Welcome to Finance Redefined, your weekly dose of essential decentralized finance insights — a newsletter crafted to bring you the most significant developments from the past week.

This week brought renewed optimism for crypto investors after Pitchbook data revealed that crypto startup funding rose 2.5% to $2.7 billion in the second quarter of 2024 despite declining overall investment deals.

In the broader crypto space, the Tron network has surpassed the 90-day revenue of the Ethereum network, which could put it on track to surpass $2 billion in revenue by the end of 2024. According to Sun, this would make it the “most profitable blockchain on Earth.”

Crypto startup funding grows to $2.7 billion in Q2 despite fall in total deals

Crypto startups secured slightly more venture capital funding in the second quarter than in the first, despite a decrease in the total number of deals, according to data from Pitchbook.

In an Aug. 9 report, Pitchbook said total capital invested increased 2.5%, but deals declined 12.5% compared to Q1.

Pitchbook said this could mean more promise from institutional investors in the market.

“With positive investor sentiment returning to crypto and barring any major market downturns, we expect the volume and pace of investments to continue increasing throughout the year,” wrote Pitchbook.

Tron network surpasses Ethereum in revenue over past 90 days

The Tron network has exceeded the Ethereum network’s revenues over the past 90 days, accruing approximately $435 million in fees compared to Ethereum’s fee revenues of roughly $364 million, according to data from Token Terminal.

Tron founder Justin Sun highlighted the 30-day revenue performance of the blockchain network, which has “exceeded Ethereum’s protocol revenue by 50%,” according to the Tron founder. Sun then offered forward-looking guidance for Tron:

“If this trend continues, Tron’s protocol revenue could even surpass $2 billion this year, making it the most profitable blockchain on Earth!”

ZK-powered DEX raises $10 million from Web3 heavyweights, launches mainnet

With $10 million in seed funding, Vessel aims to develop a comprehensive layer-3 solution for DeFi, focusing on exploring zero-knowledge (ZK) technologies and applications. Its goal is to address key challenges in DeFi, such as liquidity fragmentation and cross-chain compatibility.

One of the primary challenges in the crypto trading industry is striking the right balance between efficiency and transparency. Centralized exchanges offer fast transactions but often lack transparency, leading to concerns about security and trust.

On the other hand, decentralized exchanges (DEXs) provide users with greater visibility into system operations but typically involve lengthy processes, conflicting with the rapid pace of the crypto market.

Coinbase finds flawed analysis in SEC’s proposed exchange definition

Coinbase has submitted a new letter to the United States Securities and Exchange Commission regarding the agency’s proposed revisions to the definitions of a national securities exchange. This marks Coinbase’s third comment letter, focusing on the SEC’s cost-benefit analysis of the proposed changes.

Coinbase argues that the SEC lacks the necessary information to conduct a cost-benefit analysis and depends on irrational arguments instead. The letter’s author, Coinbase chief legal officer Paul Grewal, said the SEC should at least withdraw the proposal and start over again after it has done its research.

Ethereum supply surpasses 120 million ETH as staking, restaking surge

The decentralized open-source blockchain platform Ethereum has recently hit a significant milestone as the total supply of Ether reached 120 million.

The development comes as both staking and restaking Ether (ETH) witness a surge in uptake, further reinforcing its proof-of-stake consensus mechanism.

According to the latest data on Ultrasound.money, ETH supply has increased to approximately 120.28 million ETH, with 77,091 ETH issued over the last 30 days.

