NEW YORK: Crypto startups have drawn in roughly US$100bil of venture funding since the industry’s inception, after a recent pick-up in investment that coincided with a rally in bitcoin and other major tokens.

Data collected by DeFiLlama suggest the crypto sector’s fundraising haul stands at US$101bil since 2014, while The Block Research has tallied more than US$95bil of cumulative investment starting from 2017.

Fundraising in the form of venture capital (VC) deals and token sales has been a major propellant of the crypto industry’s growth, but the billions of dollars poured into startups have produced decidedly mixed results for investors.

Traditional exits in the form of landmark acquisitions and public listings have “definitely taken longer than I think you normally expect from traditional VC,” said Paul Veradittakit, managing partner at Pantera Capital, the US$4.7bil crypto investment firm.

Coinbase Global Inc’s US$86bil direct listing on the Nasdaq in 2021 during the last crypto bull market is a notable exception, he added, but exits in general have been scarce, largely limited to a smattering of trade sales.

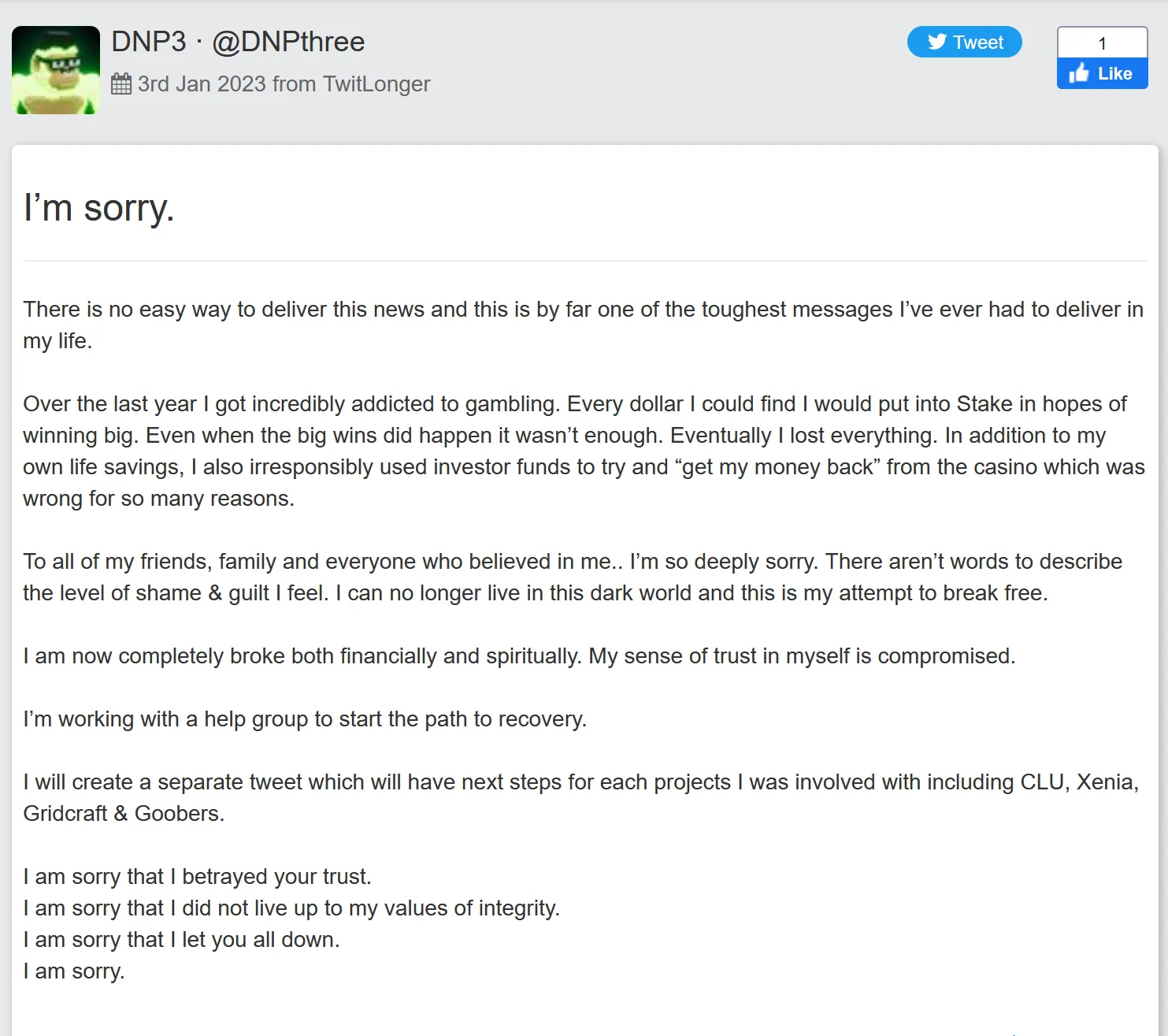

Investors have also been scarred by outlandish blow-ups at once-vaunted crypto startups like Sam Bankman-Fried’s FTX and crypto lender BlockFi.

The likes of Tiger Global Management LLC and Temasek Holdings Pte have largely retreated from the sector since. Tiger Global notched just four crypto deals since the start of 2023, after an earlier flurry that saw the firm back dozens of startups, according to The Block Research data.

Temasek said last year it had no plans to invest in crypto exchanges after writing down a US$275mil stake in FTX to zero. Temasek declined to comment further while Tiger Global didn’t immediately reply to a request for comment.

Fundraising by crypto startups dropped off sharply after the excesses of 2021 and 2022, in line with a broader decline in venture investment across fintech, which peaked at over US$110bil globally in 2021 alone.

Helping to offset the challenges are tokens issued by startups, which venture capitalists often purchase as part of early-stage funding pacts. Typically listed on crypto exchanges, the tokens are another proxy for the value of projects.

Institutional backers that lost money on crypto bets did so because they arrived too late or were “lured into” investing in equity, according to Ray Hindi, chief executive officer of L1 Digital. “That was the wrong investment,” he said.

