MANILA: The Marcos administration is hiking its borrowing plan for this year to 2.57 trillion pesos, as it also expects to plug a bigger budget deficit than it previously projected.

This is 4.47% higher than the previous 2024 borrowing programme of 2.46 trillion pesos, figures released on Monday by the Finance Department (DoF) showed.

“That’s the result of the adjustment in the budget deficit limit for 2024,” National Treasurer Sharon Almanza said.

Economic officials came up with a higher financing plan for 2024 as they also project a wider fiscal deficit of 1.5 trillion pesos (5.6% of gross domestic product or GDP), from the old forecast of 1.4 trillion pesos (5.1% of GDP).

For Aris Dacanay, economist at HSBC Global Research, the wider budget gap was a result of a less upbeat outlook on economic growth, and not because president Marcos is pursuing a more relaxed fiscal policy through aggressive spending.

“There is no change in fiscal policy here. It is just an incorporation of the fact that times are still harder than usual,” Dacanay said in a commentary.

The inter-agency Development Budget Coordination Committee (DBCC) tempered its economic growth target for 2024 to 6% to 7% – from 6.5% to 7.5% previously – to make the goal more realistic and take into account persistent headwinds brought about by high inflation and elevated borrowing costs.

When the economy slows, state revenues would take a hit due to a smaller tax base. Based on latest DBCC projections, revenues are now expected to hit 4.3 trillion peso this year, from the previous forecast of 4.2 trillion peso.

Expenditures, meanwhile, are capped at 5.8 trillion pesos this year, from the old programme of 5.6 trillion pesos.

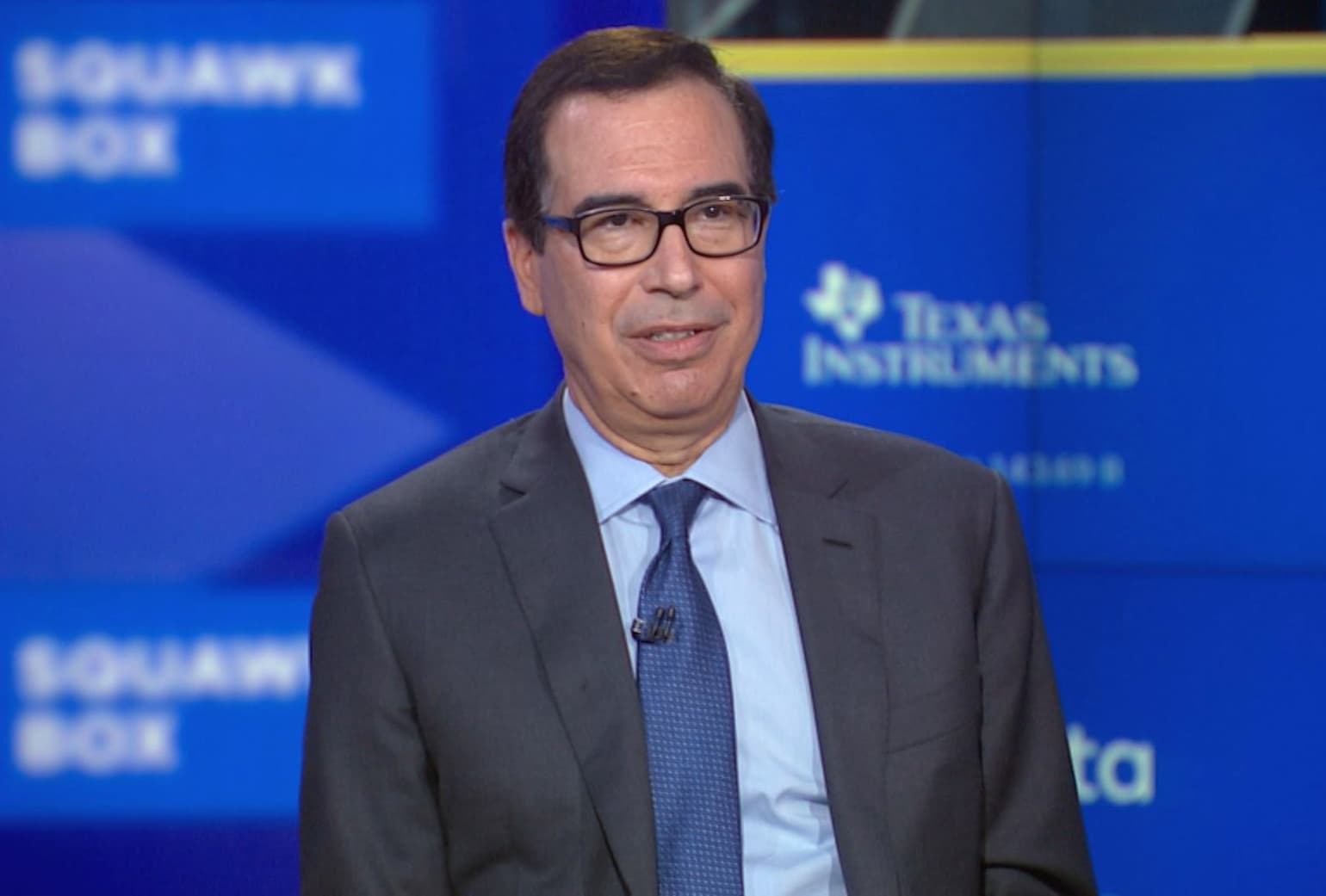

“A lower GDP will result in lower revenues,” Finance Secretary Ralph Recto said in a message to reporters.

“I plan to meet both (Bureau of Internal Revenue and Bureau of Customs) soon to discuss revenue targets. If they hit revenue targets then we do not need additional borrowings,” Recto added.

The larger borrowing plan in 2024 would put the debt-to-GDP ratio, a measure of the government’s ability to pay its debts, to 60.3%, still above the 60% threshold deemed manageable by credit rating agencies for emerging economies like the Philippines.

This, while interest rates are expected to stay elevated for a much longer period as inflation remains stubbornly high.

The debts are needed to plug the state’s budget deficit, which is no longer expected to normalise to pre-pandemic level by the time Marcos leaves office in 2028, as Recto avoids new taxes that, he said, would burden Filipinos at a time of rising cost of living.

Moving forward, the DoF said the Bureau of the Treasury developed a “strategic fundraising plan” that will continue to adopt a 75:25 borrowing mix in favour of domestic sources. — Philippine Daily Inquirer/ANN