Microsoft shareholders are set to vote in December on whether the tech giant should publicly assess adding Bitcoin to its balance sheet, a filing with the United States securities regulator reveals.

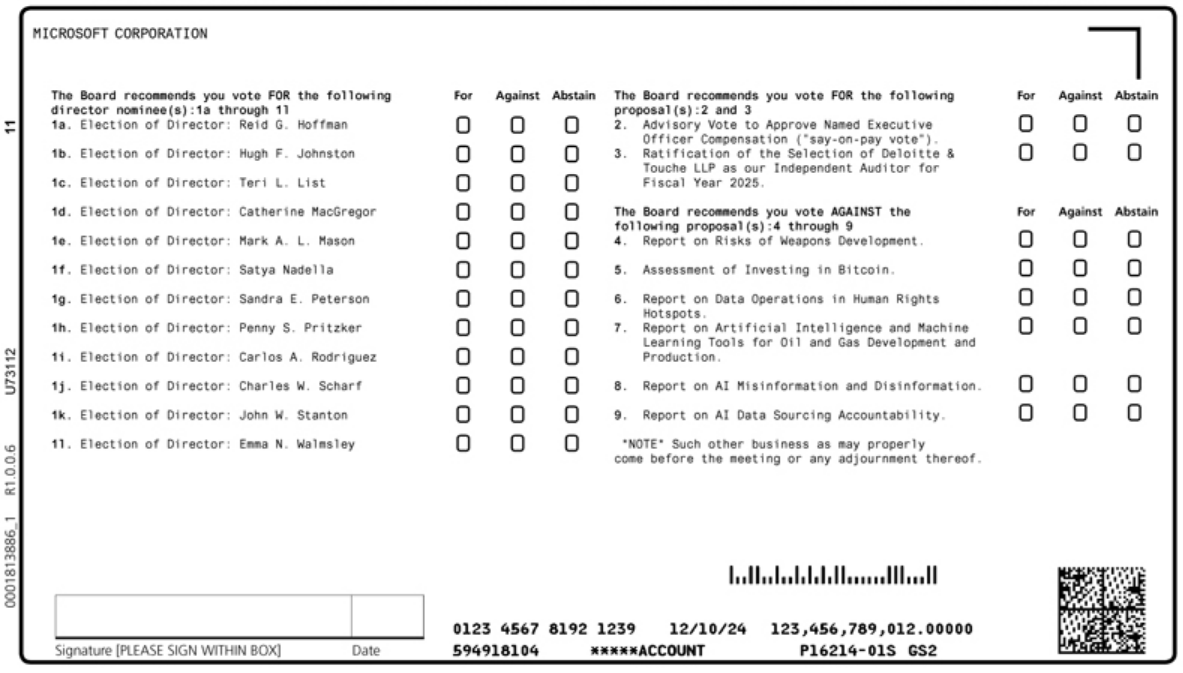

In the Oct. 24 filing, Microsoft disclosed that “Assessment of Investing in Bitcoin” is currently proposed to certain shareholders who will cast their vote in a Dec. 10 meeting.

However, the Microsoft board is already recommending they vote against it because they already “evaluate a wide range of investable assets,” including Bitcoin.

Item 5 stating the Microsoft board recommends shareholders to vote against a Bitcoin investment. Source: Securities and Exchange Commission

