The scientific community’s search for patterns in complex phenomena has led to an overenthusiastic application of mathematical models, with “Power Law” relationships emerging as the model du jour in many circles. The Bitcoin Power Law Theory (BPLT) is the latest in a series of predictive models attempting to forecast Bitcoin’s (BTC) future value.

While the BPLT is superficially appealing, it ultimately applies faulty assumptions to create a theory that purports to explain everything about Bitcoin’s price movements — and yet it explains very little.

Bitcoin is not just a physical system

The power law — created by former physics professor Giovanni Santostasi — provides a price band for Bitcoin that — proponents claim — has accurately predicted its support levels since Bitcoin traded at $1. The law predicts Bitcoin will reach a price of $1 million by 2036.

Related: Bet more on the Bitcoin miners cashing in on AI

Proponents of BPLT argue that because power laws exist in nature, Bitcoin’s adherence to a power law elevates it to the status of a physical system governed by physics. This assertion represents a fundamental mischaracterization of Bitcoin’s nature and leads to a series of logical fallacies.

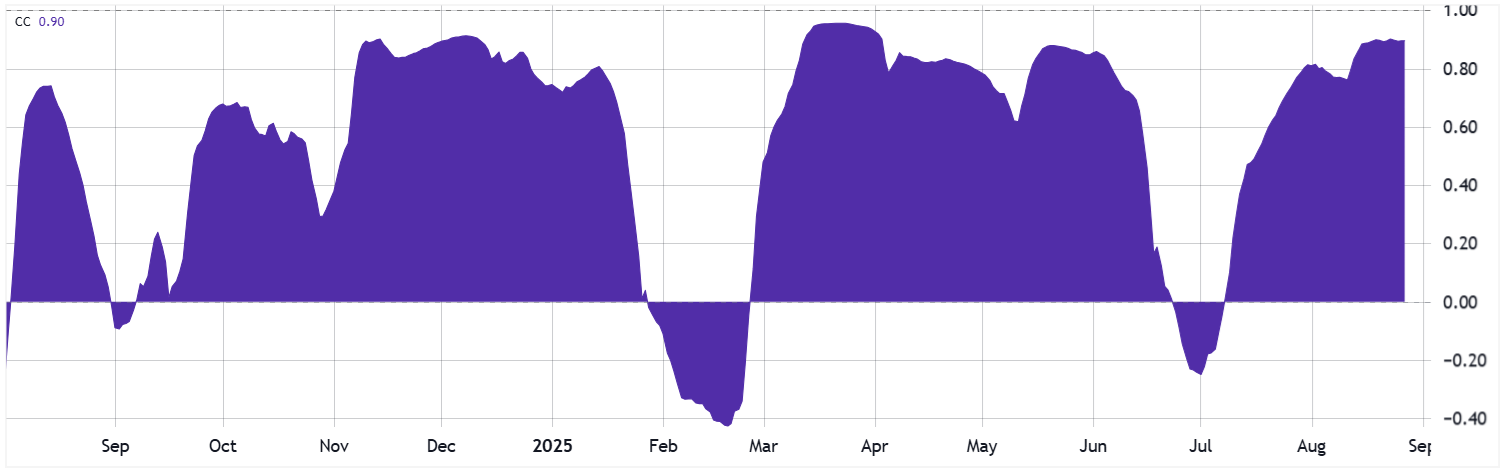

There’s a line that bitcoin’s price shall not pass. A lower bound on price, a power law.

Time contours tell us how long it will be before the support forces current prices upwards.

For 12 years, every bear market has returned to this support line.

The support passes one… pic.twitter.com/Jfz98ef1eQ

— apsk32 (@apsk32) June 23, 2024

Simply put, Bitcoin’s classification as a physical system represents a fundamental category error. There is Bitcoin, the asset, and Bitcoin, the network — and predictive theories must account for both. As a digital construct, Bitcoin finds its core nature in its code, cryptographic algorithms, and rules — better understood through information theory than physics. This misclassification leads to several logical inconsistencies:

- Scale mismatch: Bitcoin operates in economic, social, political, and technological domains distinct from physical systems, making direct comparisons problematic.

- Inconsistent methodology: The BLPT claims to predict prices using financial data yet purports to treat Bitcoin as a physical system, failing to establish a cogent link between financial metrics and physical phenomena.

- Human dependency: Unlike autonomous physical systems, Bitcoin’s existence and functionality rely entirely on human-maintained systems and input.

- Misapplied analogies: Attempts to describe Bitcoin using physical system models often employ strained analogies that break down under scrutiny.

- Proper classification: A more accurate classification for Bitcoin is as a complex socio-technological system — a human-created construct with physical dependencies, not an autonomous physical system.

Bitcoin is also a social system

Even if we say that Bitcoin embedded this social aspect and trust into its code, somehow replacing human institutions with algorithmic certainty, it overlooks crucial aspects of Bitcoin’s operation. Like all complex technical systems, collective social pressures heavily influence Bitcoin, and the code doesn’t operate in a vacuum but within the context of human behaviors, expectations, and interactions. Even though Bitcoin is decentralized, there is tension between networked systems and traditional hierarchies such as mining pools, exchanges, nation-states, and institutional investors.

Related: A few lessons I learned as an institutional trader

Bitcoin is subject to human behaviors expressed on a global scale that are inherently more volatile and less predictable. Where in the Bitcoin Power Law Theory do you account for regulatory obstruction or uncertainty, bad actors in the space, political obfuscation and the like?

Bitcoin remains a complex financial asset, as part of a global network, influenced by various factors that do not fit the mold of “physical systems.” Therefore, the wholesale application of commonalities between physical systems and Bitcoin is a misalignment in kind and scale.

Adrian Morris is a guest columnist for Cointelegraph and a cryptocurrency writer living in Arizona. He holds an MS in business analytics and information systems from the University of Minnesota.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.