The origins of hawala

Hawala is an informal, trust-based money transfer system that operates without banks or formal records.

Hawala, the centuries-old money transfer system, is as fascinating as it is controversial. Originating from the Arabic word for “transfer” or “trust,” hawala operates on a simple yet powerful principle: trust. No banks, no paperwork, no formal records—just a network of brokers, called hawaladars, who facilitate transactions based on mutual trust and personal connections.

This system has been a lifeline for millions, especially in regions where traditional banking is either inaccessible or too expensive. But while hawala is a boon for many, its informal nature has also made it a headache for regulators trying to combat money laundering and terrorist financing.

So, how does hawala work, why is it so popular, and what happens when this ancient system collides with modern technology like cryptocurrencies? Let’s dive in.

How Hawala works: Trust over paperwork

Hawala is a money transfer system that has been a cost-effective solution for expatriates sending remittances, especially in regions with limited banking access.

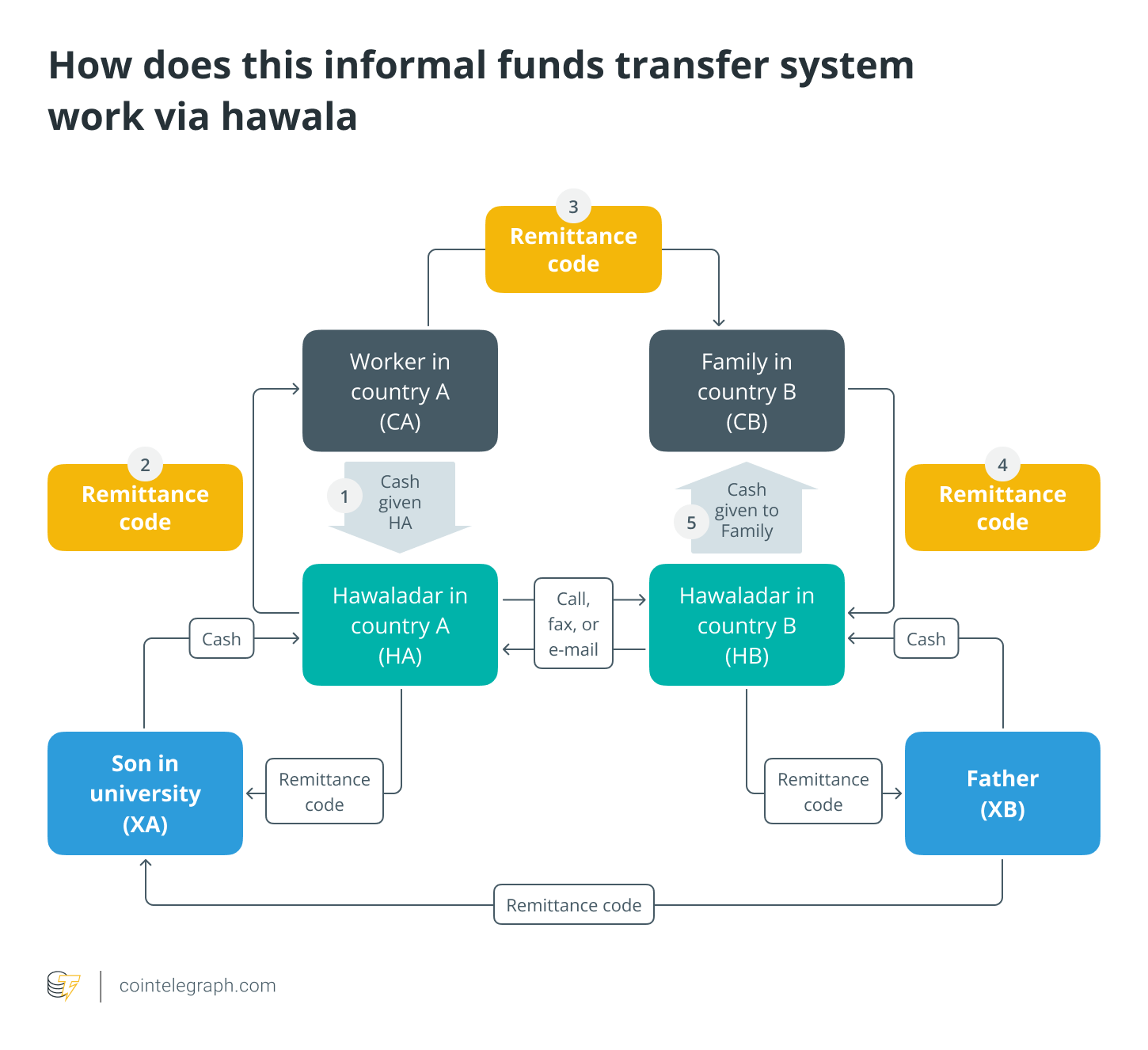

Imagine you’re an expatriate working abroad, and you need to send money back home to your family. Instead of going through a bank, you visit a local hawaladar who is a trusted broker and operates within your community. You hand over the cash, and the hawaladar contacts a counterpart in your home country.

Within hours, your family receives the equivalent amount from the hawaladar’s partner. No physical money crosses borders, no banks are involved, and there’s no paperwork requirement.

