The United States government appears to have moved approximately 10,000 Bitcoin associated with the Silk Road seizure. Market maker Jump Trading transferred $46.44 million worth of Ether, sparking a momentary fear around a sell-off. Meanwhile, Coinbase has teased the launch of “cbBTC,” an in-house alternative to Wrapped Bitcoin (BTC).

US government moves 10K BTC

Data reported by blockchain analytics firm Arkham Intelligence indicates that a wallet associated with funds seized in the US government’s takedown of the Silk Road online black market recently transferred 10,000 Bitcoin to an address associated with Coinbase Prime. As of the date of the transaction on Aug. 14, the BTC would be worth around $594 million.

While this isn’t the first time the US government has transferred funds associated with the Silk Road seizure, the timing of this particular transaction is interesting given the potential political ramifications. The question of what the next US president intends to do with the nation’s Bitcoin holdings has loomed over each candidate’s campaigns. But, depending what the purpose of this particular transaction is, any potential plans for the reserve could be in flux.

Jump Trading transfers $46.44M in ETH amid sell-off, manipulation fears

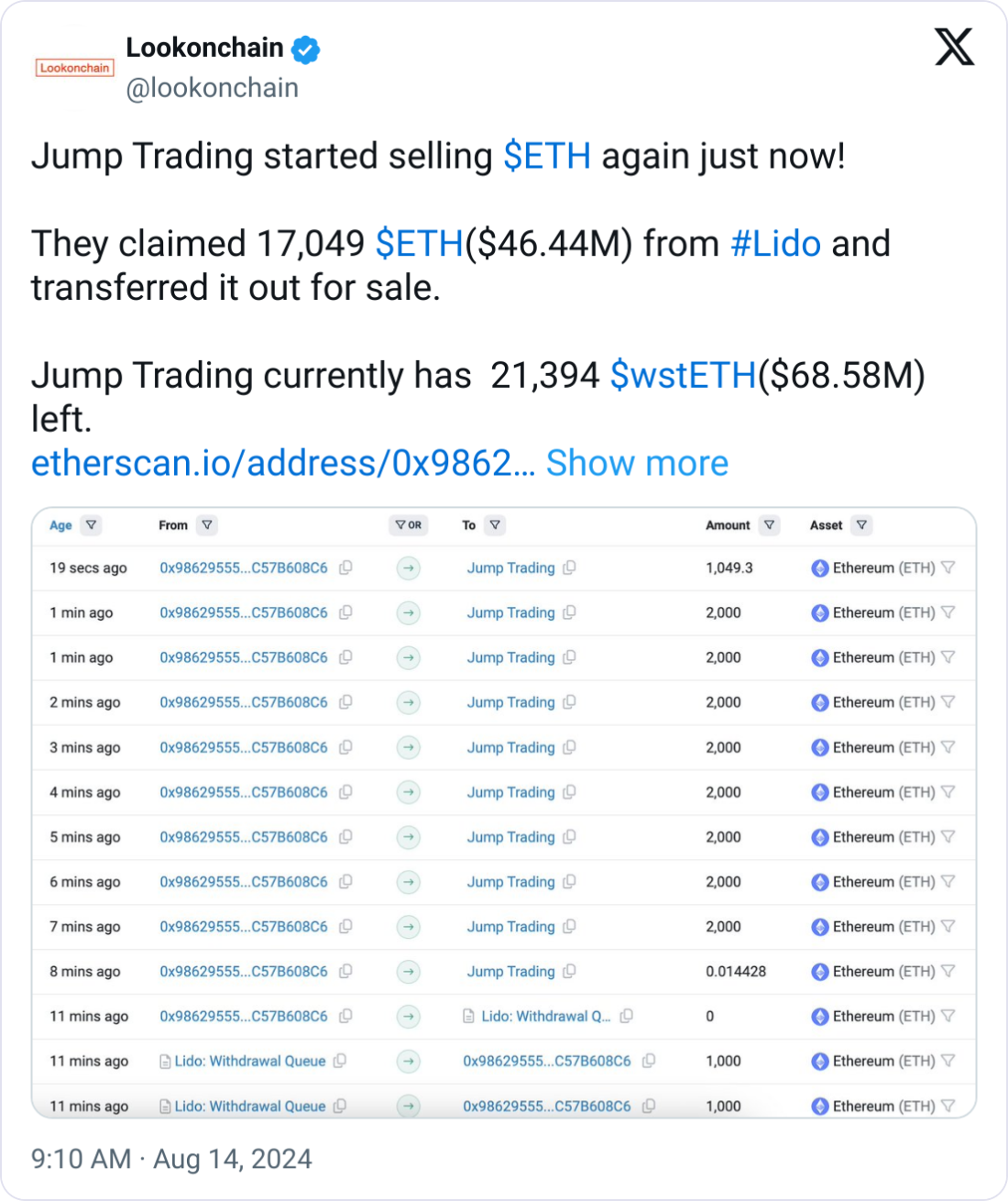

Market maker and trading firm Jump Trading moved 17,049 Ether (ETH) worth approximately $46.44 million in preparation for an expected sell-off.

According to blockchain analysis firm Lookonchain, the $46.44 million worth of Ether claimed from the liquid staking protocol Lido has been “transferred out for sale.” Following the massive transfer, Jump Trading currently holds a remaining 21,394 ETH worth approximately $68.58 million as the new wave of ETH sales reportedly begins.

Further investigations based on Arkham data revealed that the shifts in funds indicate preparation for liquidity provision for trading activities across the exchange and oppose the sell-off narrative suggested by Lookonchain.

Coinbase teases ‘cbBTC’ days after BitGo Wrapped Bitcoin controversy

Coinbase has just teased the possible launch of a new product called “cbBTC” — with many commentators speculating that the United States-based crypto exchange is launching its own wrapped Bitcoin token

In an Aug. 13 post to X, the official Coinbase account said just one word: “cbBTC” before adding “coming soon” in a follow-up comment to the original post.

The cryptic posts about cbBTC come three days after controversy was sparked when BitGo — the team behind Wrapped Bitcoin — announced plans to transfer control over WBTC to a joint venture made up of itself, Hong Kong-based investment manager BiT Global, and Justin Sun’s Tron ecosystem.

Crypto risk management firm Block Analitica Labs (BA Labs) proposed that decentralized finance giant MakerDAO close all new wBTC debts on the protocol and prevent new borrowing against WBTC collateral.

“We find that Sun’s involvement as a controlling interest in the new WBTC joint venture presents an unacceptable level of risk,” BA Labs said.