Legal Challenges in Online Casinos, Cryptocurrency Exchanges and Crypto Processing of Russian and Belarusian International Criminals Targeting Europe, Americas, Australia, and Beyond

Apart from quite strong allegations of money laundering, helping to avoid sanctions and false hacking, SoftSwiss guys (let’s call them that for the sake of simplicity) had close encounters with legal entities before.

As we already know, there are multiple people behind the scam and money laundering operated by SoftSwiss, CoinsPaid, AlphaPo, Merkeleon and Dream Finance, including Ivan Montik, Max Krupyshev, Pavel Kashuba, Dmitry Yaikov, Roland Yakovlevich Isaev and Paata Gamgoneishvili.

Running a plethora of online casinos, a very niche field comes with many legal regulations and subsequent repercussions. It’s not rare for such businesses to run into some kind of legal trouble, and ultimately to pay some hefty fine considering the nature of gambling.

In the case of SoftSwiss, or rather their supposed owner Dama NV, the legal regulations came knocking with multimillion-dollar fines.

To clarify, all of the companies mentioned are part of one well-oiled and well-maintained corporate machine, and even though Dama NV allegedly owns SoftSwiss, they should be looked at as equal.

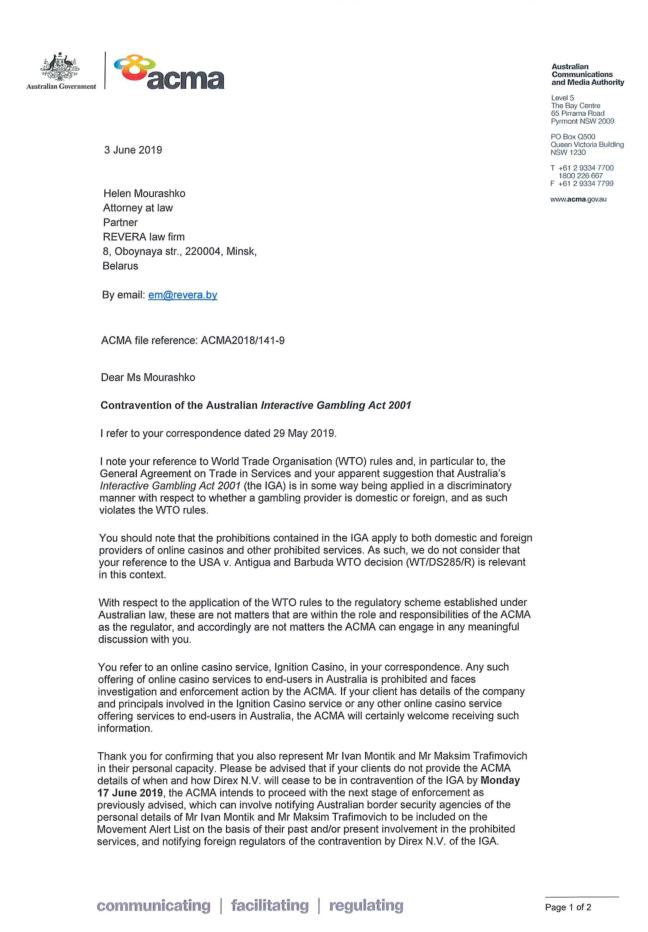

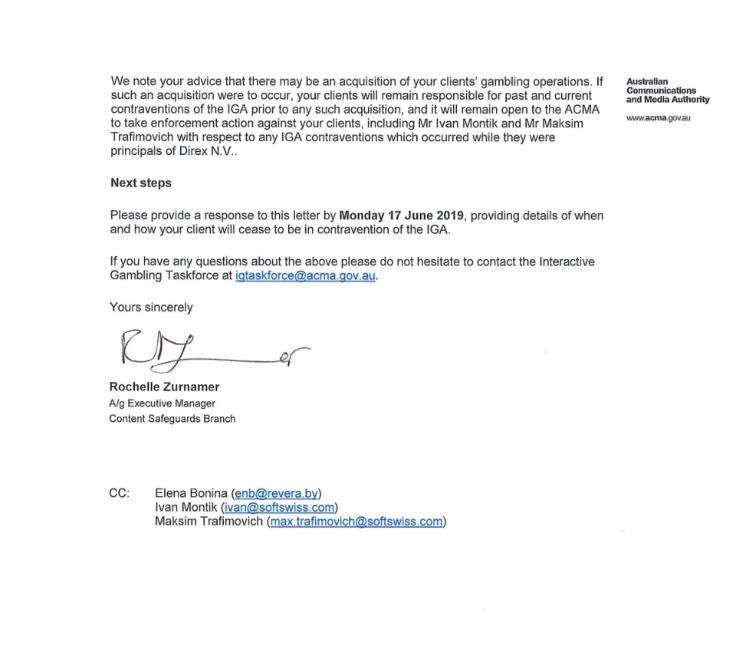

Furthermore, Dama NV is also connected to a company called Direx NV, another online gambling giant. Back in 2019, Direx NV ran into legal trouble with the Australian Communications and Media Authority (ACMA).

