Bitcoin (BTC) declined by 5.3% between Oct. 9 and Oct. 10, reaching a three-week low of $58,900. The market correction began after the United States reported higher-than-anticipated consumer inflation data, suggesting traders are concerned that the Federal Reserve has less incentive to continue cutting interest rates in the near future.

The reaction from Bitcoin price reflects investors’ view that there is an increased chance of a recession. The US Bureau of Labor Statistics reported a 0.2% increase in the Consumer Price Index (CPI) for September compared to the prior month, which triggered concerns of ‘stagflation’ among investors, according to Yahoo News. In this scenario, prices continue to rise despite economic stagnation, a situation that runs contrary to the central bank’s objectives of stimulating growth while controlling inflation.

Meanwhile, US jobless claims rose to a 14-month high, according to data released on Oct. 10. Initial filings for unemployment benefits unexpectedly increased, reaching a seasonally adjusted 258,000 by Oct. 5. Although part of the rise can be attributed to a labor strike at Boeing, the broader negative impact on the economy remains a significant concern for policymakers, as reported by CNBC.

While there’s no guarantee that Bitcoin’s price will be adversely affected if the US Federal Reserve is compelled to adopt a tighter monetary policy, investors fear that an overheated economy will cause a stock market correction. Consequently, traders’ morale is dampened, given the current high 88% price correlation between the S&P 500 and Bitcoin.

In this context, it’s natural to expect Bitcoin traders to become less optimistic about short-term prices, especially after two consecutive days of outflows from the US spot Bitcoin ETFs. According to data from Farside Investors, these instruments saw net outflows of $59 million between Oct. 8 and Oct. 9, reversing the trend from the prior two trading days.

Bitcoin’s bearish momentum accelerated after reports that market maker Cumberland DRW was sued by the US Securities and Exchange Commission for acting as an “unregistered dealer” in cryptocurrency transactions. According to a statement from the regulator, the Chicago-based company profited from sales of crypto assets “akin to sales of commodities.”

Bitcoin derivatives reflect short-term sell pressure

Regardless of whether those claims will hold up in court, traders tend to seek protection when fear and uncertainty arise. When Bitcoin fell below $59,000, its primary derivatives metrics showed weakness, suggesting a reduced demand for leveraged buying (long) activity.

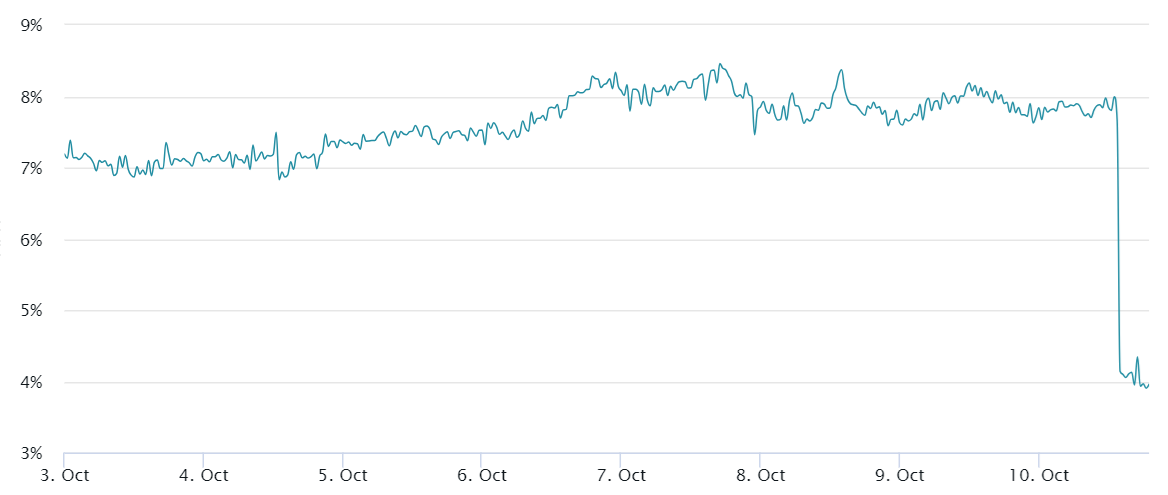

In neutral markets, the Bitcoin futures premium, which measures the difference between monthly contracts and the spot price on regular exchanges, should reflect a 5%–10% annualized premium (basis) to compensate for the longer settlement period.

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

On Oct. 10, the Bitcoin basis rate dropped below the 5% neutral threshold for the first time in more than two months. More importantly, Bitcoin dropped 24.6% in three days to $49,268 the last time this indicator flipped bearish, on Aug. 5. Therefore, the recent change in BTC futures metrics signals a major shift in traders’ sentiment.

Traders should also analyze the options market to understand the impact of the recent Bitcoin price movement. The 25% delta skew reveals when arbitrage desks and market makers overcharge for upside or downside protection. If traders anticipate a Bitcoin price drop, the skew metric tends to rise above 7%; conversely, during periods of excitement, it tends to be negative 7%.

Related: Dip in trading at Binance and other major crypto exchanges confounds experts

Bitcoin 30-day options 25% delta skew. Source: Laevitas.ch

The Bitcoin options 25% skew remained near zero, indicating that whales and market makers did not change their short-term risk-reward perception. Consequently, the sharp decline in BTC basis could be temporary, suggesting that a handful of large entities may have unexpectedly closed their leveraged long positions. Ultimately, derivatives traders are not betting on an imminent Bitcoin price decline.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.