The Ethena Foundation signed off on Wintermute’s proposal to share a portion of the decentralized finance (DeFi) protocol’s revenues with tokenholders, according to Wintermute’s governance forum.

On Nov. 6, Wintermute, a cryptocurrency market maker, proposed allocating a portion of Ethena’s fee revenue to stakers of ENA (ENA), Ethena’s native token.

“The Ethena Foundation is pleased to share that the proposal to enable an $ENA fee switch has been approved by the Risk Committee,” it said in the governance forum on Nov. 15.

“The Foundation will be working with the Risk Committee to crystallize parameters for fee switch activation by 30th November, with precise implementation mechanics to follow.”

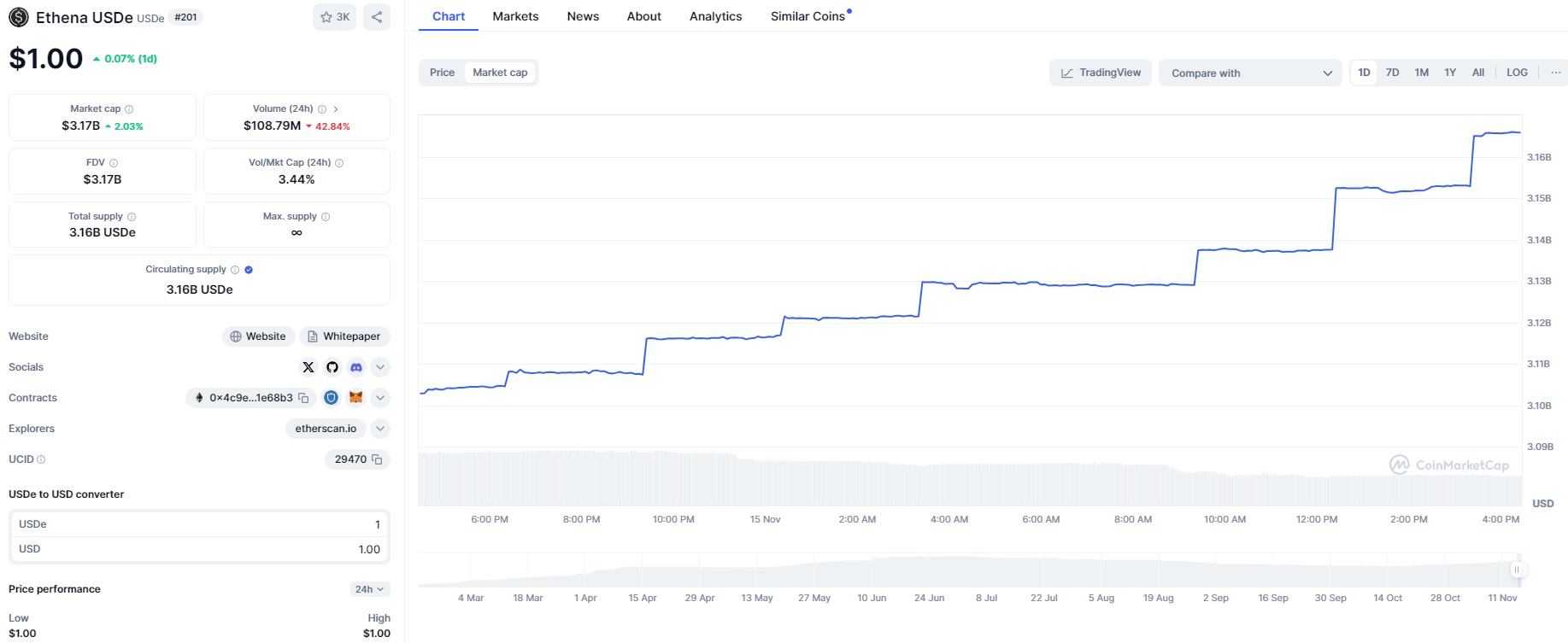

Source: CoinMarketCap

Related: Wintermute to take Ethena’s USDe as trading margin

In February, Ethena Labs launched an interest-earning stablecoin called USDe, which users can mint against tokens including Bitcoin (BTC), Ether (ETH), liquid staking derivatives, and other stablecoins.

Ethena then hedges against the portfolio’s inherent volatility using offchain financial derivatives.

USDe’s circulating supply has soared to nearly $3.2 billion since issuer Ethena Labs launched the unique stablecoin in February, according to CoinMarketCap.

Launched in April, Ethena’s ENA can be staked for sENA, which, before Wintermute’s governance proposal, lacked a clear value accrual mechanism.

“The Ethena Protocol has and continues to generate substantial amounts of real revenue, indicating a clear level of [product market fit] for USDe,” according to Wintermute’s Nov. 6 governance proposal.

“Unfortunately, sENA does not directly benefit from this revenue, resulting in an explicit disconnect between sENA holders and the growth of the protocol,” it added.

“It’s time to acknowledge this and look towards establishing clear alignment between ENA holders and the underlying fundamentals of the protocol.”

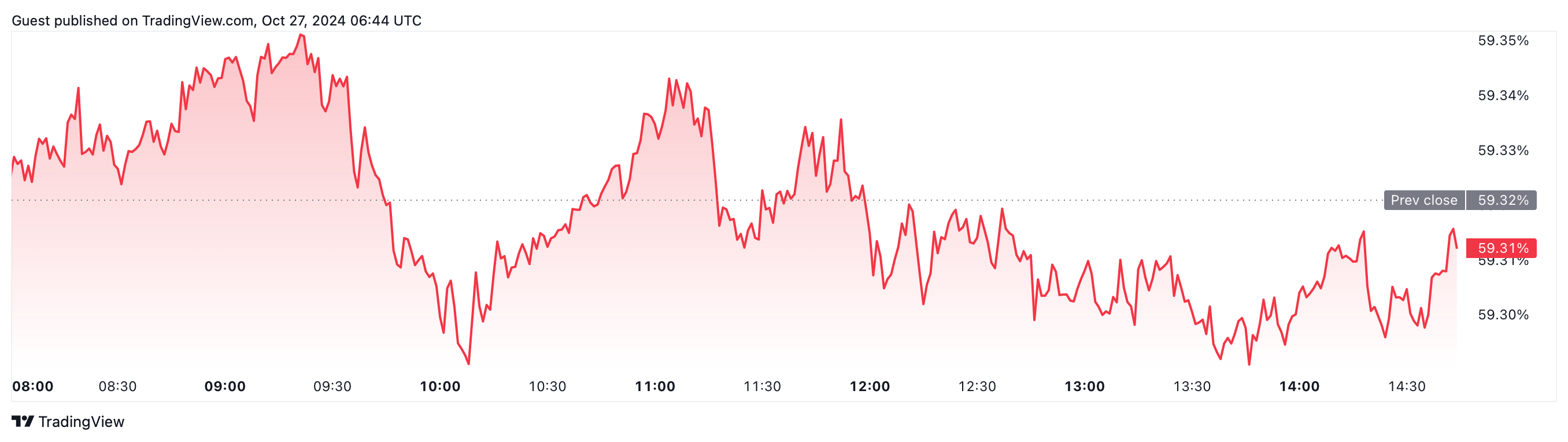

On Oct. 25, Wintermute started accepting USDe as collateral for spot crypto and derivatives trades.

Wintermute’s clients can now post “USDe as collateral for options, [credit default swaps], forward, and spot trading,” the company said in a post on the X platform.

The stablecoin joins Wintermute’s existing roster of accepted crypto collateral, which includes BTC, ETH, Solana (SOL), and USD Coin (USDC), Wintermute said.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime