Bitcoin (BTC) reached an all-time high of $109,321 on Jan. 20, driven by expectations of a more crypto-friendly administration under United States President Donald Trump. The optimism stemmed from campaign promises for regulatory clarity and the appointment of pro-crypto figures to key positions.

Bitcoin derivatives show modest risk appetite from bulls

Despite the price surge, sentiment among Bitcoin whales and market makers remained stable. According to derivatives data, there was little confidence in further gains above $110,000, at least in the short term.

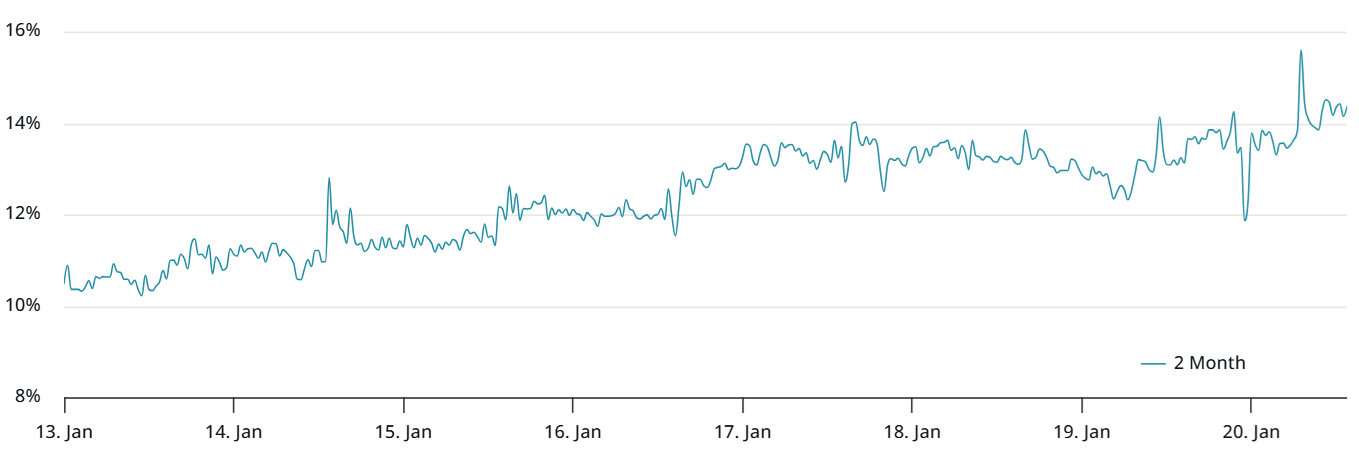

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

On Jan. 20, the Bitcoin futures premium relative to spot markets rose to 14%, up from 12% on Jan. 17. Although this figure exceeds the 10% neutral threshold, it reflects moderate skepticism among professional traders. Historically, bullish rallies have pushed the BTC futures premium beyond 30%.

To assess whether this effect is confined to futures markets, analysts also examine the BTC options skew metric. This indicator compares premiums on similar call (buy) and put (sell) options. Ratios between -6% and +6% are considered neutral, while a negative skew suggests bullish sentiment.

Bitcoin 2-month options 25% delta skew (put-call). Source: Laevitas.ch

Currently, the Bitcoin options 25% delta skew at Deribit stands at -6%, indicating a cautious level of optimism. This suggests that BTC derivatives markets are not showing signs of overconfidence, though this does not imply bearish sentiment.

Is Trump’s inauguration a “sell the news” event for Bitcoin?

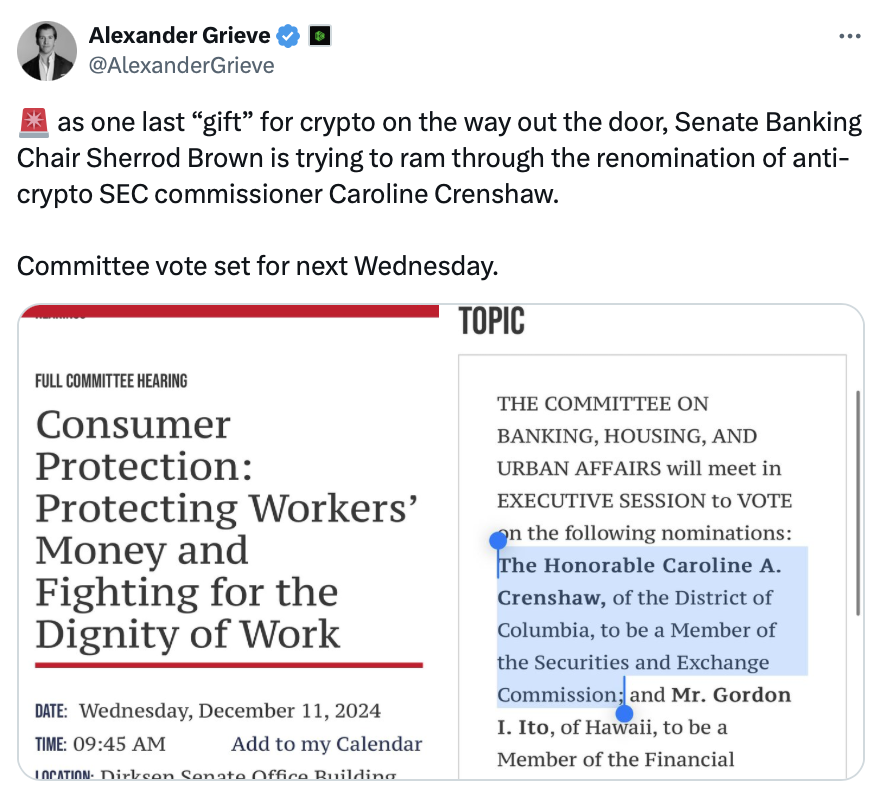

After hitting a record high, Bitcoin’s price fell below $105,000, leading traders to speculate whether Trump’s inauguration represents a “sell the news” scenario. Many expected measures to support the crypto market have already been announced, reducing the element of surprise. Furthermore, the potential for a “Strategic Bitcoin Reserve” plan depends on congressional and Senate approval, making its implementation uncertain.

Part of Bitcoin investors’ lack of enthusiasm and the subsequent price correction can be attributed to uncertainty surrounding the spiraling US fiscal debt situation, which has prompted investors to tread more cautiously.

The US federal budget deficit for the first fiscal quarter of 2025 surged nearly 40% compared to the same period in the previous year, according to the Treasury Department. Additionally, market projections estimate government debt financing costs will exceed $1.2 trillion in 2025, surpassing last year’s record.

Related: Bitcoin hits new all-time high above $109K ahead of Trump’s inauguration

In a Jan. 17 letter to congressional leaders, US Treasury Secretary Janet Yellen warned that the federal government would reach its borrowing limit on Jan. 21. She announced plans to employ “extraordinary measures” to temporarily free up borrowing capacity under the $36.1 trillion debt ceiling, averting a potential default.

Failure by lawmakers to reach a fiscal agreement in the coming days could trigger a partial government shutdown, disrupting essential services, delaying federal employee payments, and unsettling financial markets. This uncertainty has increased traders’ incentives to secure profits, particularly after Bitcoin’s price above $109,000 reflected a 17% year-to-date gain.

While professional traders remain cautious about further Bitcoin price increases, there are no signs of a surge in bearish bets. Data indicates that most traders have either stayed on the sidelines or positioned themselves for more sideways price action. However, a continued Bitcoin price surge could catch whales and market makers off guard, especially in a more crypto-friendly regulatory environment in the US.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.