AMP, an Australian superannuation fund, revealed that it invested approximately $27 million into Bitcoin (BTC) in May 2024 — making it the first large Australian superannuation fund to embrace the digital asset.

According to a report from Financial Review, the fund has roughly $57 billion in assets under management (AUM). The Bitcoin allocation is fairly conservative at 0.05% of the fund’s total assets under management.

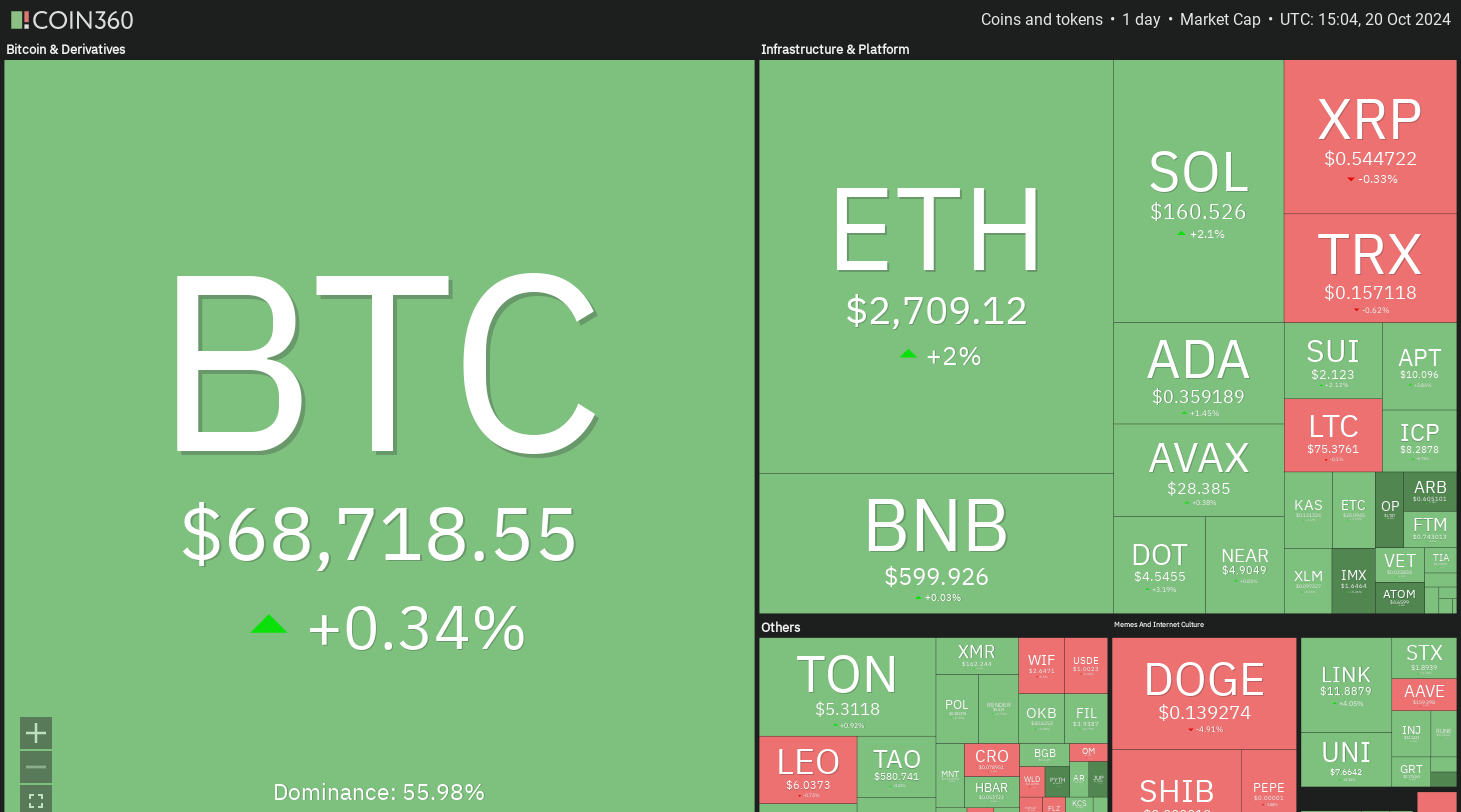

The superannuation fund reportedly acquired Bitcoin in the $60,000 to $70,000 range as a diversifier and to capitalize on the upward trajectory of Bitcoin, which has experienced a historic price rally following Donald Trump’s electoral victory on Nov. 5.

Despite Bitcoin’s upward price action and hitting the $100,000 milestone, other Australian superannuation funds show no signs of following AMP’s lead and still view the nascent asset as too risky to adopt.

AMP’s (ASX) price per share from December 2023 to December 2024. Source: AMP

Related: State pension plans can adopt crypto more easily than private plans

Pension funds diversify into Bitcoin

Bitcoin’s continued price appreciation and hedging properties have attracted the attention of pension funds worldwide, which seek to maximize gains and preserve purchasing power.

In July 2024, the state of Michigan’s pension fund revealed it had a $6.6 million exposure to Bitcoin through ARK 21Shares’ Bitcoin exchange-traded fund (ETF).

South Korea’s National Pension Service (NPS), which is the world’s third-largest public pension fund, followed suit in August with the purchase of 24,500 MicroStrategy shares.

Investing in MicroStrategy is viewed as a leveraged Bitcoin bet by market participants. MicroStrategy issues corporate debt in the form of convertible note offerings and equity to finance the continuous acquisition of Bitcoin.

In October, Jimmy Patronis, the official responsible for seeing the state of Florida’s public pension funds, began advocating for the state pension funds to invest in Bitcoin.

More recently, in November, United Kingdom-based pension manager Cartwright announced a 3% allocation into Bitcoin. At the time, Cartwright’s director of investment consulting Sam Roberts cited Bitcoin’s “Unique asymmetric risk-return profile,” as one of the main drivers behind the fund’s allocation.

“We are proud to have led this ground-breaking move which we hope will be the start of a trend for institutional investors in the UK,” Roberts wrote while imploring other fund managers to diversify holdings into Bitcoin.

Magazine: Big Questions: Did the NSA create Bitcoin?