GameStop Corp. (GME) has acknowledged a letter from Strive Asset Management urging the gaming retailer to buy Bitcoin, which a crypto exchange executive says could blow the minds of traditional finance investors.

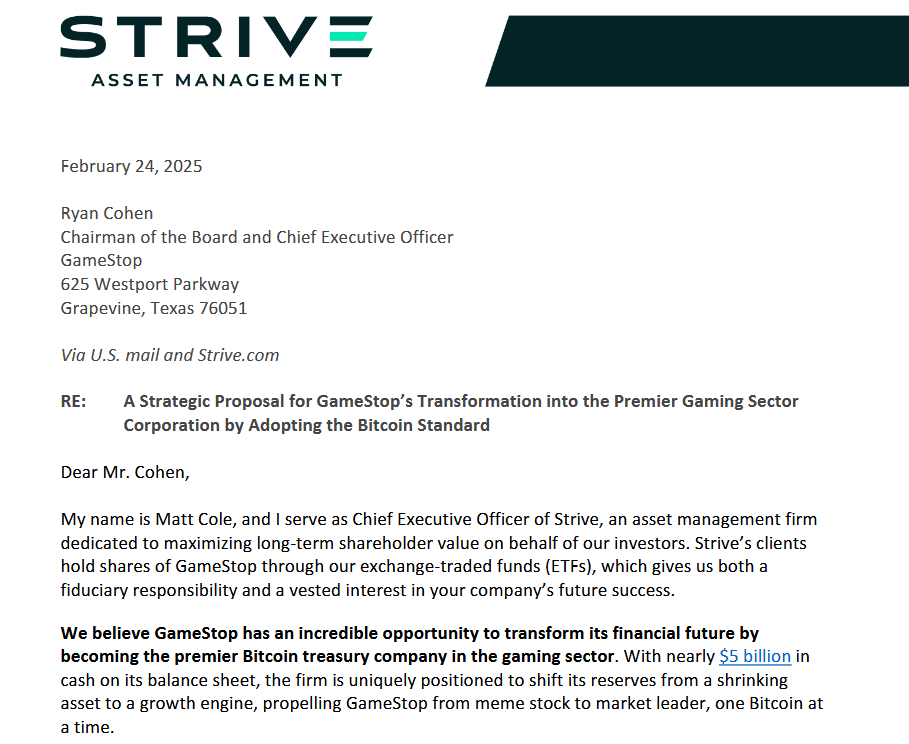

GameStop CEO Ryan Cohen confirmed in a Feb. 26 X post that he had received a Feb. 24 letter from Strive CEO Matt Cole advising the gaming retailer to use its $4.6 billion in cash to buy Bitcoin (BTC) and to use market offerings to fund additional purchases.

“If GameStop embarks on the LBE (Leveraged Bitcoin Equity) strategy… It will bake the noodles of so many TradFi investors and commentators who think both GME and Bitcoin are a joke,” the managing director of the BTC-only exchange Swan Bitcoin, John Haar, said in a Feb. 25 X post.

GameStop was central to the 2020 and 2021 meme stock craze and a short squeeze strategy inspired by Reddit users, which caused substantial losses for Wall Street firms short on GME.

GME increased nearly 11,500% from $0.70 to $81.25 between April 2020 and January 2021, Google Finance data shows.

Cole’s letter follows a Feb. 13 report that GameStop started considering investing in Bitcoin and alternative asset classes.

An excerpt of Matt Cole’s letter to GameStop’s Ryan Cohen. Source: Strive

In his letter to GameStop, Cole recommended the company purchase more Bitcoin by issuing new equity via at-the-market offerings and convertible debt securities.

He also said the company should sell or close “all stores operating at a loss” and expand its online presence, which would allow it to “be able to purchase more Bitcoin.”

Cole said a Bitcoin treasury would position GameStop “from meme stock to market leader” while serving as a “true savings asset” by protecting the company against inflationary pressures impacting fiat currencies.

Related: LIBRA memecoin scandal: What really happened (feat. Bubblemaps)

Cole advised GameStop to steer clear of investing in any other cryptocurrencies, as a Bitcoin-only approach would reinforce GameStop’s image as a “disciplined, forward-looking organization” while protecting long-run shareholder returns.

GameStop’s Cohen has recently shared a photo with Michael Saylor, the chair of the $44.2 billion Bitcoin-holding business intelligence firm Strategy, formerly MicroStrategy.

Source: Ryan Cohen

Strategy’s Bitcoin-buying has inspired other public firms, including Metaplanet and Semler Scientific, to adopt similar strategies.

Magazine: Elon Musk’s plan to run government on blockchain faces uphill battle