After years of bashing cryptocurrencies, US investment bank Goldman Sachs has admitted it was wrong about the asset class. Not in words, but with actions.

The investment giant, which manages nearly $3 trillion in client assets, is buying up huge quantities of Bitcoin (BTC) and Ether (ETH) exchange-traded funds (ETFs). In a matter of months, the investment bank increased its ETH exposure by 2,000% and upped its Bitcoin ETF holdings by 114%.

Goldman’s U-turn on digital assets reminds crypto advocates of the quote, “First they ignore you, then they laugh at you, then they fight you, then you win.”

This week’s Crypto Biz newsletter explores Goldman’s crypto capitulation, the rush of Japanese companies buying Bitcoin and the surge in stablecoin adoption this year. Although crypto prices are down so far in February, institutional adoption is clearly on the rise.

Goldman Sachs increases crypto exposure

According to regulatory filings with the US Securities and Exchange Commission, Goldman purchased nearly $1.28 billion worth of iShares Bitcoin Trust (IBIT) in the fourth quarter of 2024, along with $288 million worth of the Fidelity Wise Origin Bitcoin Fund. The filings show Goldman also holds $3.6 million worth of the Grayscale Bitcoin Trust (GBTC).

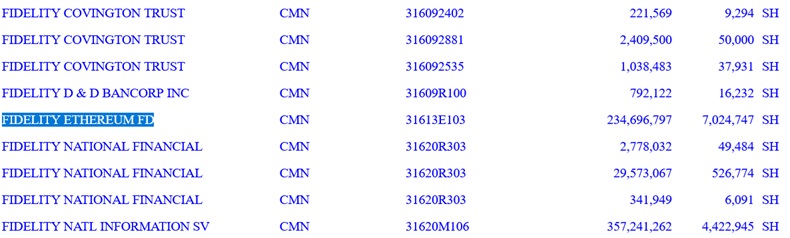

During the same quarter, Goldman increased its exposure to Ether ETFs from $22 million to $476 million through BlackRock’s iShares Ethereum Trust and the Fidelity Ethereum Fund.

Goldman’s 13F filing shows holdings of $234.7 million worth of Fidelity’s Ethereum ETF. Source: SEC

The investment bank’s first foray into crypto ETFs was in the second quarter of 2024, when it purchased $418 billion worth of Bitcoin funds. The company’s buying spree in Q4 was likely triggered by the election of pro-crypto President Donald Trump, who has promised to transform America into the world’s blockchain capital.

Metaplanet’s Bitcoin buy triggers a 4,800% stock surge

Bitcoin treasurer Metaplanet has seen its stock price surge since adding BTC to its balance sheet. According to Bloomberg, the Tokyo-listed stock has risen by nearly 4,800% over the past 12 months. The gains coincided with the company’s first Bitcoin purchase in April 2024. As of Jan. 28, 2025, the company had acquired 1,762 BTC worth about $171 million. Metaplanet plans to hold up to 21,000 BTC by the end of 2026, which could make it the world’s second-largest Bitcoin treasurer behind Michael Saylor’s Strategy. The ambitious plan includes raising up to 116 billion yen, or $745 million, to finance more Bitcoin purchases.

Metaplanet’s stock surged over the past year. Source: Bloomberg

Japanese gaming studio buys 1 billion yen worth of BTC

Metaplanet isn’t the only publicly listed Japanese company to acquire Bitcoin. This week, the Tokyo-listed gaming studio Gumi announced a 1 billion yen allocation to BTC, equivalent to $6.6 million at the current exchange rate. The company intends to stake the newly acquired Bitcoin on Babylon, a digital asset staking protocol. The BTC acquisition supports Gumi’s broader blockchain and Web3 ambitions, which include “expanding our portfolio in the node management business,” the company said. Gumi also operates a Silicon Valley venture capital fund that invests in early-stage blockchain projects.

