Cryptocurrencies like Bitcoin (BTC) will likely play a role in the looming United States presidential election as many US crypto investors are concerned about a candidate’s approach to regulating the industry.

The vast majority of crypto owners in the US plan to consider the crypto regulation stance of US presidential candidates at the upcoming election in November, according to a new report by Winklevoss twins-founded crypto exchange Gemini.

Released on Sept. 10, Gemini’s latest “Global State of Crypto” report featured a survey of 6,000 adults representing a random sample of the consumer population in the US, the United Kingdom, France, Singapore and Turkey. The survey was conducted online from May 23 to June 28, 2024.

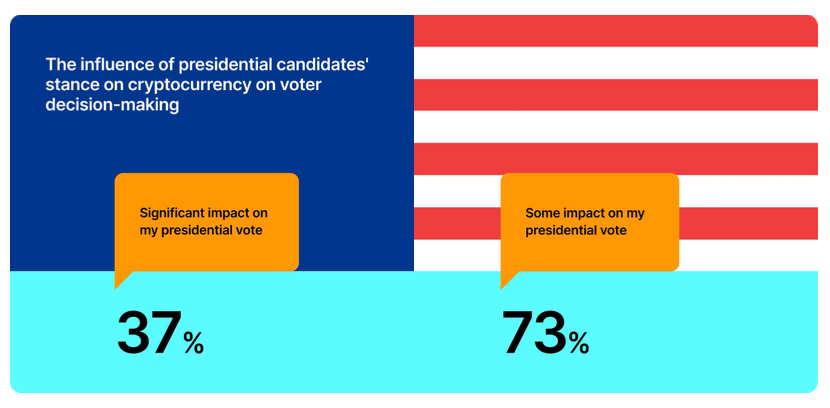

73% of crypto owners in the US plan to look at a candidate’s crypto agenda

According to Gemini’s findings, as many as 73% of US respondents who currently own crypto believe that a candidate’s stance on crypto will have “some impact” on their presidential vote.

Additionally, another 37% of respondents indicated that a presidential candidate’s position on crypto would have a “significant impact” on their vote for president.

Three in four crypto owners say crypto policy will impact the US presidential vote. Source: Gemini

According to Gemini, the survey’s results reflect the growing role of crypto in the ongoing presidential campaigns in the US:

“For the first time in United States history, crypto has become a significant campaign issue in a presidential election.”

Regulatory concerns are a barrier for past crypto holders and non-holders

Among other insights in the survey, Gemini found respondents were increasingly worried about regulatory uncertainty as a barrier to investing in crypto compared to 2022.

In 2024, 38% of US respondents cited regulatory concerns as a barrier to entering crypto, a significant increase from 28% who indicated the same two years ago.

Percentage of past owners and non-owners citing regulatory concerns as a barrier. Source: Gemini

The survey suggests that, despite increasing concerns about crypto regulations, US investors have seemingly been shifting toward cryptocurrencies in recent years.

Related: Ripple co-founder signs letter endorsing Harris for president

The amount of US respondents who indicated to have zero crypto exposure dropped from 75% in 2022 to 65% in 2024. The number of crypto holders slightly increased from 20% in 2022 to 21% in 2024, while past owners also surged from 5% in 2022 to 14% in 2024.

Crypto ownership by country in Gemini’s 2024 Global State of Crypto report. Source: Gemini

Some previous reports suggested that the number of US adults reporting crypto exposure dropped over the past few years, though.

According to the Fed’s Survey of Household Economics and Decisionmaking, only 7% of surveyed US adults reported using crypto in 2023, which was a significant decline from 10% in 2022 and 12% in 2021.

Magazine: 2 auditors miss $27M Penpie flaw, Pythia’s ‘claim rewards’ bug: Crypto-Sec