NEW YORK: Bitcoin rode out a surprisingly strong US inflation print that roiled global markets by dimming hopes for rapid interest-rate reductions.

The digital asset traded at US$49,500 as of 10.21am yesterday in Singapore, near the highest level in over two years and little changed since Tuesday’s publication of above-forecast figures on US consumer prices in January.

In contrast, the S&P 500 Index slid 1.4% – its worst consumer price index-day performance since September 2022 – while gold slumped and bond yields soared as traders dialled back expectations for a Federal Reserve rate cut before July.

Bitcoin showed “impressive resilience despite the overnight deterioration in risk sentiment,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note.

At the same time, separate technical analysis based on chart patterns signals the possibility of a temporary dip to the high US$30,000s, he said.

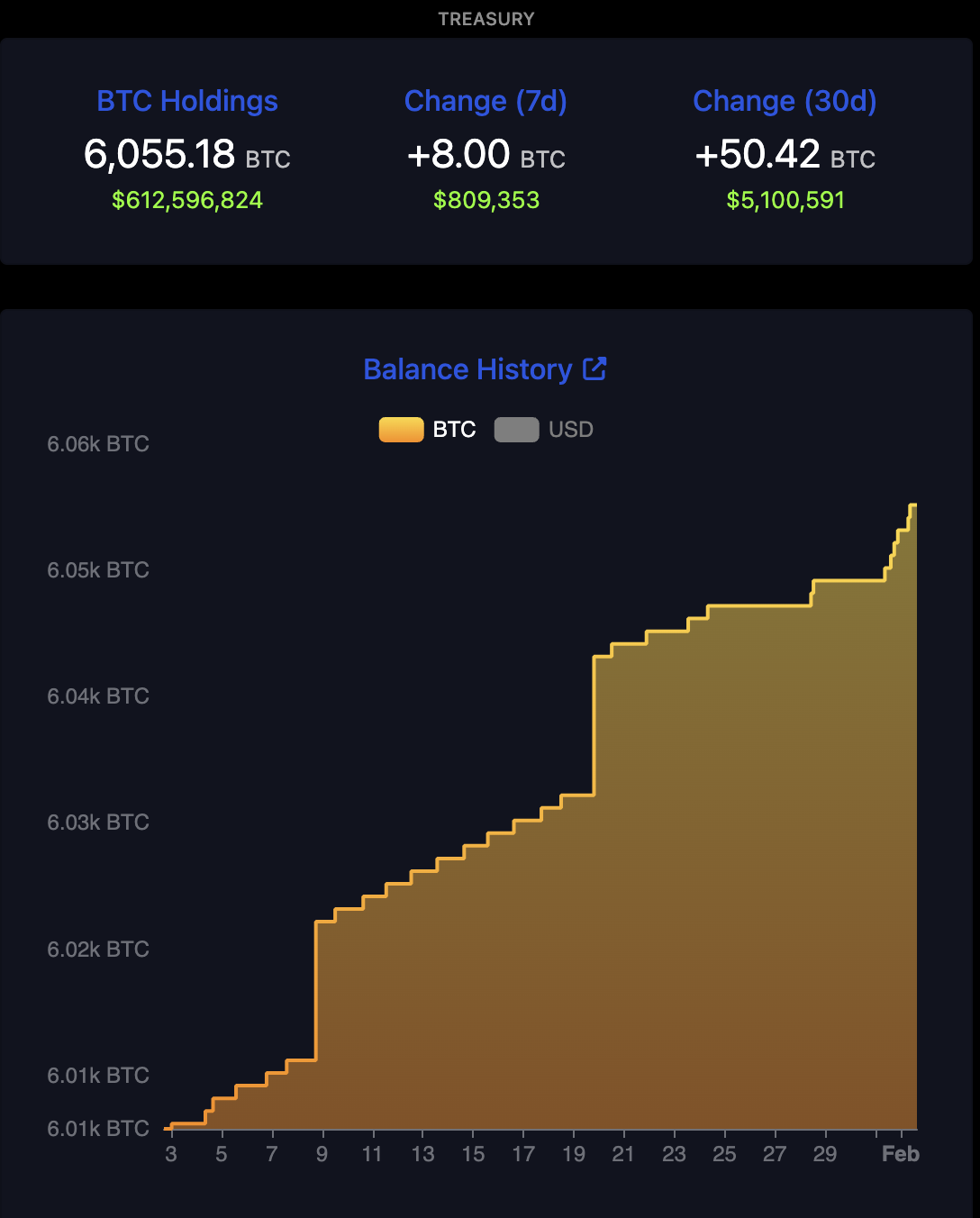

Sector-specific factors have been supporting bitcoin, including the debut of US exchange-traded funds dedicated to the token. The batch of products from the likes of BlackRock Inc and Fidelity Investments have attracted a net US$3.3bil since they began trading on Jan 11.

Meanwhile, the so-called bitcoin halving due in April will curb supply of the largest digital asset, a development viewed by many as a prop for prices based on historical precedent.

“We expect the market to take a short pause here after a spectacular four-month-long rally, before the upcoming bitcoin halving takes over the narrative,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets.

Bitcoin has tripled since the start of last year in a comeback from the 2022 digital-asset rout.

Wagers in the options market indicate traders are targeting prices beyond the record of almost US$69,000 achieved in November 2021. — Bloomberg