A crypto analyst warned there was a high likelihood of a “flash crash” after the broader crypto market clocked significant gains over the past month.

“If corrections happen, and they will, and a flash crash is likely to happen, inducing a massive liquidation crash across Altcoins,” MN Capital founder and crypto analyst Michael van de Poppe said in a Nov. 3 X post.

Buying opportunity awaits, says analyst

“Don’t panic. Use those as an opportunity to get into the markets. They are a blessing,” van de Poppe added.

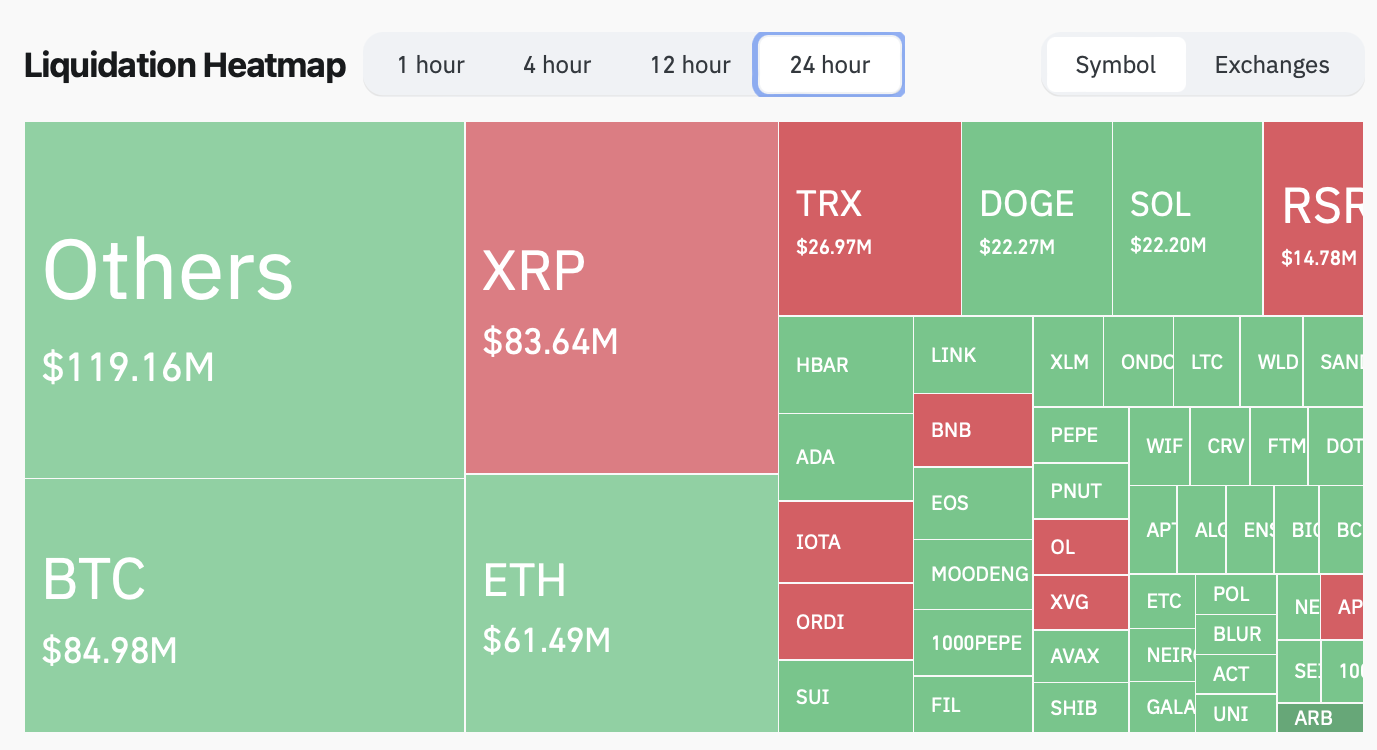

A total of $618.7 million was liquidated from the crypto market over the past 24 hours. Source: CoinGlass

An increasing number of crypto market positions means that even a small pullback could trigger a large amount of liquidations.

In the past 24 hours, about $618.7 million was liquidated from the entire crypto market after South Korean President Yoon Suk-yeol’s declaration of martial law and then quick reversal.

Of that total, $85.8 million in Bitcoin (BTC) positions and $61.5 million in Ether (ETH) positions were liquidated, according to CoinGlass data.

The prices of Bitcoin, Ether, XRP (XRP), and other cryptocurrencies dropped after the emergency declaration but have since clawed back some losses, recovering 2.4%, 3.3% and 9.2%, respectively, according to CoinMarketCap.

Bitcoin was trading at $96,700 at the time of publication. Source: CoinMarketCap

Recent crypto trading surge in South Korea

It came only a day after 10x Research said on Dec. 3 that retail trading volumes for crypto assets in South Korea had surged to $18 billion in the previous 24 hours, outperforming the country’s stock market by 22%.

Related: Wrapped Bitcoin flash crashes to $5K on Binance exchange

Meanwhile, it was recently reported that Bitcoin whales were standing on the sidelines with their holdings as BTC continued to tease and retrace, hovering just below $100,000.

“Although there is currently no immediate selling pressure, the rising inflow of Bitcoin into exchanges highlights a potential risk of future sell-offs,” CryptoQuant contributor Onat Tütüncüler said in a Nov. 2 analyst note.

Magazine: 5 incredible use cases for Based Agents and Near’s AI Assistant

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.