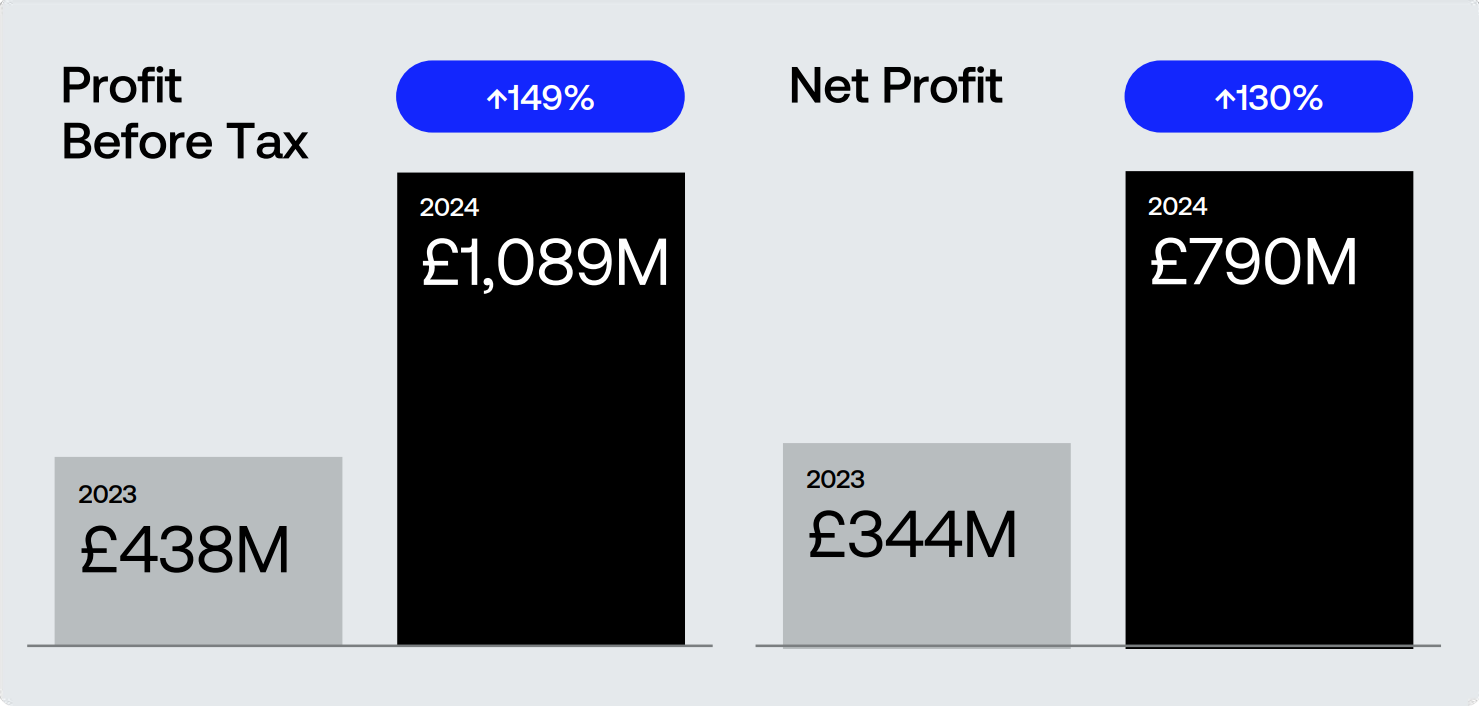

Circle’s USDC erases bear market losses

The crypto bull market has fueled a proliferation of stablecoin usage, with Circle’s USD Coin (USDC) fully rebounding from its bear market bottom in 2023. As of Feb. 12, USDC’s market capitalization was above $56.1 billion, more than double the $24.1 billion bottom in November 2023. The value of USDC in circulation has also increased by 23% from early January. USDC’s growing market cap comes as Circle expands its stablecoin to other blockchains, including Sui and Aptos. USDC is also active on the Solana blockchain.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.