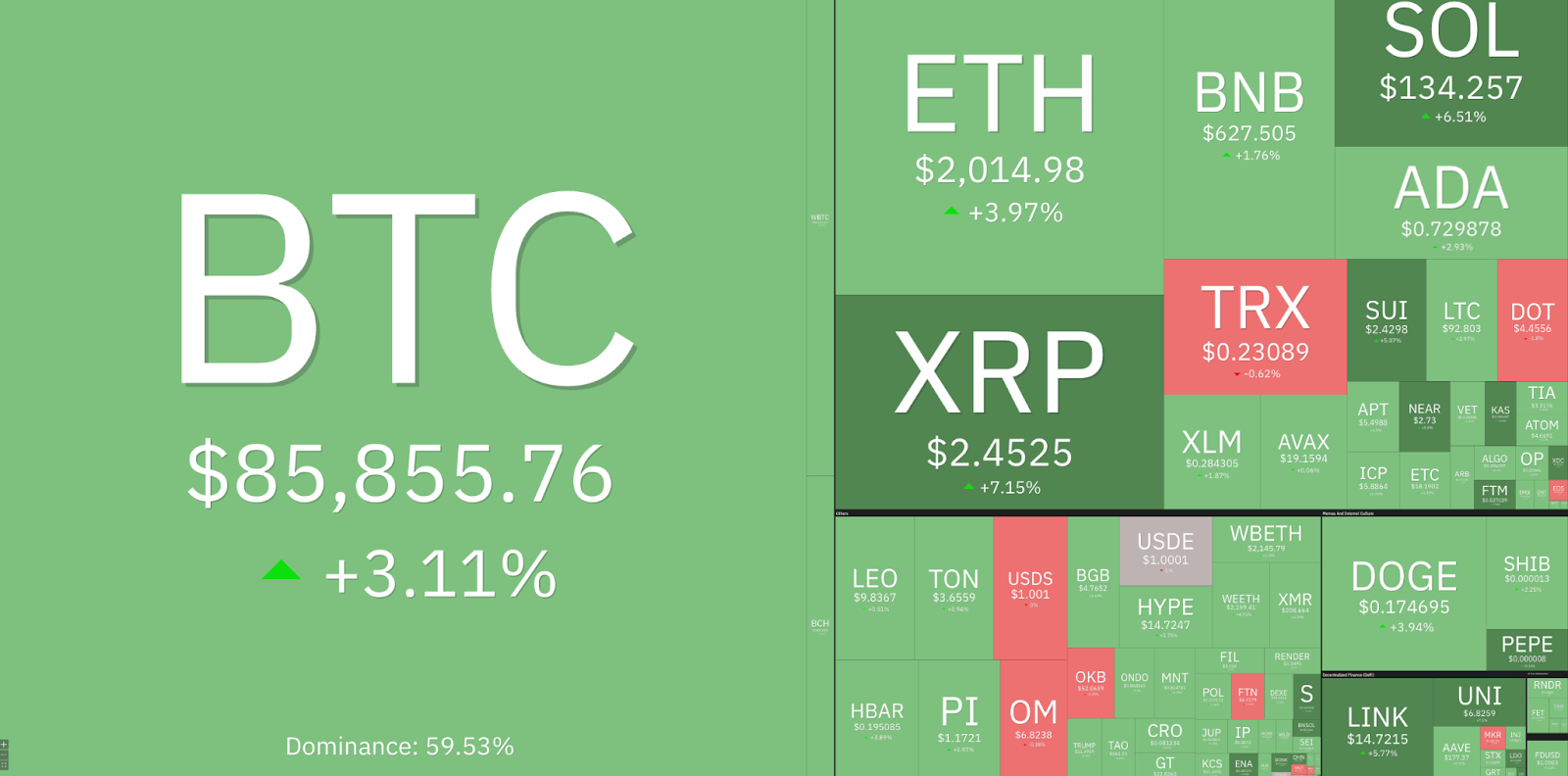

The proposal was pushed by the National Center for Public Policy Research, which highlighted business intelligence firm MicroStrategy’s Bitcoin investment strategy and that it has outperformed Microsoft by over 300% this year “despite doing a fraction of the business” of Microsoft.

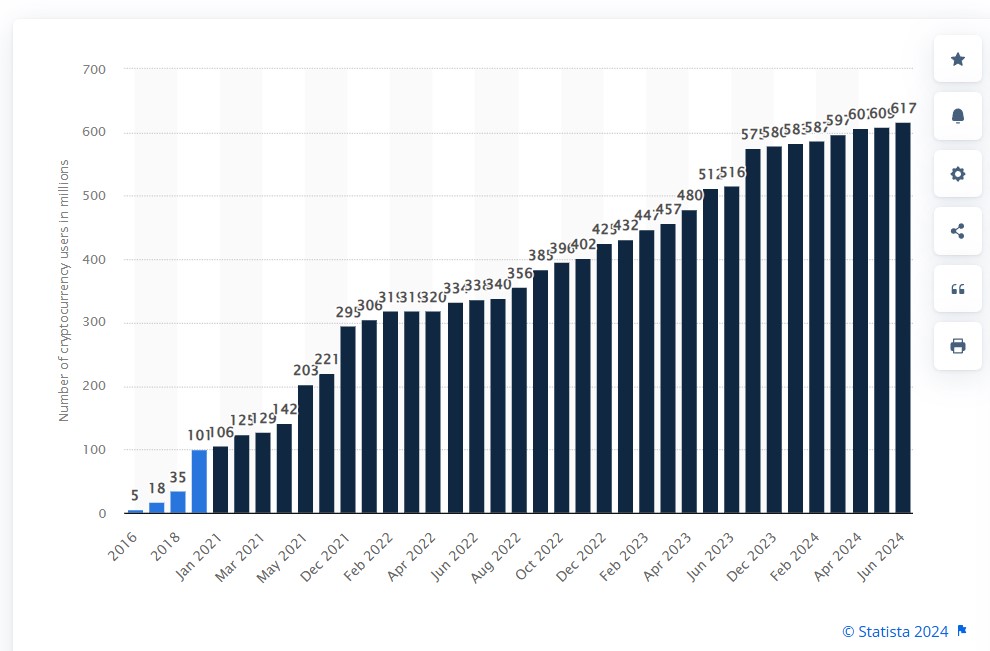

It also noted that institutional and corporate adoption is becoming more “commonplace” through spot Bitcoin exchange-traded funds.

