Hong Kong’s financial regulator, the Securities Futures Commission, says it expects to issue more licenses to crypto exchanges and digital asset firms operating in the region by the end of the year.

SFC CEO Julia Leung said she expects it to “make progress” in issuing licenses to 11 currently operating Virtual Asset Trading Platforms (VATPs) on the regulator’s list of potential licensees, according to an Oct. 6 report from local media outlet HK01.

She added that licenses would be granted in “batches” moving forward in a bid to bring crypto exchanges into compliance more easily.

A total of 16 companies are awaiting a decision on their VATP application. Eleven are already operating as “deemed to be licensed,” even though the SFC discourages traders from doing business with them.

Leung added that it had completed the first round of “on-site” reviews for the crypto firms and said all VATPs that are compliant with its licensing model can expect to have their applications approved.

Leung said all firms that do not meet the SFC’s requirements can expect to lose their qualifications for licensing.

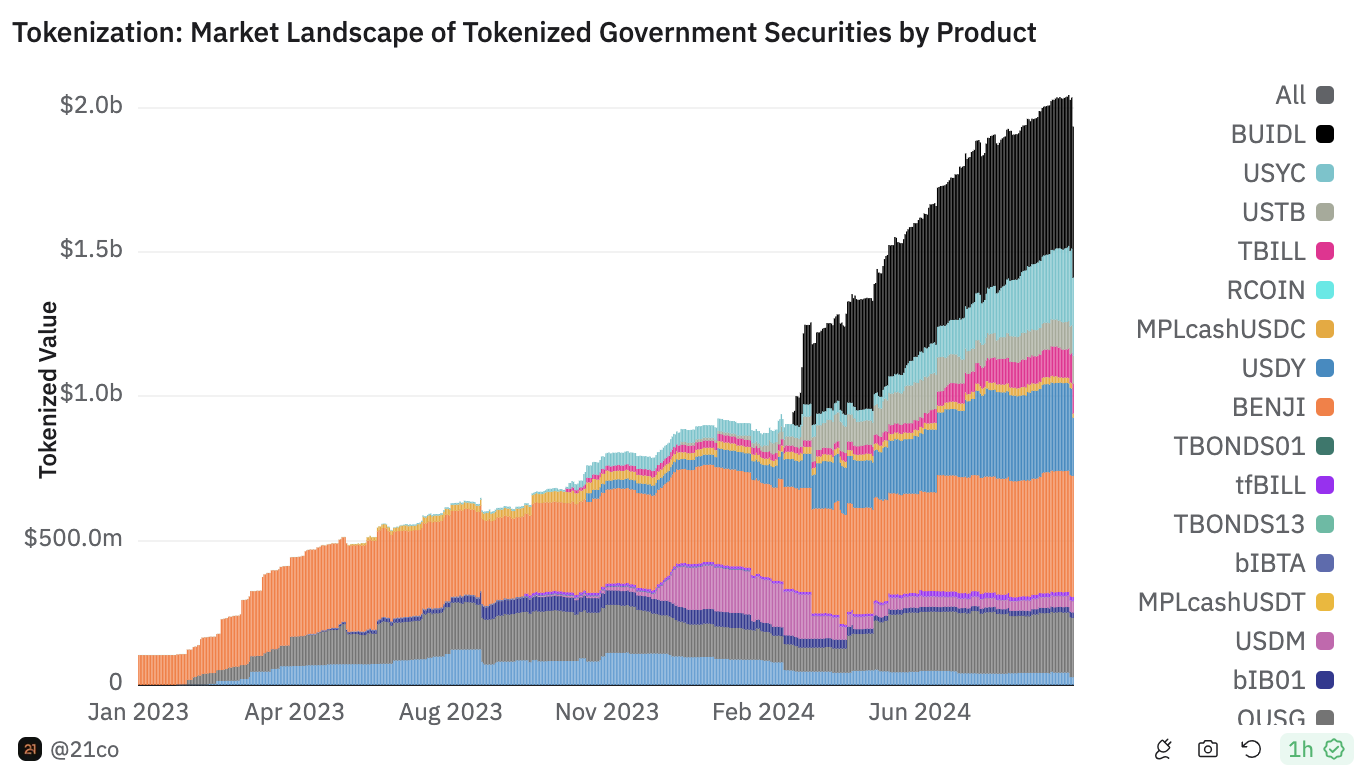

Leung’s comments came as the SFC released its roadmap for 2024 to 2026 on Oct. 6, with plans to advance regulations on crypto platforms, promote Real World Asset (RWA) tokenization, and more thoroughly explore blockchain technologies.

The SFC listed four top priorities in its 2024-2026 roadmap. Source: Hong Kong SFC

Retail crypto investors in Hong Kong currently only have four cryptocurrencies they can buy, and Hong Kong has been criticized for the slow pace of its crypto regulations despite its repeatedly proclaimed desire to become a world hub for crypto and financial technology.

However, Leung said she expects the regulatory framework for crypto assets to be finalized by the end of next year.

Related: Hong Kong to align crypto OTC derivative rules with European standards

The update on crypto licenses comes just three days after crypto exchange HKVAX was approved as the third to be licensed for trading in Hong Kong after OSL and HashKey respectively received their licenses in 2020 and 2023.

Hong Kong has made licensing and regulation for crypto firms a top priority following the $165 million scandal involving the now-defunct Dubai-based crypto exchange JPEX in 2023.

Over 2,500 Hong Kong residents claim they were defrauded by the exchange, which promoted its services heavily in Hong Kong before hiking withdrawal fees in September and preventing users from accessing their funds.

In the wake of the scandal, Hong Kong said it would bolster its crypto regulations and policing of unlicensed firms. Additionally, the SFC set up a task force with the police to deal with illicit crypto exchange activities and updated its policies on crypto sales and requirements.

Asia Express: Bitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam