Bitcoin’s (BTC) surprising 9.4% rally between Dec. 4 and Dec. 5 pushed the price to a new all-time high above $100,000. This movement was followed by a surge in demand from leveraged buyers, prompting traders to question whether the rally is sustainable and how whales and market makers are positioned.

Bitcoin 2-month futures annualized premium. Source: Laevitas.ch

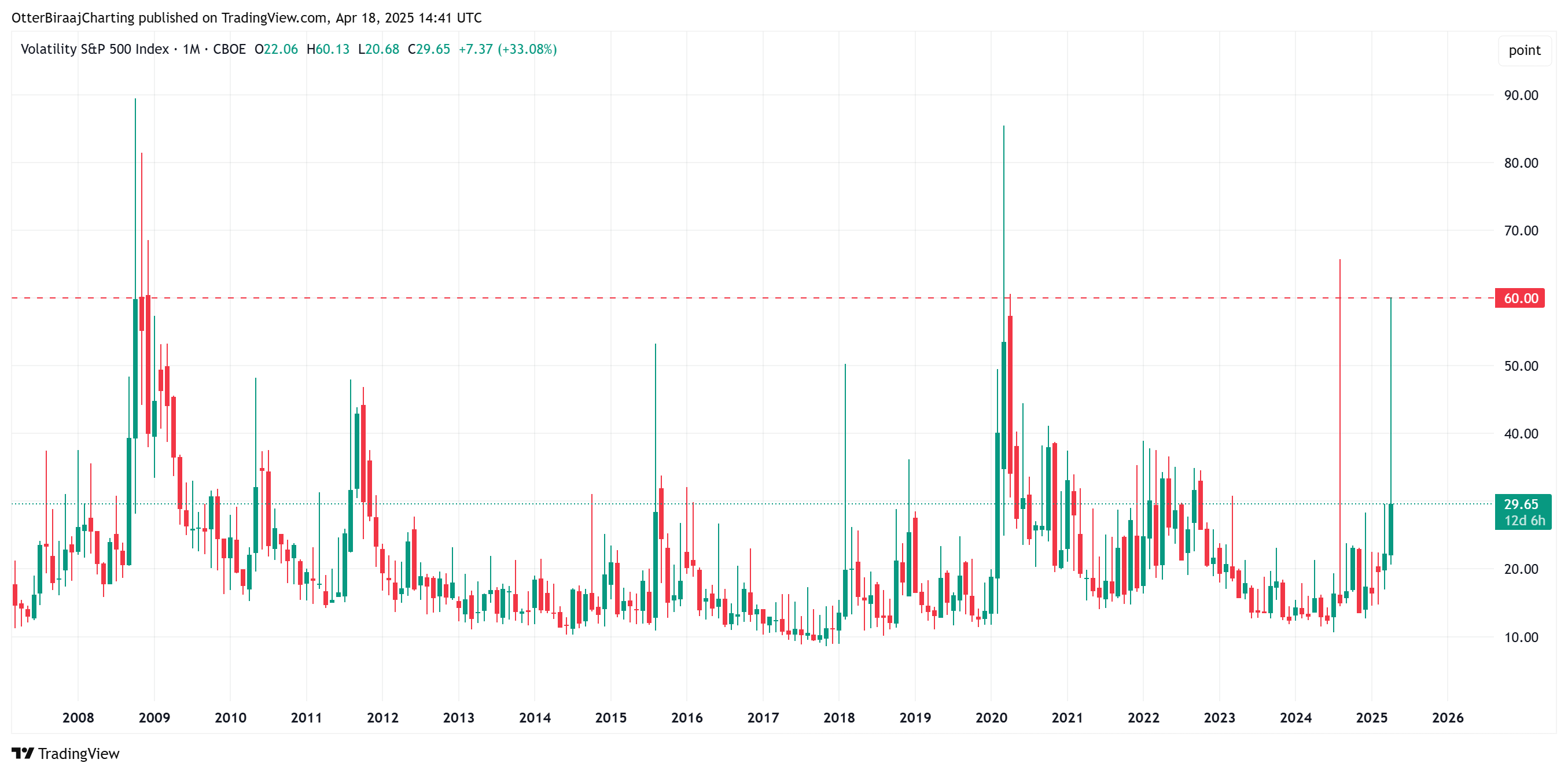

The last time Bitcoin futures traded with a 20% annualized premium (basis rate) relative to spot markets was on March 24, when BTC reclaimed the $70,000 level. Prior to that, even when Bitcoin reached its high of $73,757 on March 13, Bitcoin futures remained below the 20% mark.

However, most traders rely on leverage for short-term trades, and even a 40% annualized premium represents only a 3.8% cost for 40 days. Given that cryptocurrency investors are typically optimistic about price movements, the current 20% basis rate should not be a concern, especially after Bitcoin rallied 46% in the past 30 days.

Pinpointing the exact trigger behind Bitcoin’s surge to $103,844 is challenging, as several factors boosted traders’ sentiment. On Dec. 4, President-elect Donald Trump reportedly selected former Securities and Exchange Commissioner Paul Atkins, a well-known advocate for cryptocurrencies, to lead the agency.

On the same day, Russian President Vladimir Putin praised Bitcoin’s censorship-resistant features, stating that the new technology is “inevitable.” Additionally, US Federal Reserve Chair Jerome Powell remarked that Bitcoin is a direct competitor to gold, despite being a speculative asset.

Even for those who believe Bitcoin should not be used as a store of value due to its volatility, its $107 billion spot exchange-traded fund (ETF) market is too significant to overlook. Similarly, MicroStrategy, the publicly traded company that has been issuing shares and debt to acquire Bitcoin, is expected to join the Nasdaq-100 index in 2025.

MicroStrategy’s potential inclusion in the Nasdaq-100 index is positive for Bitcoin’s price, as it enables passive funds that track the index to allocate capital to MSTR shares, indirectly increasing exposure to Bitcoin holdings and driving demand.

Bitcoin options market signals continued confidence in bullish trend

To assess whether professional traders are overconfident, one should examine the Bitcoin options markets. Unlike futures contracts, options traders can engage in call (buy) and put (sell) positions, so analyzing the demand imbalance provides a useful indication of market sentiment.

Bitcoin options put/call ratio at Deribit. Source: Laevitas.ch

Since Dec. 2, open interest in put options at Deribit has lagged behind call options by 48%, consistent with prior weeks. This data suggests that derivatives markets were unlikely the driving force behind Bitcoin’s rally above $100,000, indicating that traders remain confident in the potential for further upside.

Related: Bitcoin ‘still in early innings’ at $100K — ARK’s Cathie Wood

Bitcoin is not immune to external factors, as investors worry that the global economy may have entered a standstill. Even without a real estate market collapse or a tech bubble burst, the stock market’s valuation presents a risk if earnings stagnate. Historically, when fear takes hold, investors tend to offload recent winners, which could negatively impact Bitcoin’s price.

Brian Leonard, portfolio manager at Keeley Teton, told CNBC on Dec. 5: “You’re sitting at records, but there’s not a lot of enthusiasm or euphoria. Historically, when the records happened, the valuations were more reasonable.” In other words, despite offering an alternative to the stock market, Bitcoin’s short-term trajectory remains closely tied to traditional financial markets.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.