At the time, Ivan Montik and Maksim Max Trafimovich (CCO at SoftSwiss) were listed as directors and owners of Direx NV, while being legally represented by law firm REVERA, based in Cyprus.

The law firm REVERA represents the SwissSoft machine in all legal issues, which is fitting given that one of the partners in that firm, Helen Mourashko, is married to Pavel Kashuba, CFO at SoftSwiss.

REVERA, interestingly, also provides “Migration and Immigration services”, taking care of any legal issue one individual might run into. In the document pictured below, Helen Mourashko is a legal representative for her friends too.

Those individuals, most of them of Belarussian nationality, had their share in another scandal, which links them to crypto processing for the Russian market, hence, providing a sanction bypass, using their net of companies to hide their trails.

Despite removing all evidence of their connection, there was a time when Montik boasted his friendship with Russian criminal partners Roland Yakovlevich Isaev and Paata Gamgoneishvili quite publicly.

Isaev, together with his longtime friend Paata Gamgoneishvilli, was involved in multiple companies and multiple crimes. Recently, they have been hit by sanctions imposed by the international community and they had to find a way to move money in and out of Russia. Of course, oligarchs used their crypto services before, to launder money from their illegal activities, but after the Russian invasion they used it to save their assets.

Naturally, as a hotshot entrepreneur dealing in crypto and casinos, Montik cut all ties with Russian criminals, at least publicly, to save his skin. But the trade volume suggests that they are still in very good relations, perhaps better than ever.

Back to the ACMA, that was only the start of their troubles, as the ACMA conducted 9 separate collective investigations and issued 13 formal warnings to Dama NV, targeting different casinos operated by them, mostly for “providing prohibited and unlicensed regulated interactive gambling services”. Those casinos are not available in Australia anymore.

In Europe, this time it was the N1 that got into legal trouble, not insignificant by scale. Namely, N1 Interactive Ltd. was penalized in 2021 with a €500,000 fine by the Dutch regulatory body, de Kansspelautoriteit (KSA). This penalty is imposed for unlawfully providing gambling services to Dutch players through its Betchan website.

According to the regulator, an investigation into the Betchan platform revealed its infringement of Dutch laws by allowing access from the Netherlands without acknowledging the country’s prohibition on online gambling activities. The fine amount was determined by considering several factors, including the absence of visible age verification measures on the site and the imposition of inactivity fees on players. Consequently, the fine exceeded the standard level typically applied to similar violations.

Furthermore, the KSA announced that the Betchan website is now inaccessible from the Netherlands, as a result of actions taken by the operator.

However, a year later, in March of 2023, a fine of €500,000 might have seemed like peanuts to N1, since the KSA struck again. This time with a ridiculously high fee of €12,6 million!

N1 Interactive got such a fine because the violation was repeated after the previous fine had been issued. The official statement of N1 “categorically” disputed the fine, arguing that it had already taken several measures to prevent players from the Netherlands from accessing its online casino offerings. N1 had asked the regulator to delay the publication of the decision since the court appealed the official issue, but this request was denied.

Either way, it seems that the fines imposed are not going anywhere and that our squad will eventually have to pay their dues. Registering their companies off-shore, in places that have a high tolerance for betting and gambling businesses is not a guarantee that highly regulated markets of the EU and Australia will look lightly at them.

If anything, other countries should take a deeper look into their legal practices, considering that they not only commit legal offenses but have no intention of following them at all – even when threatened with multimillion-dollar fines.

Criminals from SoftSwiss have been fined by Netherlands and Australia, and we hope for a swift reaction from other countries. But, the main reason they haven’t already made any moves is bribe.

We know that SoftSwiss boys use bribe as their solution to every problem, and it works great for them, since this is the way of Russian and Belarusian criminals involved. The ones who really suffer from their crimes are scams are regular, innocent people.

Some questions are answered, but some remain hidden still. Who supervises the €13 billion profit they claim they make?

What else has to happen for authorities to look into dirty crime money of Ivan Montik, Pavel Kashuba, Roland Isaev and Paata Gamgoneishvili made from drug trafficking, illegal gambling, Forex and investments scams and helping Russian criminals under sanctions?