According to the World Bank, global remittances to middle- and low-income countries reached a staggering $785 billion in 2024, with a significant portion flowing through informal channels like hawala. For many people, especially in developing countries, hawala is the only affordable way to send money home.

The magic of hawala lies in its simplicity. Instead of moving cash, hawaladars settle debts among themselves. For example, if a hawaladar in Dubai owes money to a hawaladar in Mumbai, they might balance the books through other transactions, like property deals or trade goods. This system is fast, cheap and incredibly efficient, which is why it’s so popular in regions with underdeveloped banking infrastructures.

Did you know? If convicted of a Hawala banking offense, you may face ancillary orders such as financial reporting requirements, business restrictions or confiscation of assets. Courts can also demand repayment of prosecution costs, including legal fees and investigation expenses.

The dark side of Hawala: A haven for illicit activities

Hawala’s lack of transparency makes it vulnerable to illicit activities like money laundering and terrorist financing, as it operates without records or oversight, raising concerns for regulators.

There is a catch. Hawala’s lack of transparency makes it a magnet for illicit activities. Traditional banks are required to follow strict Anti-Money Laundering (AML) measures, such as Know Your Customer (KYC) and Suspicious Activity Reporting (SAR). These rules force banks to verify identities, monitor transactions, and report anything suspicious to authorities.

