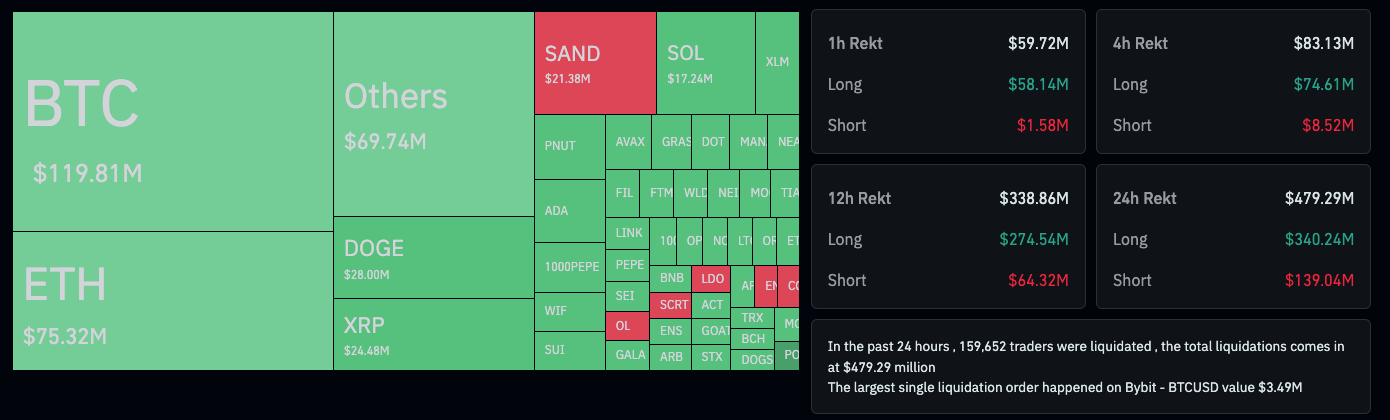

Bitcoin’s quest for $100,000 hit an impasse as sellers took control and pushed BTC price under $93,000. Margin traders sitting in long positions saw heavy losses as the total crypto market liquidations on the buy side reached $337.6 million over the past 24 hours.

Crypto market liquidations. Source: CoinGlass

Proof of the liquidations-driven sell-off can be seen in the chart below depicting volume-by-side data for major centralized exchanges and showing heavy selling at exchanges offering perpetual futures trading.

BTC/USD and BTC/USDT CEX volume by side. Source: TRDR.io

Looking beyond the forced selling of margin longs (liquidations), Glassnode identified Bitcoin long-term holders (LTHs) as another culprit behind the current selling. The analysts pinpointed the 6-month to 12-month LTH cohort as the primary seller “when an average cost basis 71% lower than the market price ( ~$57.9K).”

Things are getting heated! #Bitcoin long-term holders (LTHs) have come out in force, with selling pressure hitting -366K #BTC/month – the highest since April 2024. But who is actually selling? Let’s dig deeper: https://t.co/hr64gBGUCd

🧵👇 pic.twitter.com/OpsayTaNsf— glassnode (@glassnode) November 25, 2024

“With Bitcoin surging from $74K to $99K, they capitalized big on the rally.”

Financial markets are always a delicate balance between buyers and sellers and today’s price action saw the bias shift from the shorter-term sentiment being spot and leveraged long to short. As liquidations ramped up and Bitcoin price dropped closer to $90,000, a surge in short positions opened, and BTC’s funding rate climbed from 0.019 to a peak at 0.04.

BTC/USD 1-day chart. Source: TRDR.io

Related: Who cares about $100K? 5 Things to know in Bitcoin this week

BTC/USDT liquidation map. Source: CoinGlass

Liquidation map data now suggest that a Bitcoin price drop below $94,000 will kick off the next wave of forced selling to $90,000, a level which some traders have suggested they would be happy to bid.

$BTC Day 21 of the Cycle. Back at the 10dma generally a good spot to bounce and continue the uptrend.

Generally the midpoint (around day 30) there is weakness, so if no bounce here, $86-88k likely for the midpoint over next 7-10 days.

— Bob Loukas 🗽 (@BobLoukas) November 25, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.