Ether (ETH) declined on Dec. 9, retesting the $3,800 level after failing to break above $4,050—a resistance level intact since December 2021. The 5% price drop has raised concerns among traders about the sustainability of the bull run, especially as Bitcoin (BTC) hovers near $100,000.

Investor unease is partly fueled by record-high inflows into Ether exchange-traded funds (ETFs), which failed to translate into a breach of the multi-year resistance level. Despite this, Ether futures data suggests that professional traders remain unfazed, showing no signs of anticipating further corrections.

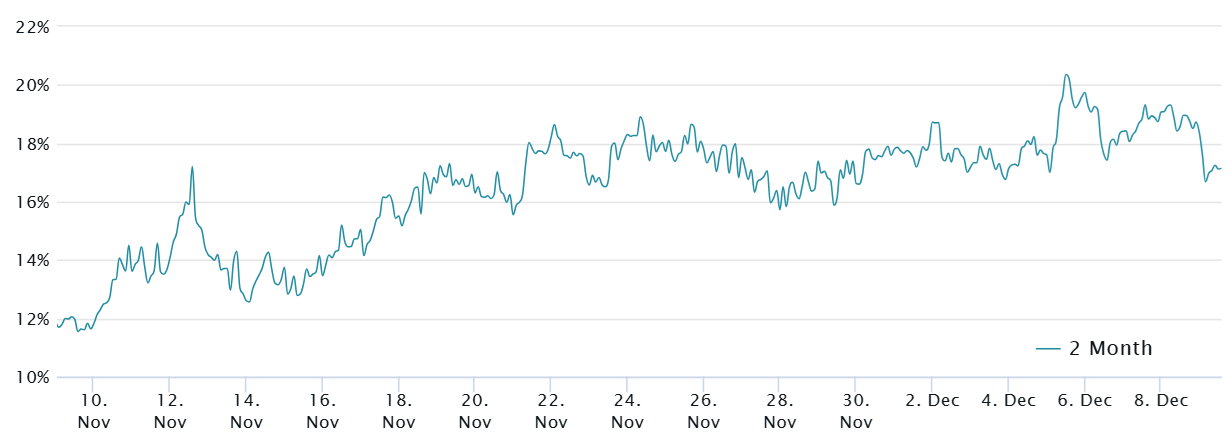

Ether 2-month futures annualized premium. Source: Laevitas.ch

The annualized premium for Ether futures currently stands at 17%, unchanged from the previous week and significantly above the 10% neutral benchmark. This elevated premium may indicate increased demand for ETH leverage, potentially driven by arbitrage opportunities in perpetual contracts, also known as inverse swaps.

Retail traders typically avoid monthly futures due to their price detachment from spot ETH markets, stemming from their longer settlement cycles. Consequently, heightened leverage demand—reflected in funding rates for perpetual contracts—can influence monthly futures pricing as whales and market makers closely monitor arbitrage opportunities.

Ether perpetual futures 8-hour funding rate. Source: laevitas.ch

The funding rate for Ether perpetual futures currently reflects a 2.7% monthly premium, slightly above the 2.1% neutral threshold. Notably, this metric peaked at 5.4% on Dec. 5, potentially contributing to the increased appetite for leveraged positions in monthly ETH contracts.

ETF inflows and Ethereum activity boost bullish derivatives demand

Other factors driving the demand for bullish ETH positions in derivatives include an unprecedented $1.17 billion inflow into spot Ether ETFs since Nov. 29. Additionally, onchain activity on the Ethereum network surged by 24% compared to the prior week, mitigating concerns over the current $7.50 average transaction fee.

Blockchains ranked by 7-day DApps volumes, USD. Source: DefiLlama

The Solana network maintained its position as the leader in decentralized application (DApp) volumes, but Ethereum significantly narrowed the gap, reaching $24.2 billion over seven days. When incorporating Ethereum layer-2 scaling solutions such as Base, Arbitrum, Polygon, and Optimism, the combined volume rises to $48.6 billion—65% higher than Solana’s $29.5 billion.

To evaluate whether professional ETH investors anticipate further price corrections, the ETH options skew must also be analyzed. In bearish markets, traders typically demand higher premiums for put (sell) options, causing the 25% delta skew to rise above 6%.

Deribit Ether 1-month options 25% delta skew, put-call. Source: Laevitas.ch

The Ether options market has shown diminished optimism, with the skew moving to -2% (neutral) from -7% on Dec. 6. However, despite ETH’s 5% price correction and repeated failures to breach $4,050, the options market has displayed resilience. A shift toward bearish sentiment would have driven the skew above the 6% neutral threshold.

Related: Crypto ETPs hit record $3.85B inflows as Bitcoin smashes $100K

Ether’s price decline appears to be influenced more by macroeconomic concerns than crypto-specific factors. Investor confidence was likely shaken after Nvidia (NVDA) shares dropped following the announcement of a monopoly investigation, alongside China’s inflation data showing a 0.6% decline in November compared to the previous month.

Fears of weakening global economies potentially impacting cryptocurrency markets likely played a role in the recent ETH price correction. However, traders’ sentiment remained optimistic, as reflected in derivatives market indicators.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.