Bitcoin (BTC) reclaimed the $60,000 level on Sept. 13, indicating a solid comeback by the bulls. Bitcoin’s rally of about 10% this week has helped buyers turn around September’s returns to positive.

Next week, investors will focus on the FOMC meeting scheduled for Sept. 18. CME Group’s FedWatch Tool shows a 50% probability of a 50-basis point rate cut. However, if the Federal Reserve delivers a 25-basis point rate cut, the cryptocurrency markets may witness a knee-jerk reaction to the downside.

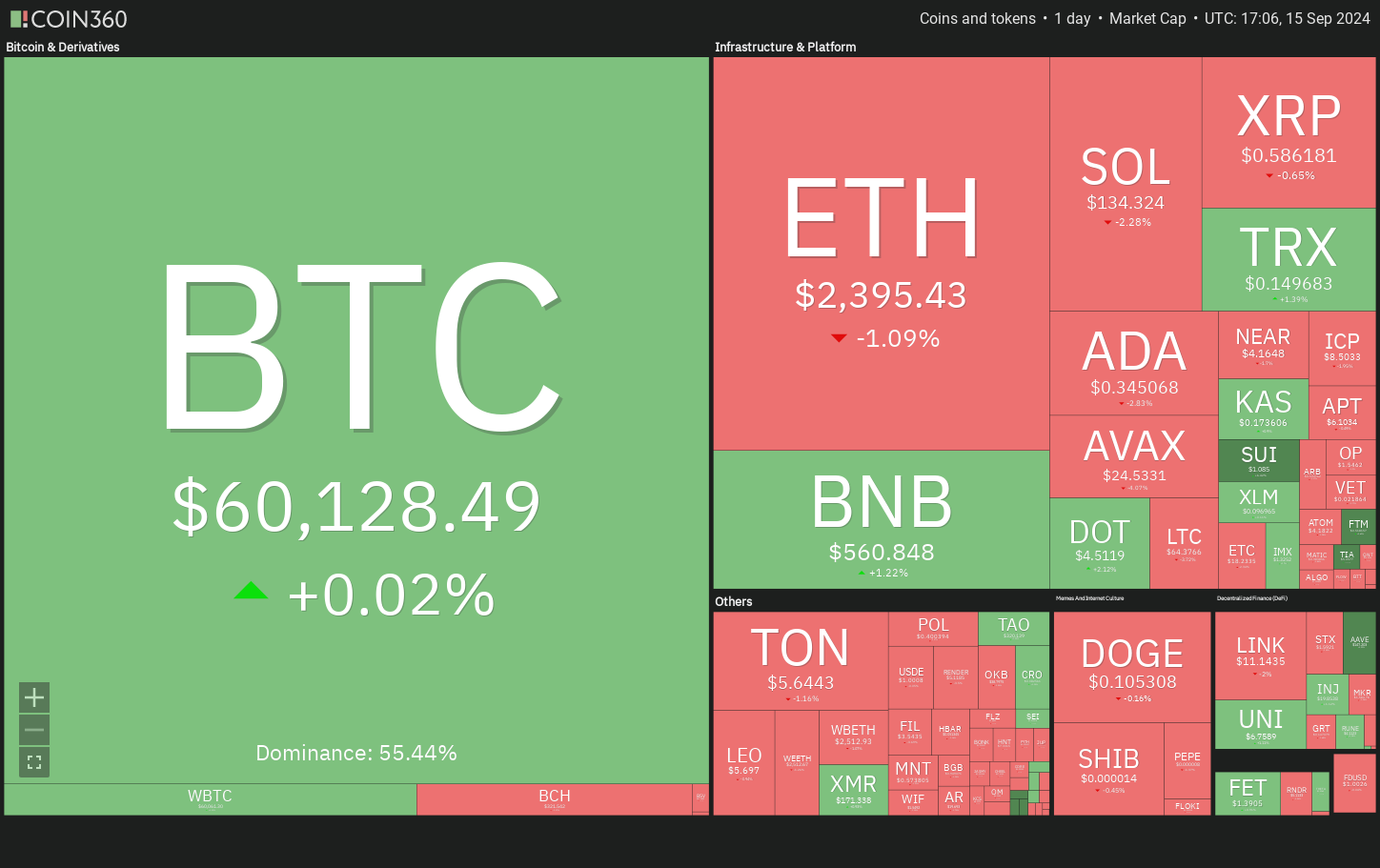

Crypto market data daily view. Source: Coin360

Bitcoin’s short-term uncertain price action has not deterred the long-term bulls from buying. Business intelligence and software company MicroStrategy announced that it had acquired 18,300 Bitcoin between Aug. 6 and Sept. 12 at an average price of $60,408 per Bitcoin, including expenses and fees. That increases the firm’s holdings to 244,800 Bitcoin, purchased at an average price of $38,585.

Could Bitcoin maintain above $60,000, attracting further buying? Will altcoins follow Bitcoin higher? Let’s study the top 5 cryptocurrencies that look strong on the charts.

Bitcoin price analysis

Bitcoin closed above the 50-day simple moving average ($59,693) on Sept. 13, indicating that the markets had rejected the breakdown below $55,724.

