Crypto.com has launched an institutional cryptocurrency custody service in the United States as part of a broader plan to expand its presence in the country, the crypto exchange said on Dec. 23.

Dubbed Crypto.com Custody Trust Company, the chartered trust is eligible to custody assets for US institutions and high-net-worth individuals, Crypto.com said.

Digital assets held by Crypto.com’s US and Canadian customers will migrate to Crypto.com Custody Trust Company “over the coming weeks,” the exchange said.

“This step reflects our confidence in the North America[n] market,” Kris Marszalek, Crypto.com’s CEO, said in a statement.

It also advances Crypto.com’s roadmap for “building our business and presence in two of the most important and active crypto markets in the world — the US and Canada,” Marszalek said.

Related: Trump meets with Crypto.com CEO as firm drops SEC lawsuit

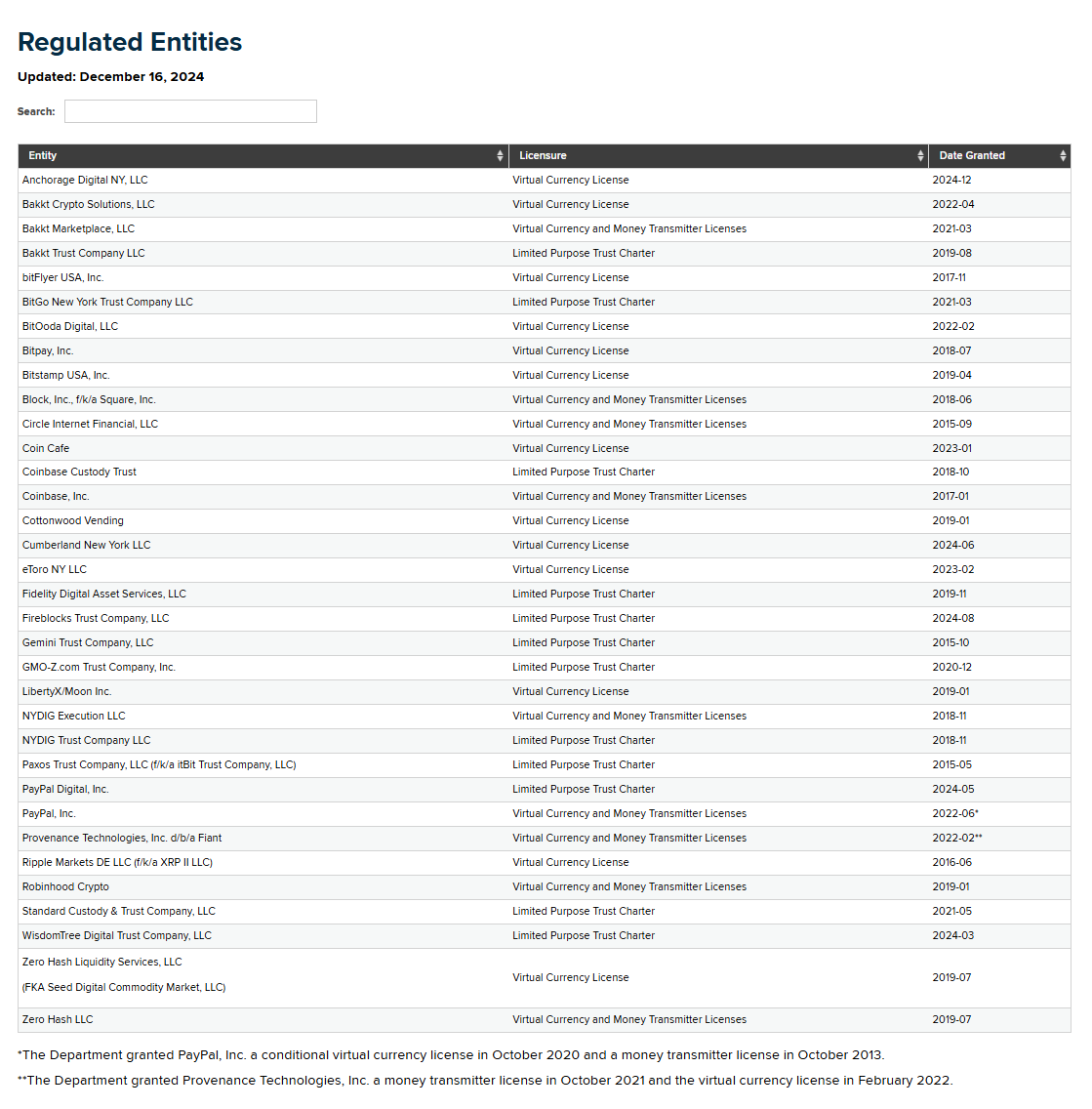

Regulated crypto businesses. Source: NYDFS

US expansion plans

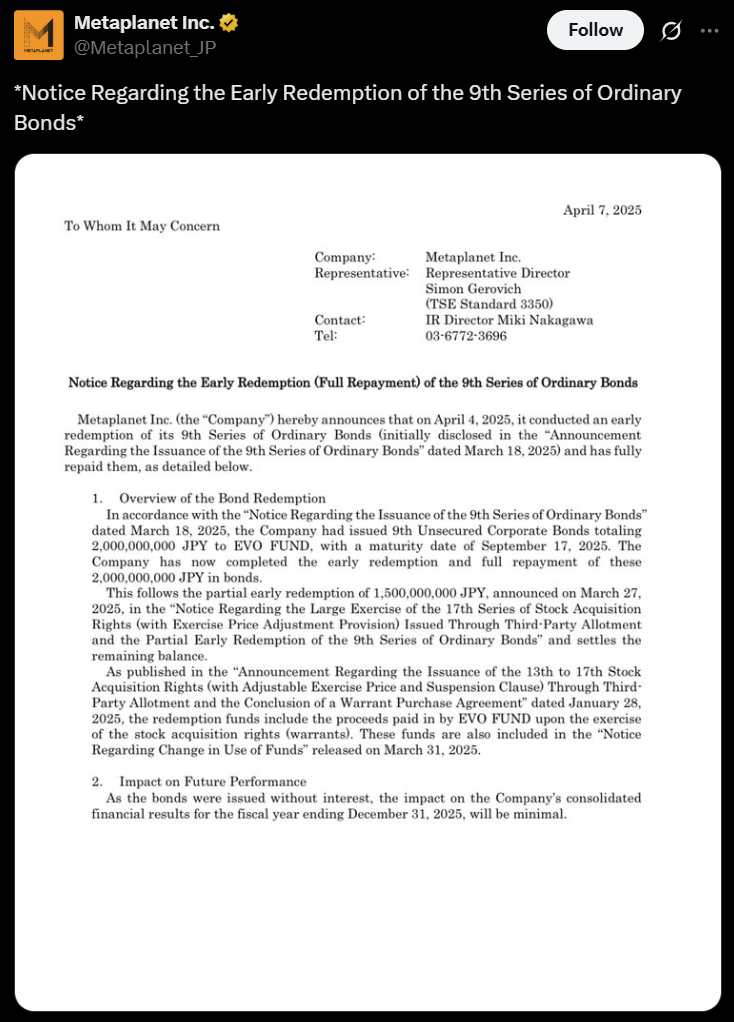

In December, US President-elect Donald Trump met with Marszalek at Trump’s home in Mar-a-Lago to discuss crypto policies.

The same day, Crypto.com dropped its lawsuit against the US Securities and Exchange Commission, citing its “intent to work with the incoming administration on a regulatory framework for the industry.”

Trump has said he wants the US to be “the world’s crypto capital” and is tapping pro-industry leaders to head key regulatory agencies when he starts his presidential term in January.

Crypto.com is headquartered in Singapore and launched in the US in 2022, initially only for institutional investors. It suspended its exchange services in the country in 2023 but has since reversed course.

In October, Crypto.com bought Watchdog Capital, a broker-dealer registered with the SEC, in a bid to expand its US footprint.

Regulated custodians

Regulated digital asset custodians are proliferating in the US. In September, BitGo, a US crypto custodian, launched a regulated platform designed to custody and manage native tokens for Web3 protocols.

In August, Cointelegraph reported that Fireblocks — best known for its self-custody treasury management products — obtained approval from New York’s financial regulator to custody assets for US clients.

Other institutional crypto companies — including Coinbase Custody Trust, Fidelity Digital Asset Services, and Anchorage Digital NY — are also similarly licensed.

Magazine: 13 Christmas gifts that Bitcoin and crypto degens will love