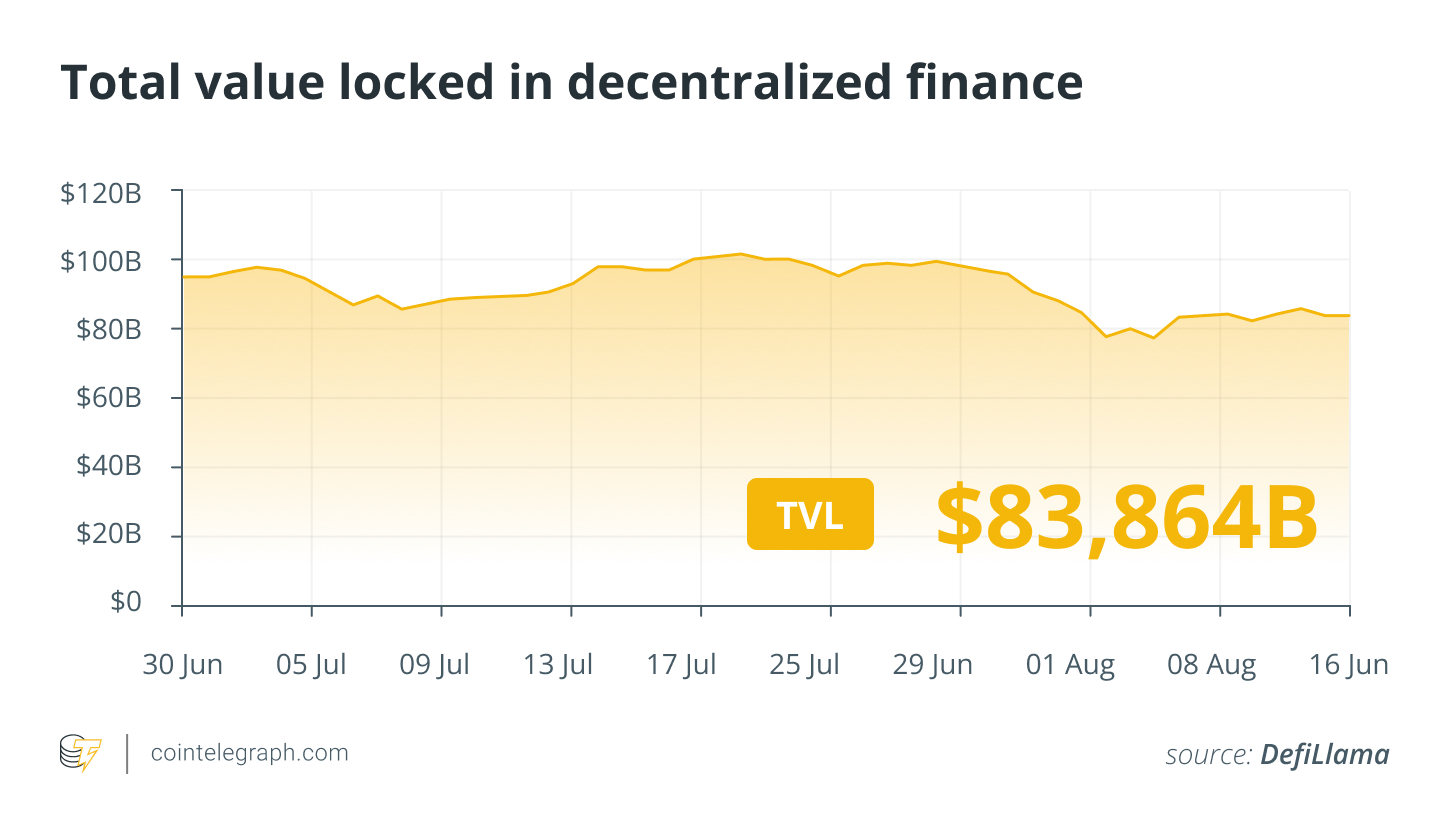

DeFi Market overview

According to data from Cointelegraph Markets Pro and TradingView, the majority of the 100 largest cryptocurrencies by market cap ended the week in the red for the second consecutive week.

Of the top 100, Solana-based memecoin Dogwifhat (WIF) fell over 20% on the weekly chart as the biggest loser, followed by the Brett (BRETT) token, which fell nearly 17%.

Total value locked in DeFi. Source: DefiLlama

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.