Tokens are a different story. While subject to certain lock-ups, sales of these volatile digital-assets are often possible relatively swiftly and can generate short-term returns. Many large crypto venture outfits, such as Polychain Capital, have in-house funds to help manage the tokens amassed through investments.

Kinjal Shah, general partner at Blockchain Capital, is among those taking a more old-school approach.

“The way that we really position investing is still oriented around a venture style return,” she said. “So still fund lifecycles of five to 10 years and really orienting around what can be accomplished in a decade.”

For some, liquid tokens can cut the return cycle for venture investors down from five to 10 years to as little as two, according to Richard Galvin, co-founder of Digital Asset Capital Management.

The Block Research data show that Coinbase Ventures tops the charts with 443 investments or roughly 4% of all deals since 2017. Animoca Brands Corp and Outlier Ventures Ltd are in second and third spots, respectively.

Crypto venture investment rose to US$2.5bil in the first quarter of this year, up from a recent low of US$1.9bil in the fourth quarter of 2023, according to PitchBook data. With that uptick came the return of eye-catching billion-dollar valuations for startups like Farcaster, Berachain and Hidden Road Partners.

Those investments came alongside a wider crypto rally, including a record of US$73,798 for bitcoin in March. The climb has stalled but some analysts expect fresh momentum and a wave of crypto-related initial public offerings.

As many as 15 crypto firms could go public, Matthew Kennedy, senior market strategist Renaissance Capital, said in a recent interview.

In the bitcoin mining sector, merger and acquisition (M&A) activity has picked up, with Core Scientific Inc and Bitfarms Ltd fielding takeover bids.

M&A and listing activity will accelerate in the digital-asset industry as the sector matures, said Hoolie Tejwani, director of corporate development and ventures at Coinbase.

“This activity has been held back by the lack of regulatory clarity, which we are fighting for in courts and in Congress,” Tejwani said.

L1 Digital’s Hindi remains circumspect, unconvinced that a trickle of deals will turn into a flood. “We’re talking about a few data points,” he said. “We’re not talking about a wave of M&A and there’s no reason to think that.” — Bloomberg