United States cryptocurrency miner CleanSpark increased its Bitcoin (BTC) holdings in the final month of 2024, as the company touted efficiency improvements and a sharp acceleration of hashrate growth as reasons for its success.

According to a Jan. 6 report, CleanSpark mined 668 BTC in December and 7,024 BTC for the entire year. The company’s hashrate—or the amount of computational power deployed to secure the Bitcoin network—jumped 287.9% year over year.

Hashrate efficiency also improved by 33.3% from the previous year, bringing the company’s operating hashrate to 39.1 exahashes per second by the end of 2024.

CleanSpark sold 12.65 BTC in December, which represented only 58% of the company’s average daily production during the month.

The average selling price was roughly $101,246, netting the company $1.28 million in proceeds.

CleanSpark significantly increased its mining capacity in 2024 by acquiring seven facilities in Knoxville, Tennessee. At the time, the company said the new facilities would boost its hashrate by 22%.

CleanSpark stock, which trades under the ticker symbol CLSK, rallied sharply on Jan. 6. However, CLSK still trades at less than half of its 52-week high.

Related: Bitcoin hashrate taps all-time high

A top-5 corporate Bitcoin holder

By the end of 2024, CleanSpark had accumulated 9,952 BTC for a total value of $1.01 billion. It’s now the fifth largest corporate holder of Bitcoin, leapfrogging Tesla.

Only MicroStrategy and three other mining companies hold more Bitcoin than CleanSpark.

As Cointelegraph reported, MicroStrategy added to its Bitcoin holdings by acquiring another 1,070 BTC in the first week of January.

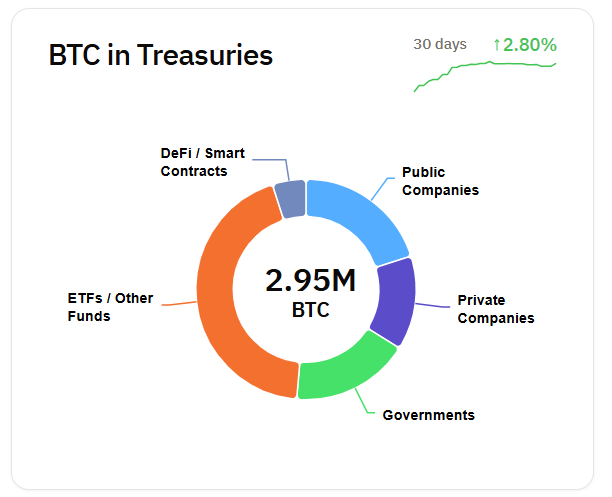

There is a total of 2.95 million BTC held in treasuries. Source: BitcoinTreasuries.NET

Publicly listed companies now hold 593,152 BTC, accounting for roughly 20% of institutional Bitcoin treasuries, according to industry data. However, the caveat is this data also includes government holdings of confiscated Bitcoin.

There are signs that more corporations are looking to add Bitcoin to their balance sheets. Last month, space technology company KULR announced that it had converted $21 million in cash into Bitcoin.

This came after Canadian companies Matador Technologies and Quantum BioPharma purchased Bitcoin as part of their corporate treasury strategy.

Source: Hunter Horsley

Bitwise CRO Hunter Horsley believes 2025 will be the year of “Bitcoin Standard” corporations as more companies add BTC to their balance sheets.

Related: Bitwise files for ETF tracking firms with Bitcoin treasuries