Opinion by: Dmitry Zhelezov, co-founder and CEO of SQD Network

The decentralized finance (DeFi) industry is held back by a mess of its own making. Problems around liquidity fragmentation add to its complexity and intimidate users. Blockchain-based “intents” might be the solution, but only if the DeFi industry can find a way to ease concerns around centralization.

Intent-based architectures focus on the user’s intent or desired outcome. They’re a new paradigm in blockchain that’s gaining substantial traction, providing an original and simplified approach to managing and executing transactions with smart contracts.

Liquidity fragmentation brings complexity

Intents can resolve much of DeFi’s complexity, making it easier to move funds across networks and fix the problems with liquidity fragmentation.

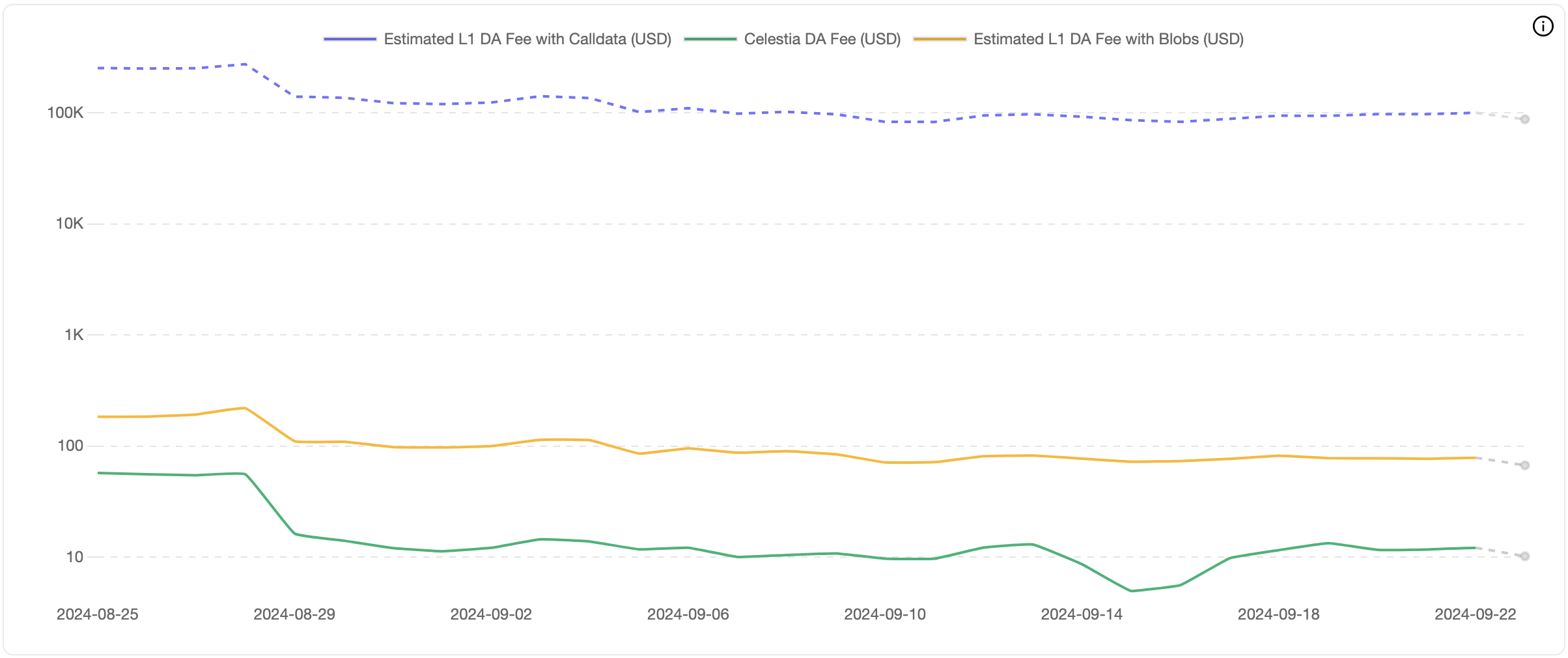

Many DeFi protocols struggle with limited liquidity. Although there are billions of dollars locked up in DeFi, this capital is spread across multiple blockchains that cannot interact with one another, leading to slow transactions, high fees and substantial price slippage.

Liquidity fragmentation is one of the most significant obstacles for developers launching new DeFi applications. Developers can get around the problem using crosschain bridges to facilitate the flow of more funds from other networks, but doing this increases the complexity for users.

Fixing crosschain interactions with intents

Intents starkly contrast existing blockchain architectures, which require users to provide detailed instructions on each step of a transaction, causing frustration and confusion and leaving users vulnerable to exploitation by sophisticated hackers and scammers.

Recent: 2025 will be crypto’s best year ever — Steno Research

With intents, the user expresses what they want to achieve, and the intricacies of transaction execution are left to the protocol.

To better understand, let’s look at an example. Dave plays a blockchain game decentralized application (DApp) on the Polygon network, but all his funds are held on Ethereum. To get those funds onto Polygon so he can use them in the game, Dave needs to do a lot of work:

-

First, Dave must go to the DApp on Polygon and connect his wallet.

-

Next, he needs to find the appropriate bridge, a different DApp.

-

Then, Dave has to connect his wallet to the Ethereum blockchain.

-

After that, he must initiate the bridging process to transfer his funds from the wallet to the bridge.

-

Once that’s done – and it can take some time – he must return to the game, switching his wallet to the Polygon network.

-

Only then, can Dave start spending money on the game.

Intent-based architectures keep it simple. They enable Dave to state his intent to purchase a non-fungible token (NFT) for the game in question, and the above steps are automated by “solvers,” which are agents tasked with executing transactions on behalf of users. These solvers work like a short-term loan, providing Dave with the upfront capital to spend his Ethereum funds in the Polygon game instantly, so there’s no need to wait for each transaction to be verified.

Solvers don’t solve everything

Intents make DeFi interoperable with reduced complexity, but critics say solvers increase centralization, potentially compromising neutrality and increasing the risk of malicious behavior.

Independent solvers compete with one another to “solve” problems, and the ones with more resources quickly gain an advantage over the smaller players, leaving the network in the hands of just a few powerful agents. This consolidation of power erodes trust and decentralization.

Blockchain intents still need some work, but simplicity should compel the DeFi industry to solve the problems inherent with solvers. If DeFi wants to grow beyond what it is now, it needs to find a way to streamline crosschain transactions and increase the flow of liquidity without the headaches. Intents and solvers are the best proposals put forward so far.

Intents can enable streamlined, user-focused applications that boost the appeal of DeFi, bringing more liquidity to every protocol without complexity. The exponential growth intent can make it imperative for DeFi developers to solve this challenge.

Opinion by: Dmitry Zhelezov, co-founder and CEO of SQD Network.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.