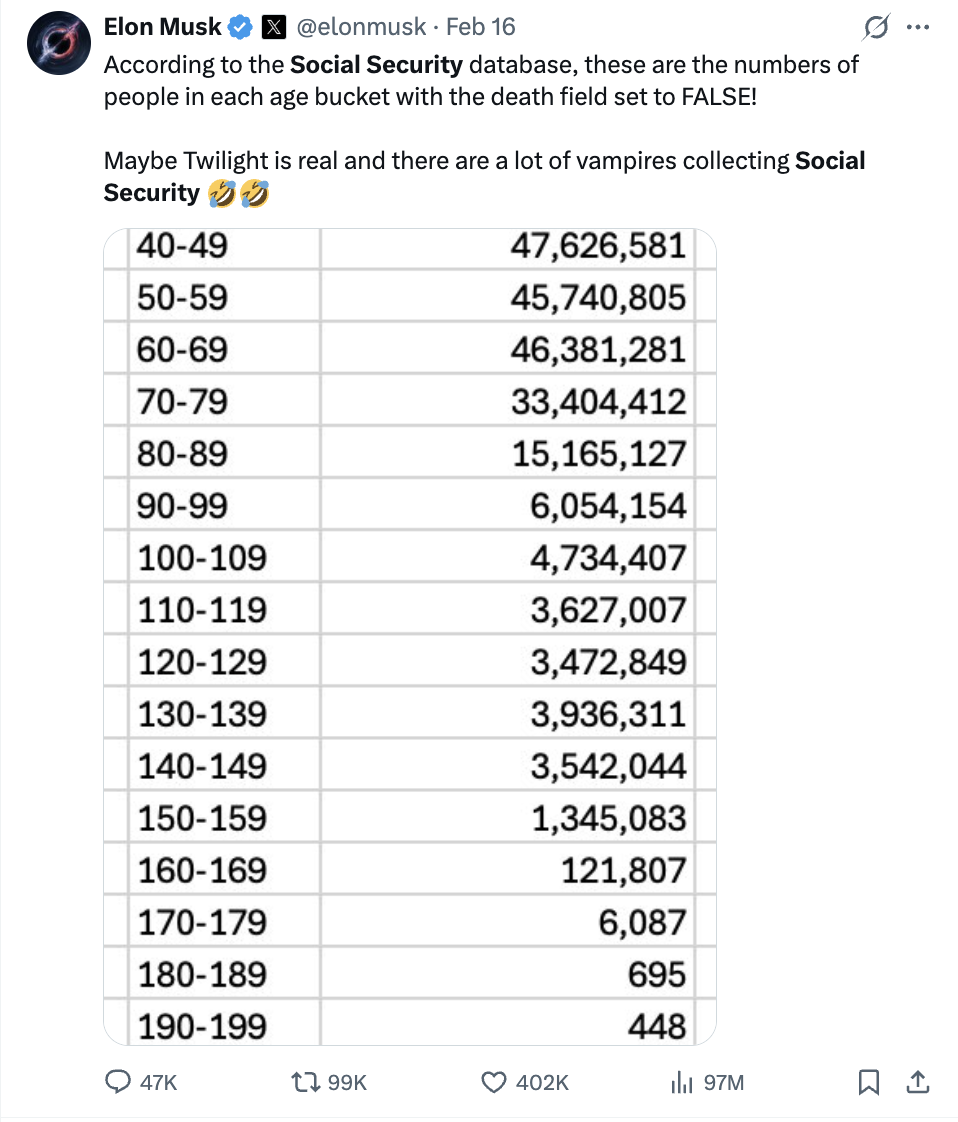

Hawala, on the other hand, operates entirely off the grid. There are no records, no receipts and no oversight. This makes it incredibly difficult for regulators to track the flow of money. According to the United Nations Office on Drugs and Crime (UNODC), an estimated $800 billion to $2 trillion is laundered globally each year, and informal systems like hawala play a significant role in this.

For example, hawala has been used to fund terrorist activities, smuggle goods, and evade taxes. The lack of documentation means that law enforcement agencies often have no way of tracing these transactions. This opacity is a major concern for governments and international organizations trying to prevent financial crimes.

So, how is this connected to cryptocurrencies? Imagine a world where an opaque hawala network chooses to use cryptocurrencies to obfuscate the source and destination of the funds.

Hawala and cryptocurrencies: A match made in (shadowy) heaven?

Cryptocurrencies, with their pseudonymity, complement hawala’s trust-based model, though blockchain transparency may offer better tracking compared to traditional financial systems.

Now, let’s add another layer of complexity: cryptocurrencies. Digital currencies like Bitcoin (BTC) offer the same speed, low cost and anonymity that make hawala so appealing. But they could make it even harder to track illicit activities.

Cryptocurrencies are decentralized, meaning they operate outside the control of governments and traditional financial institutions. Transactions are pseudonymous, making it difficult to identify the parties involved. This makes cryptocurrencies a perfect match for hawala’s trust-based model.

Blockchain analytics firm Chainalysis highlighted the scale of this issue in its 2024 Crypto Money Laundering Report. The report found that $31.5 billion in cryptocurrency was laundered in 2022 alone (but did not explicitly mention hawala). While the number seems to have dropped in 2023, it remains to be seen whether it was due to better transaction monitoring controls within cryptocurrencies or whether it was due to muted crypto activity in the year.

Blockchain analytics firm Chainalysis highlighted the scale of this issue in its 2024 Crypto Money Laundering Report. The report found that $31.5 billion in cryptocurrency was laundered in 2022 alone (but did not explicitly mention hawala). While the number seems to have dropped in 2023, it remains to be seen whether it was due to better transaction monitoring controls within cryptocurrencies or whether it was due to muted crypto activity in the year.