BTC/USDT daily chart. Source: TradingView

The 20-day exponential moving average ($58,461) has started to turn up, and the relative strength index (RSI) is in the positive zone, indicating that the bulls have the upper hand. If the price takes support at the moving averages, the BTC/USDT pair is likely to rally to $65,000 and then to $70,000.

This optimistic view will be negated if the price turns down sharply and breaks below the 20-day EMA. The pair could then tumble to $55,724. Repeated retests of a support level tend to weaken it, opening the doors for a fall to $52,500.

BTC/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows the bears are trying to stall the recovery near $61,200. If the price turns down and breaks below the 20-EMA, it will suggest that the bulls have given up. That may pull the price down to the 50-SMA and subsequently to $55,724.

Conversely, if the price bounces off the 20-EMA, it will signal that every minor dip is being purchased. That will improve the prospects of a rally above $61,200, and the pair could then jump to $65,000.

Fetch.ai price analysis

Fetch.ai (FET) is forming an inverse head-and-shoulders pattern, which will complete on a break and close above $1.51.

FET/USDT daily chart. Source: TradingView

If that happens, the FET/USDT pair could start a new uptrend. The pattern target of the bullish reversal setup is $2.32. However, it may not be an easy ride higher as the bears are expected to aggressively defend the $1.86 and $2.20 levels.

Contrary to this assumption, if the price turns down from the overhead resistance and breaks below the 20-day EMA ($1.23), it will suggest a range-bound action between $1.51 and $1 for a few days.

FET/USDT 4-hour chart. Source: TradingView

The pair has pulled back to the 20-EMA, indicating that short-term traders are booking profits closer to $1.51. If the 20-EMA cracks, it will suggest that the bulls are rushing to the exit. The pair may slide to the 50-SMA. This is a critical level for the bulls to defend because a break below it may sink the pair to $1.

If bulls want to retain the advantage, they will have to defend the 20-EMA and swiftly push the price above $1.45. If they do that, the pair may rally to $1.51.

Sui price analysis

The bulls are trying to break the lower lows and lower highs sequence in Sui (SUI), indicating a trend change.

SUI/USDT daily chart. Source: TradingView

The 20-day EMA ($0.92) has started to turn up, and the RSI is near the overbought zone, suggesting that the bulls have the edge. If buyers kick the price above the $1.11 to $1.18 resistance zone, the SUI/USDT pair could pick up momentum and climb to $1.44.

On the contrary, if the price turns down sharply from the overhead zone, it will suggest that the bears remain active at higher levels. The pair may then slide to the 20-day EMA and later to the 50-day SMA ($0.84).

SUI/USDT 4-hour chart. Source: TradingView

The bears are expected to mount a strong defense in the $1.11 to $1.18 zone. On the downside, the 20-EMA is the critical support to watch out for. If the price rebounds off the 20-EMA, the possibility of a break above the overhead zone increases.

Instead, if the price turns down and breaks below the 20-EMA, it will suggest profit booking by short-term traders. The pair may then slump to the 50-SMA. A break below this support could sink the pair to $0.86.

Related: Bitcoin ‘ticking time bomb’ setup targets $150K by 2025

Aave price analysis

Aave (AAVE) bounced off the 20-day EMA ($135), indicating that the sentiment has turned positive, and traders are buying on dips.

AAVE/USDT daily chart. Source: TradingView

Buyers will try to push the price to the overhead resistance of $160. A break and close above $160 will indicate the resumption of the uptrend. The AAVE/USDT pair may rise to $180 and then to $200.

This positive view will be invalidated in the near term if the price turns down sharply from the current level or the overhead resistance and breaks below the 20-day EMA. That could open the doors for a fall to $118.

AAVE/USDT 4-hour chart. Source: TradingView

The 4-hour chart shows that the bulls stalled the pullback at the 50-SMA, indicating buying on dips. There is minor resistance at $152, but it is likely to be crossed. The next stop is $160, where the bears will try to halt the up move again.

Alternatively, if the price turns down from the current level and breaks below $137, it will suggest that the bears are trying to make a comeback. The pair may then plummet toward $131.

Injective price analysis

Injective (INJ) has reached the resistance line of the descending channel pattern, which is likely to act as a stiff resistance.

INJ/USDT daily chart. Source: TradingView

The moving averages are about to complete a bullish crossover, and the RSI is in the positive territory, indicating advantage to buyers. A break and close above the channel will signal a potential trend change. The INJ/USDT pair could rally to $23 and thereafter to $28.

Contrarily, if the price turns down sharply from the resistance line and breaks below the moving averages, it will suggest that the pair may extend its stay inside the channel for some more time.

INJ/USDT 4-hour chart. Source: TradingView

The pair has been gradually moving toward the channel’s resistance line, which is expected to act as a stiff hurdle. If the price turns down from the resistance line but rebounds off the 20-EMA, it will signal strength. That will increase the likelihood of a break above the channel. The bears may again pose a strong challenge at $23, but the level is likely to be crossed.

If bears want to prevent the upside, they will have to pull the price below the 20-EMA. The pair may then slide to the 50-SMA.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.