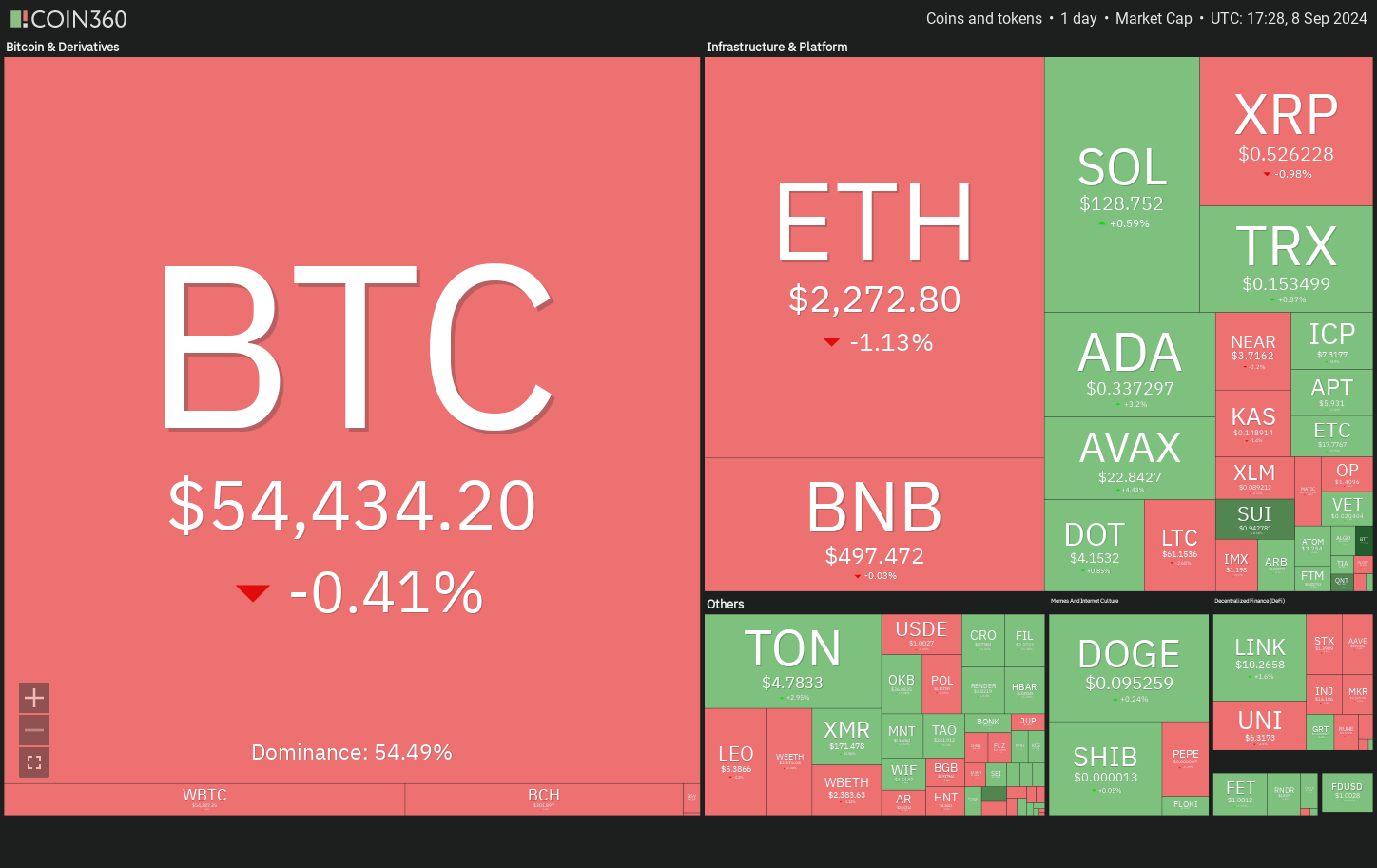

The research center noted Bitcoin remains volatile but could serve as a hedge against inflation and corporate bond yields.

”At minimum, companies should evaluate the benefits of holding some, even just 1% of its assets in Bitcoin,” it said.

Related: US government crypto wallets hacked for $20M — Arkham Intelligence

National Center for Public Policy Research’s supporting statement for Microsoft to conduct an assessment into investing in Bitcoin. Source: SEC

Cointelegraph reached out to Microsoft and the National Center for Public Policy Research but didn’t receive an immediate response.

Microsoft’s (MSFT) share price traded relatively flat on Oct. 24, increasing 0.03% to $424.7, Google Finance data shows.

Magazine: Fake Rabby Wallet scam linked to Dubai crypto CEO and many more victims

This is a developing story, and further information will be added as it becomes available.