Bitcoin has a slight chance of dropping nearly 26% in the first quarter of 2025 to around $75,000, a crypto analyst says — but other crypto commentators are less confident about a fall.

Derive head of research Dr. Sean Dawson said in a Jan. 28 markets report viewed by Cointelegraph that the probability of Bitcoin (BTC) falling below $75,000 by March “has risen to 9.2%, up from 7.2% in the last 24 hours.”

BTC faced volatility amid broad market downturn

Still, Bitcoin (BTC) moving closer to $100,000 has slightly bumped that probability.

Dawson based this on Bitcoin’s at-the-money implied volatility spiking from 52% to 76%, a sign of increased demand for put options “to protect against downside risk.”

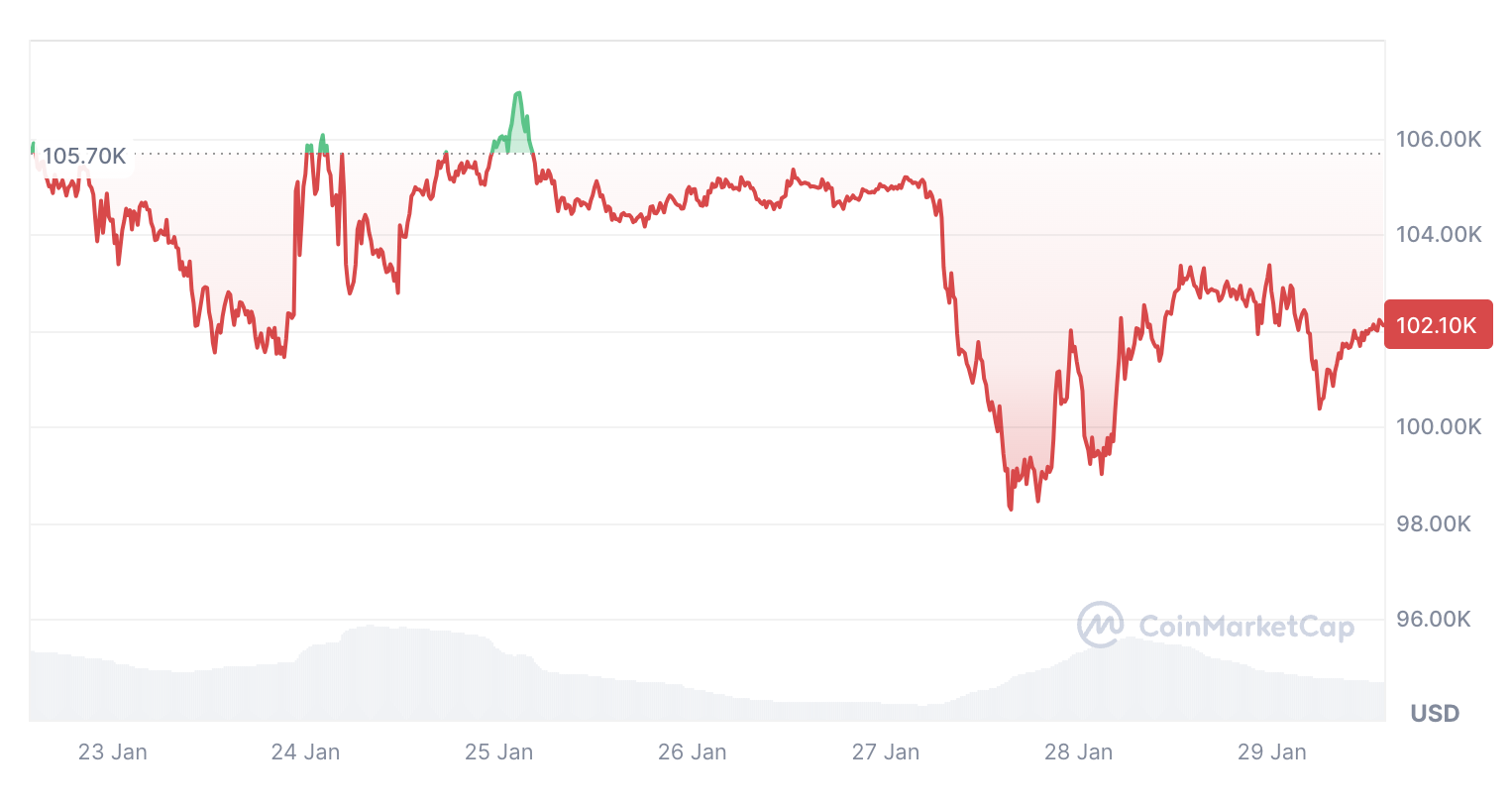

Bitcoin dropped 6.5% on Jan. 27 to $97,906 amid a broader crypto and stock market decline triggered by the release of China-based artificial intelligence project DeepSeek’s latest AI model.

Bitcoin has since bounced back above the $100,000 mark, trading at $102,100 at the time of publication, per CoinMarketCap data.

Bitcoin is trading at $102,100 at the time of publication. Source: CoinMarketCap

Dawson said the slight uptick in the probability of Bitcoin heading back toward $75,000 “reflects a shift in market sentiment toward bearishness as traders adjust to rising uncertainty.”

The last time Bitcoin was trading near $75,000 was on Nov. 8, just three days after Donald Trump’s US presidential victory. It then went on a month-long rally that saw BTC reach the long-awaited $100,000 price level for the first time on Dec. 5.

BTC tied to “broader macroeconomic shifts”

Bitfinex analysts noted in a Jan. 27 market report that Bitcoin’s drop, following a broader stock market downturn, reinforces its correlation with the wider market.

“Bitcoin’s price is less a standalone reflection of its market fundamentals and more tied to broader macroeconomic shifts, particularly in risk sentiment,” the analysts said.

Related: Absence of Bitcoin ‘panic selling’ suggests BTC drop below $98K is a short-term blip: Analyst

“In our view, Bitcoin is no longer just a digital asset playing by its own rules — but is now firmly tethered to the broader risk asset landscape,” they added.

Meanwhile, BitMEX co-founder Arthur Hayes predicts that Bitcoin could potentially pull back toward the $70,000 to $75,000 range, a move that may trigger a “mini financial crisis.”

According to Hayes, this could lead to a “resumption of money printing” that will send Bitcoin’s price to $250,000 by the end of 2025.

Magazine: You should ‘go and build’ your own AI agent: Jesse Pollak, X Hall of Flame

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.