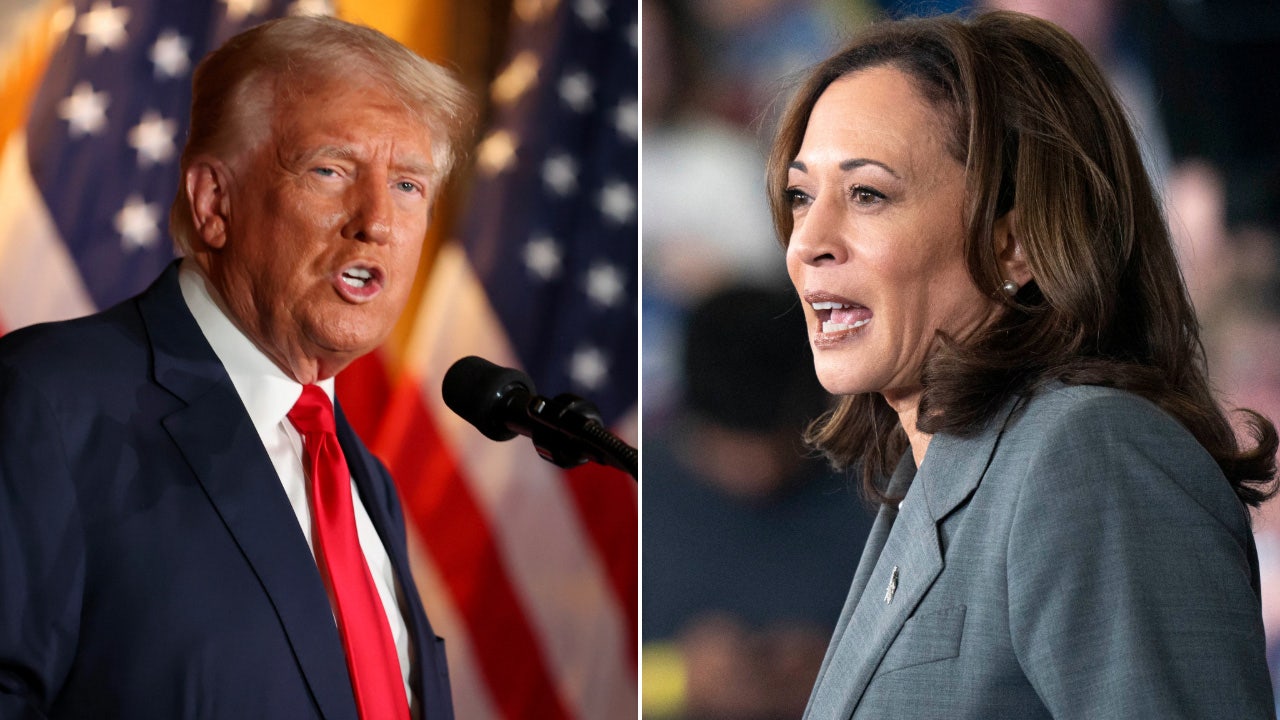

National Association of Home Builders CEO Jim Tobin discusses Vice President Kamala Harris pushing a tax incentive to build homes on ‘Maria Bartiromo’s Wall Street.’

Financial experts are revealing how Americans can prepare for the possibility of a recession with concerns about the economy.

Federal Reserve Chair Jerome Powell on Friday indicated that interest rate cuts could come soon, telling Kansas City Fed’s symposium in Jackson Hole, Wyo., “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

Chris Markowski, of Markowski Investments, told Fox News Digital that Americans should not buy into the hype or “fear” of recessions. Instead, they should look at it as a “housecleaning” opportunity where they can make necessary cutbacks and come out stronger than before.

“I think many Americans right now feel that they’re in a recession already,” Markowski said. “Their buying power has been, in essence — it’s gone away, based upon inflation and money and what it can buy them, what they’re paying for groceries or what they’re paying for cars and what they’re paying for the bare necessities of life.”

US PRODUCER PRICES RISE LESS THAN EXPECTED IN JULY

In this photo illustration, one and five dollar bills seen on display. (Photo Illustration by Igor Golovniov/SOPA Images/LightRocket via Getty Imagehoto Illustration by Igor Golovniov/SOPA Images/LightRocket via Getty Images) / Getty Images)

Markowski advised investors not to panic when it comes to their portfolios and avoid attempting to time the market. When Americans hit slow times, they can cut back on what they do not need and come out stronger due to their new efficiencies.

David Peters, from Peters Tax Preparation & Consulting PC, said Americans must look at their spending to prepare for a potential recession, must not stop saving for retirement, and try not to take out large loans.

“Where is your money going?” he asked. “Are there places where you need to tighten your belt? You should take a look at your budget and figure out how to still make room in it for savings — even in the midst of rising costs. Make sure that you have an emergency account that is funded (three months of expenses is ideal).”

“As I have told many clients, the most important thing is to have perspective,” Peters added. “We have been through economic ups and downs in the past (and a pandemic most recently). We just need to cut spending where we can and continue to save. These hard times will pass too.”

Al Lord, of Lexerd Capital Management, encouraged Americans “looking to buy a home or continue renting” to “prioritize maintaining stable employment and ensure that housing costs stay below 30% of their monthly income.”

“It’s important to review expenses, create a realistic budget, and have a contingency plan in place in case job security becomes uncertain,” he said.

Andrew Van Alstyne, from Fiduciary Financial Advisors, told Fox News Digital that ideally Americans would want to increase their liquidity amid the uncertainty.

Priceline CEO Brett Keller breaks down leisure spending in the United States on ‘The Claman Countdown.’

“That means ensuring you’re able to cover anywhere from six to 12 months of expenses without changing your lifestyle,” Van Alstyne said. “The first source of funds should be in an emergency fund sitting savings account (usually three to six months of expenses). The next source of funds would be in a brokerage account (non-retirement investment account) and would draw down on cash, then investments that are easily traded (liquid). Do not take loans or cash-out retirement accounts unless it’s RMDs or a previously established withdrawal strategy in retirement. Lastly, cut back (not necessarily eliminate) unnecessary expenses until the economy balances out and we know what best next steps are.”

Self-made multi-millionaire John Cerasani, who built his company during a recession, told Fox News Digital that “there are opportunities for entrepreneurs to emerge in recession-proof industries.”

“Focusing on services related to higher education institutions is an example of an industry that typically thrives during a recession,” he explained.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Guild Investment Management’s Tony Danaher advised Americans to “hold off on high-ticket purchases, lock down and extend employment contracts (or make yourself invaluable) and save.”

“Consider less market and economic sensitive investments,” Danaher added. “If needed, put off retiring if worried about income.”