A crypto analyst says the Trump administration’s executive order to evaluate a digital asset stockpile, rather than a Bitcoin-specific Strategic Reserve, has dampened short-term bullish expectations for Bitcoin.

“The market sees limited upside for the asset in the short term, likely due to the absence of a specific BTC reserve announcement,” onchain options protocol Derive founder Nick Forster said in a Jan. 25 analyst note viewed by Cointelegraph.

Traders see limited short-term upside

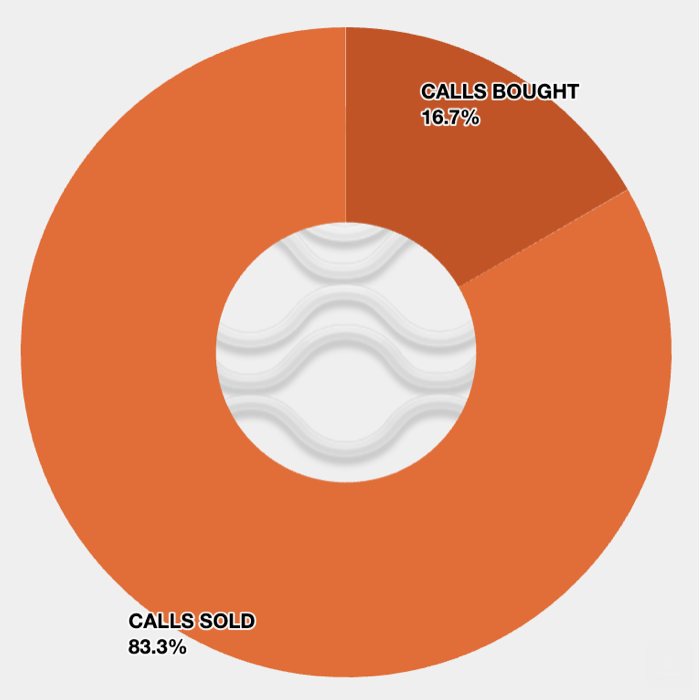

Forster cited Derive platform’s “staggering” 83.3% of Bitcoin options contracts on Jan. 24 being “calls sold” — which is when traders sell call options expecting Bitcoin’s (BTC) price to stay the same or decline.

Derive data shows that Bitcoin options contracts were calls sold on Jan. 24. Source: Derive

“Without real, actionable steps, like the creation of a national reserve, the market isn’t buying in,” he said.

On Jan. 23, US President Donald Trump signed an executive order creating a working group on digital asset markets tasked with finding ways to give the US leadership in the crypto industry, along with “evaluating the creation of a strategic national digital assets stockpile.”

Bitcoin traders’ disappointment could stall price

It sparked controversy within the Bitcoin community. Alongside this, Ripple are also advocating for a US multi-coin strategic reserve instead of one focused solely on Bitcoin.

Bitcoin is trading at $105,100 at the time of publication. Source: CoinMarketCap

Forster said, “Traders were expecting concrete actions, not vague promises, and the market is now making it clear that hype alone isn’t enough to drive lasting impact.”

At the time of publication, Bitcoin is trading at $105,100, as per CoinMarketCap data. The price is trading at around 3.8% below its most recent all-time high, just over $109,000.

Related: Bitcoin mining saved Texas $18B, boosted grid stability

Longtime trader and analyst Filbfilb recently told Cointelegraph he doesn’t think Bitcoin is trading at the $100,000 price level because people believe the Strategic Bitcoin Reserve would happen right away.

Filbfilb said there’s a reasonable argument that Bitcoin could go on toward the $180,000 target in 2025, a level he had been looking at in early 2023.

Magazine: BTC above $150K is ‘speculative fever,’ SAB 121 canceled, and more: Hodlers Digest, Jan. 19 – 25