An art gallery said a class-action lawsuit from a group of non-fungible token (NFT) holders should be dismissed, arguing that it isn’t responsible for any losses in the NFT prices due to a wider market downturn.

The Eden Gallery Group argued in a motion to dismiss, filed in a New York federal court on Jan. 7, that a “general market decline” in NFTs doesn’t show that fraud or misrepresentation occurred as alleged.

“Plaintiffs may have buyers’ remorse (even though the NFTs were a digital art product rather than an investment product), but their losses, if any, are due to market forces.”

A group of 36 individuals who purchased “Meta Eagle Club” NFTs sued Eden Gallary in October, alleging fraud, unjust enrichment and violation of New York’s General Business Law.

The group claimed Eden Gallery and artist Gal Yosef’s project “was a rug pull.” The Meta Eagle Club NFT collection sold 12,000 unique humanlike eagles and collected $13 million between February 2022 and November 2023.

In its motion, the Eden Gallery said “NFTs as an asset class were extremely popular when the Meta Eagle Club NFTs were released in early 2022, but the popularity of the NFT market in general then ebbed.”

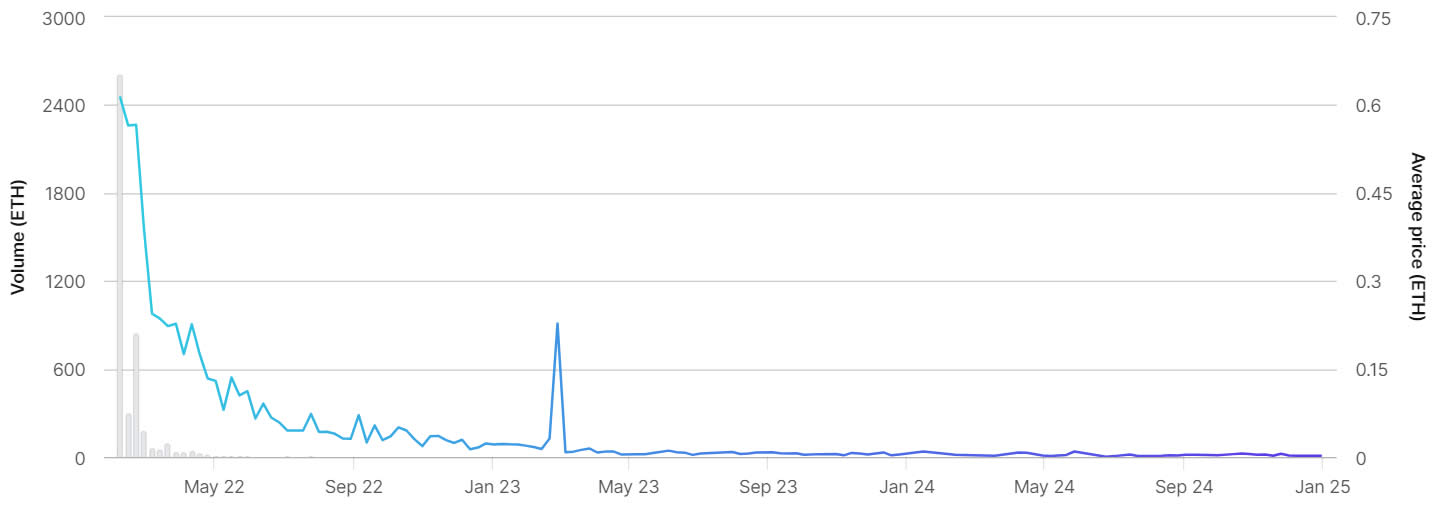

The floor price for a Meta Eagle Club NFT is currently 0.0051 ETH, or about $17, down from 0.6 ETH, or around $1,800, when they launched in February 2022, according to OpenSea.

Meta Eagle Club NFT volume and price since launch. Source: OpenSea

The group claims they overpaid for the NFTs due to alleged misrepresentations by the gallery and are seeking compensatory damages ranging between $1,224 and $70,219 per claimant.

Related: NFTs weekly sales surge 94% as crypto market continues bullish run

Eden Gallery also argued that none of the plaintiff’s individual claims meet the jurisdictional threshold of $75,000 and that aggregation of claims is impermissible.

Despite a recent uptick in NFT sales on the back of the crypto market bull run, the sector remains 98% down from its highs in early 2022 in US dollar sales volumes, according to industry analytics portal CryptoSlam.

Magazine: The 1 true sign an NFT bull market is back on: Wale, NFT Collector