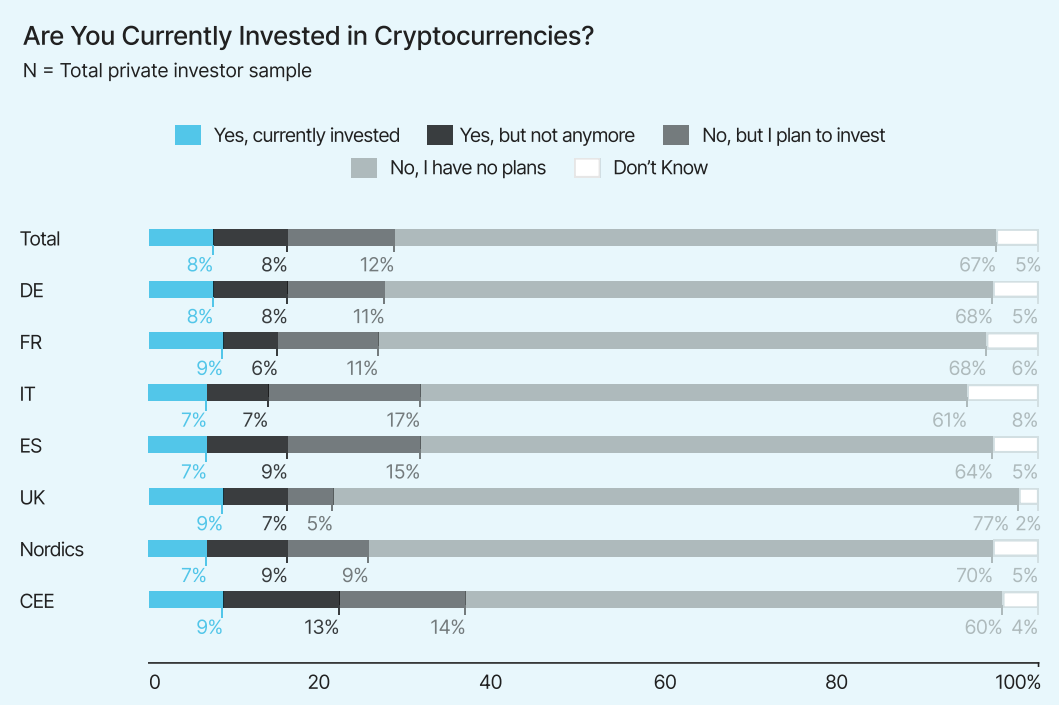

The study, which surveyed 10,000 retail and business investors across 13 European countries, found that more than 40% of business investors already hold cryptocurrencies, with another 18% planning to invest in the near future.

Yet, only 19% of surveyed financial institutions said their clients showed strong demand for crypto products — suggesting a 30% gap between actual investor adoption and perceived interest.

Crypto investments of EU private investors by country. Source: Bitpanda

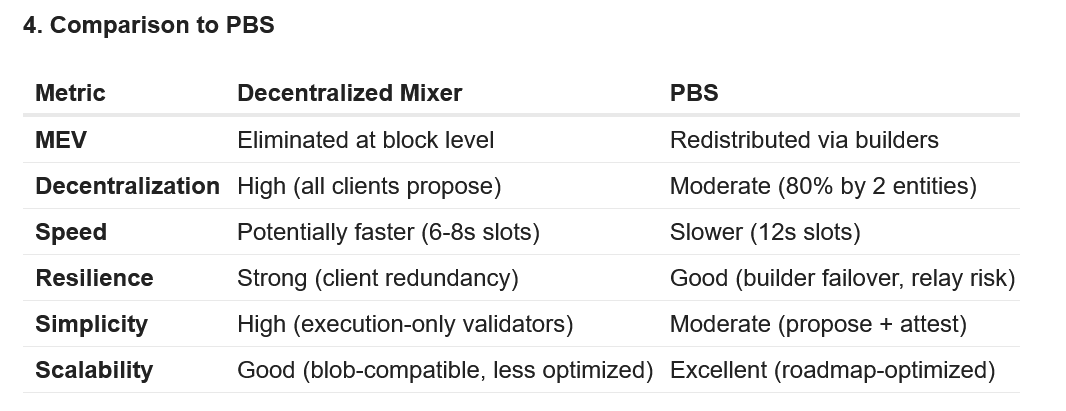

Moreover, only 19% of surveyed European financial institutions are offering crypto services, while over 80% of institutions acknowledge crypto’s growing importance.

Related: Michael Saylor’s Strategy surpasses 500,000 Bitcoin with latest purchase

Still, some European banks are recognizing the growing demand for digital assets, with 18% of surveyed financial institutions planning to expand their crypto service offering, particularly offerings related to crypto transfers.

“Financial institutions in Europe know that crypto is here to stay, but most are still not offering services that match investor demand,” according to Lukas Enzersdorfer-Konrad, deputy CEO of Bitpanda.

The main barriers to adoption aren’t external issues such as regulation but internal, like a “lack of resource or knowledge,” he told Cointelegraph, adding:

“These can be overcome, and the challenge to financial institutions is clear: go and check your revenue outflows. You can see where customers are moving their money; you can see just how real the demand for crypto is.”

Partner preferences of private investors regarding crypto investments. Source: Bitpanda

More crypto products from banks may increase European crypto adoption, considering that 27% of the survey’s respondents would prefer to invest in cryptocurrencies through a traditional bank, while only 14% would choose a crypto exchange.

In comparison, 36% of business investors choose to invest through an exchange, while traditional banks were only the third most popular option with 27%.

Related: Security concerns slow crypto payment adoption worldwide — Survey

Financial institutions with no crypto integration risk losing revenue

Banks and financial institutions without cryptocurrency integrations risk losing significant revenue share from both businesses and retail investors, according to Enzersdorfer-Konrad.

“Financial institutions that delay integrating crypto services risk losing revenue to their competition or crypto native companies. With the EU’s Markets in Crypto-Assets Regulation (MiCA) providing regulatory clarity, the time to act is now,” he added.

Crypto sentiment among European financial institutions. Source: Bitpanda

Moreover, 28% of surveyed institutions said they expect crypto to become more relevant within the next three years.

Magazine: Ripple says SEC lawsuit ‘over,’ Trump at DAS, and more: Hodler’s Digest, March 16 – 22