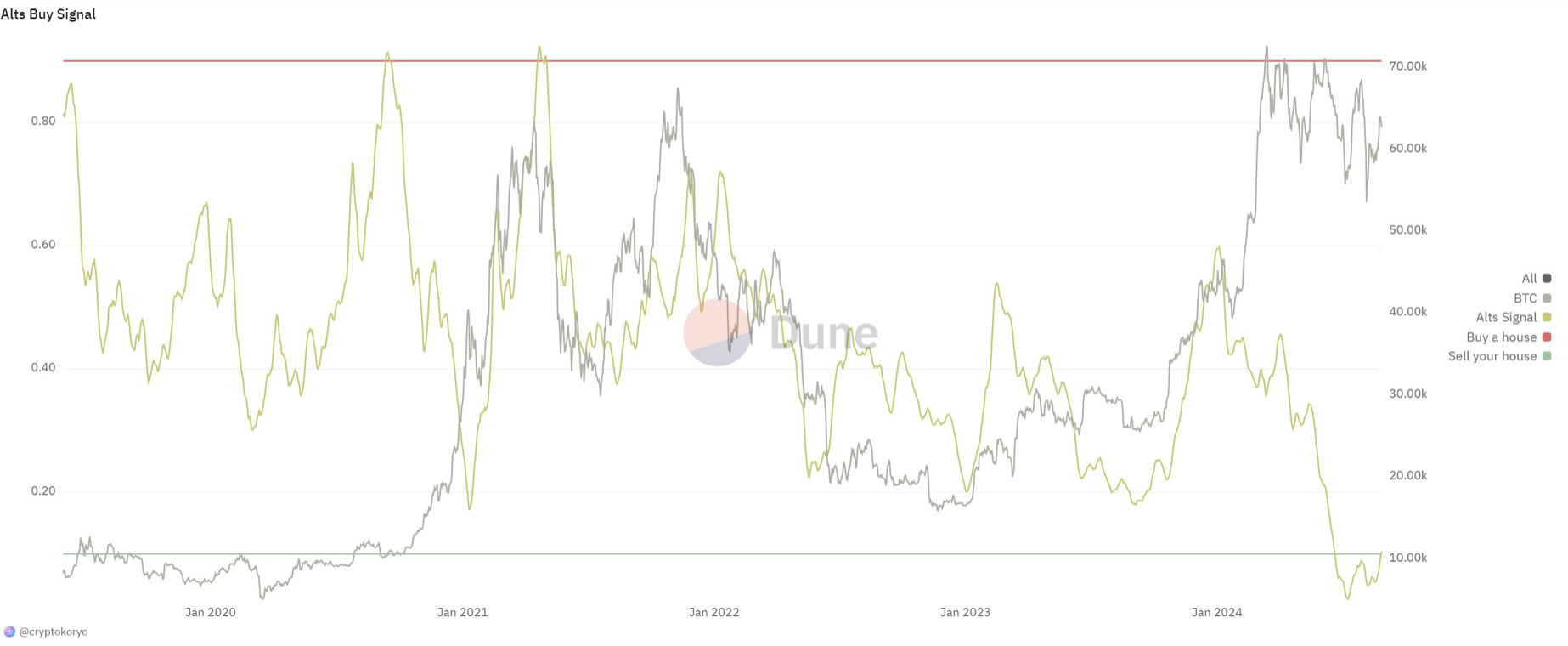

A prominent crypto trader believes altcoins might be in a prime accumulation phase, pointing out a buy signal that hasn’t triggered so low in over three years.

“Altcoins currently at the ‘sell your house to buy more’ level,” crypto trader Luke Martin told his 331,500 X followers in an Aug. 28 post.

The last time that the alts buy signal neared this level was in January 2021. Source: Luke Martin

The “alts buy signal” chart gives traders an indication when the overall altcoin market is at a buy based on historical data.

Martin said that when Bitcoin (BTC) was at this level in the summer of 2020, the price surged sixfold in the second half of the year.

“Price went vertical from 10k to 60k over the next 6 months,” Martin wrote.

Meanwhile, pseudonymous crypto trader Mags pointed out that the “altcoin market cap is forming a falling wedge pattern, which is a bullish continuation pattern.”

At the time of publication, the total altcoin market cap is $195.07 billion, according to TradingView. MN Consultancy founder Michael van de Poppe highlighted that it is “still 47% down from the highs” in an Aug. 25 X post.

The altcoin market cap peaked at $446.85 billion in November 2021.

Crypto trader Mags has pointed out a potential major shift in the altcoin market cap. Source: Mags

“Breakout is going to trigger a nice upside rally,” Mags added.

Among the top 10 cryptocurrencies, Toncoin (TON) has had the biggest decline over the past seven days, with a 15.31% fall to $5.57 following Telegram CEO Pavel Durov’s arrest in France on Aug. 24.

Other altcoins have experienced significant declines since their March year-to-date highs, which coincided with Bitcoin’s all-time high of $73,679.

Related: ‘No clear catalyst’ for bloodbath as top altcoins fall double digits

Solana’s (SOL) price has fallen 29% to $143.20 since its peak in March, while XRP (XRP) has dropped 19.7% to $0.57 from its year-to-date high in the same period, according to CoinMarketCap data.

Overall, investor sentiment in the crypto market remains cautious, according to the Crypto Fear & Greed Index, which has a “Fear” score of 29. The indicator is down 10 points from its score of 39 seven days ago.

Meanwhile, Bitcoin dominance is down slightly 0.12% over the past seven days to 57.20%. However, it is not far off 60%, which crypto analyst and Into The Cryptoverse founder Benjamin Cowen believes could be the peak for Bitcoin dominance.

“I don’t think it is going back up to 70%, my target for Bitcoin dominance has been 60%,” he explains.

Magazine: Bitcoiners are ‘all in’ on Trump since Bitcoin ’24, but it’s getting risky

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.