Bitcoin’s (BTC) monthly price chart is less than 48 hours away from completing a bullish engulfing pattern for the first time in more than 18 months. The last time this happened was in January 2023, marking the bearish bottom from 2022.

Bitcoin 1-month chart. Source: TradingView

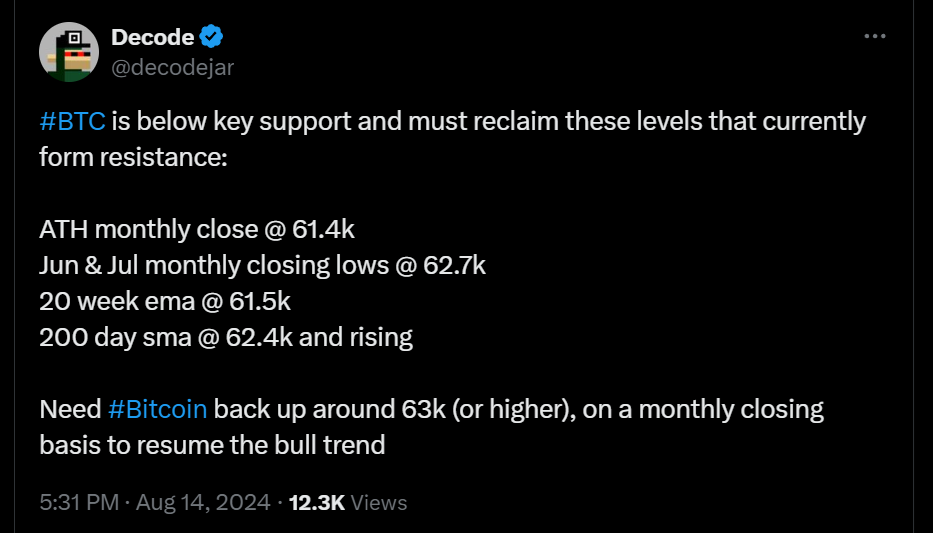

While Bitcoin’s long-term trend for Q4 and early 2025 looks positive, recent signs indicate there might be downside volatility in the short term.

Bitcoin OI retests $35B as funding rate stays flat

After a local bottom at $52,150 on Sept. 6, BTC has been on a parabolic rise, breaking past the previous lower-high pattern to facilitate a higher-high trend.

In the meantime, Bitcoin open interest (OI) has increased rapidly, reaching as high as $35 billion on Sept. 27. This is on par with previous OI tops in 2024, witnessed during February and July 2024.

Bitcoin funding rate and open interest chart. Source: Velo.data

While open interest indicates that the futures market remains heavily involved in dictating price movement, a comparatively flat funding rate indicates perpetual traders are still “indecisive.”

Adam, a popular independent trader, highlights this particular instance and points out another key factor of spot orderbook depth being skewed to the sell side.

Bitcoin spot orderbook negative depth by Adam. Source: X.com

In other words, spot traders are currently selling aggressively into $66K resistance.

Thus, BTC’s chances of downside market volatility remain high in the coming week.

Bitcoin forms a bearish div on 4-hour chart

From a technical perspective, “Uptober” may begin with a short-term correction for BTC to form a higher low pattern. As illustrated, Bitcoin’s 4-hour chart highlights a bearish divergence between its price and the relative strength index (RSI).

Bitcoin 4-hour chart. Source: TradingView

From its current price point, an immediate correction down to $62,300, or a 4.66% decline, is the immediate level. As observed, many liquidity wicks were formed near $62,000 en route to breaking above $66,000. So, an immediate bounce here is likely.

However, if the correction persists lower, the next retest range is an order block between $59,500 and $61,000, which also presents a confluence with the Fibonacci 0.5 level.

The EMA-50, 100, and 200 levels would also support a drop down to $61,000, which means this is technically the lowest correction range expected in the coming week.

A daily close below $60,000 may jeopardize the current bullish momentum.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.