Shares in China-based crypto mining chip designer Nano Labs rose slightly after announcing it is now accepting Bitcoin as payment for its goods and services through a business account on Coinbase.

In a Nov. 11 statement, the Huangzhou-based crypto mining chip maker, which is listed on the Nasdaq, said the move was part of a “commitment to embracing the latest in financial technology” as demand increases for “digital currency transactions in the technology sector.”

Nano Labs said it was taking a “proactive stance in the evolving digital economy” as crypto “adoption continues to grow, particularly among businesses seeking efficient and secure cross-border transactions.”

According to Nano Labs, adopting Bitcoin (BTC) will provide “greater payment flexibility,” but it didn’t offer any details about whether it intends to keep the cryptocurrency on its balance sheet.

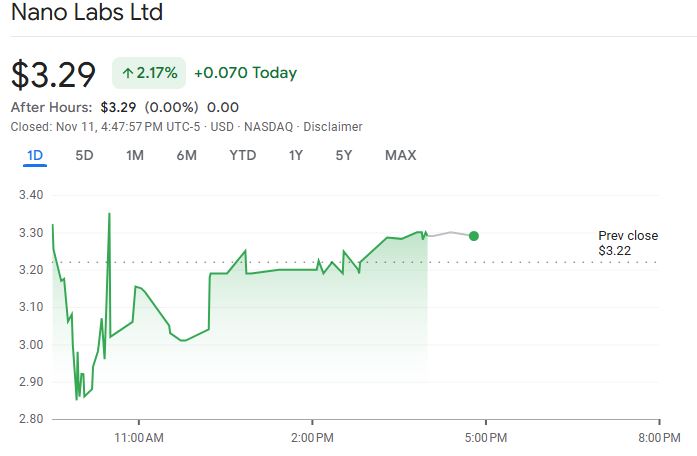

Following the announcement, shares in the Nasdaq-listed company rose 2.81% to $3.29.

Nano Labs’ share price saw a slight uptick after an announcement about accepting Bitcoin as a payment option. Source: Nasdaq

However, it hasn’t been enough to offset a share slump over the last month, with the price falling over 60% from a high of $8.33. It’s also nowhere near the all-time high of $96.20 set in July 2022, soon after the company was listed on the Nasdaq.

A growing number of companies are now accepting crypto as payment for some of their services.

Microsoft allows users of its Xbox store to pay in Bitcoin. McDonald’s adopted crypto as legal tender in its locations in El Salvador and Lugano, Switzerland.

The NBA franchise Dallas Mavericks also adopted Bitcoin as a payment option for club products and game tickets through BitPay.

China’s love-hate relationship with crypto

Beijing cracked down on crypto activities in May 2021, shutting down multiple mining firms and suspending crypto trading. However, authorities’ stance appears to have relaxed in recent times, despite an attempt to crack down on Tether (USDT) in January.

In September, former Chinese finance minister Lou Jiwei urged China to closely examine advancements in crypto during a speech at the Sept. 28 Tsinghua Wudaokou Chief Economists Forum in Beijing.

Related: China still controls 55% of Bitcoin hashrate despite crypto ban

A few days earlier, a Shanghai Intermediate People’s Court in China recognized Bitcoin as a unique and non-replicable digital asset and acknowledged its scarcity and inherent value in a Sept. 25. report. Another Chinese court came to a similar conclusion on Sept. 1.

Earlier this year, Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), also approved the first spot Bitcoin and Ether (ETH) ETFs on April 24.

Magazine: Real life yield farming: How tokenization is transforming lives in Africa