There is evidence, however, that the percentage of illicit money laundering activities on cryptocurrencies is lower than that in traditional financial services. This could be because cryptocurrency transactions can be tracked on the blockchain, and it is also not known as widely across the world as traditional money transfer methods.

Example: Crypto hawala network laundered $20 million before takedown

Anurag Pramod Murarka, an Indian national, was sentenced to over 10 years in prison for running an international money laundering scheme. Operating under aliases like “elonmuskwhm,” he used cryptocurrency to launder over $20 million in criminal proceeds.

Murarka advertised his services on dark web marketplaces, where criminals involved in drug trafficking and hacking paid him to clean their illicit funds. He used a hawala network from India to the United States, where his employees received and mailed cash hidden in books and envelopes.

The US Federal Bureau of Investigation took over his online identity, leading to multiple arrests and asset seizures. Murarka must serve at least 85% of his sentence and will be supervised for three years after release.

Did you know? Research published in the European Journal of Islamic Finance highlights that a hawala system based on blockchain could improve speed, efficiency and compliance with both AML regulations and Sharia law principles.

Regulatory efforts to combat informal money transfers via hawala

Governments and global organizations are tightening regulations on hawala and crypto transactions through AML laws, KYC requirements and reporting mandates.

Governments and international organizations are well aware of the risks posed by hawala and its crypto-enabled counterparts. Over the past decade, there’s been a global push to bring these informal systems under tighter scrutiny.

The Financial Action Task Force (FATF)

This global watchdog has been at the forefront of the fight against money laundering and terrorist financing. FATF classifies hawala providers into three separate categories:

- Traditional hawala providers: Legitimate and long-established money transfer networks that have been in use for centuries.

- Hybrid hawala providers: Businesses that blend traditional hawala methods with modern financial systems to meet transaction demands.

- Criminal hawala providers: Operators who exploit hawala networks specifically to facilitate illicit financial activities.

In 2019, the FATF introduced the Travel Rule, which requires virtual asset service providers (VASPs) to share transaction details for transfers over $1,000. The goal is to bring the same level of transparency to crypto transactions as exists in traditional finance.

Bank Secrecy Act (BSA)

The US has some of the toughest AML laws in the world. The Bank Secrecy Act (BSA) requires financial institutions to report transactions over $10,000 and flag suspicious activities. In 2021, the Infrastructure Investment and Jobs Act introduced stricter reporting requirements for crypto transactions, including a mandate to report transactions over $10,000.

Markets in Crypto-Assets (MiCA)

The European Union’s Markets in Crypto-Assets (MiCA) regulation, which took effect in 2024, aims to create a unified regulatory framework for crypto across member states. MiCA will require crypto exchanges and wallet providers to implement KYC and AML measures, making it harder for hawala networks to exploit digital currencies.

In regions where hawala is deeply ingrained, like the Middle East and South Asia, regulation is a mixed bag. For example, the United Arab Emirates has implemented stringent AML laws and requires hawaladars to obtain licenses. Meanwhile, in Pakistan and India, hawala is technically illegal but widely used due to its efficiency and low cost.

Key challenges and the road ahead

Regulating hawala within cryptocurrencies remains challenging due to its informal nature and global reach, prompting regulators to enhance international cooperation and leverage advanced technologies.

Despite these efforts, regulating hawala, whether in traditional finance or crypto, remains a daunting task. The system’s informal nature and global reach make it difficult to monitor, and the rise of cryptocurrencies has only added to the complexity.

One of the biggest challenges is enforcement. Cryptocurrencies are inherently decentralized, and their pseudonymous nature makes tracking transactions a nightmare. To stay ahead, regulators are focusing on two key strategies.

- International cooperation: Organizations like the FATF are pushing for greater collaboration between countries to share intelligence and harmonize regulations.

- Technological innovation: Advanced tools like blockchain analytics and artificial intelligence are being used to track suspicious transactions and identify patterns of illicit activity.

Hawala is a system built on trust, but that trust can be exploited for nefarious purposes. As it evolves with the rise of cryptocurrencies, regulators worldwide are racing to adapt. The challenge is to strike a balance by preserving the benefits of hawala for legitimate users while cracking down on its misuse.