The altcoin market has seen substantial gains since Donald Trump’s United States presidential victory, but a venture capitalist has warned of a potential near-term shakeout as institutional investors increase their profit-taking activity.

However, not all traders agree.

“Considering alt season tapped out for now,” Hartmann Capital managing partner Felix Hartmann said in a Dec. 7 X post.

VCs will ‘start clipping more aggressively’

“Traders may stay irrational, but we are at the point where teams and VCs start clipping more aggressively,” Hartman said.

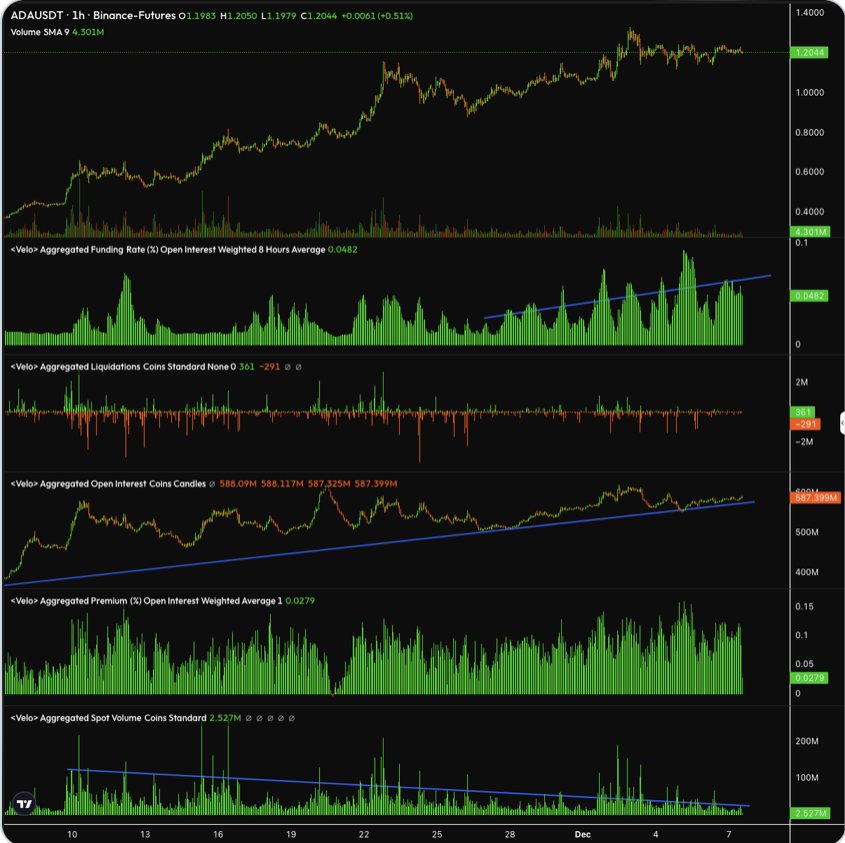

“Once momentum tips, we’ll have to get that lever out, and see some murder wicks,” Hartmann said. He explained that most altcoins funding rates are now “north” of 100% annualized, with recent “moves purely” driven by perpetual traders amid declining spot volumes.

“Leg down will be ugly,” Hartmann said.

Source: Felix Hartmann

Among the top 100 cryptocurrencies, the three altcoins with the highest gains since Nov. 1 were Hedera (HBAR) with a 99.31% increase, IOTA (IOTA) with 79.61% , and JasmyCoin (JASMY) with 72.47%, according to CoinMarketCap data.

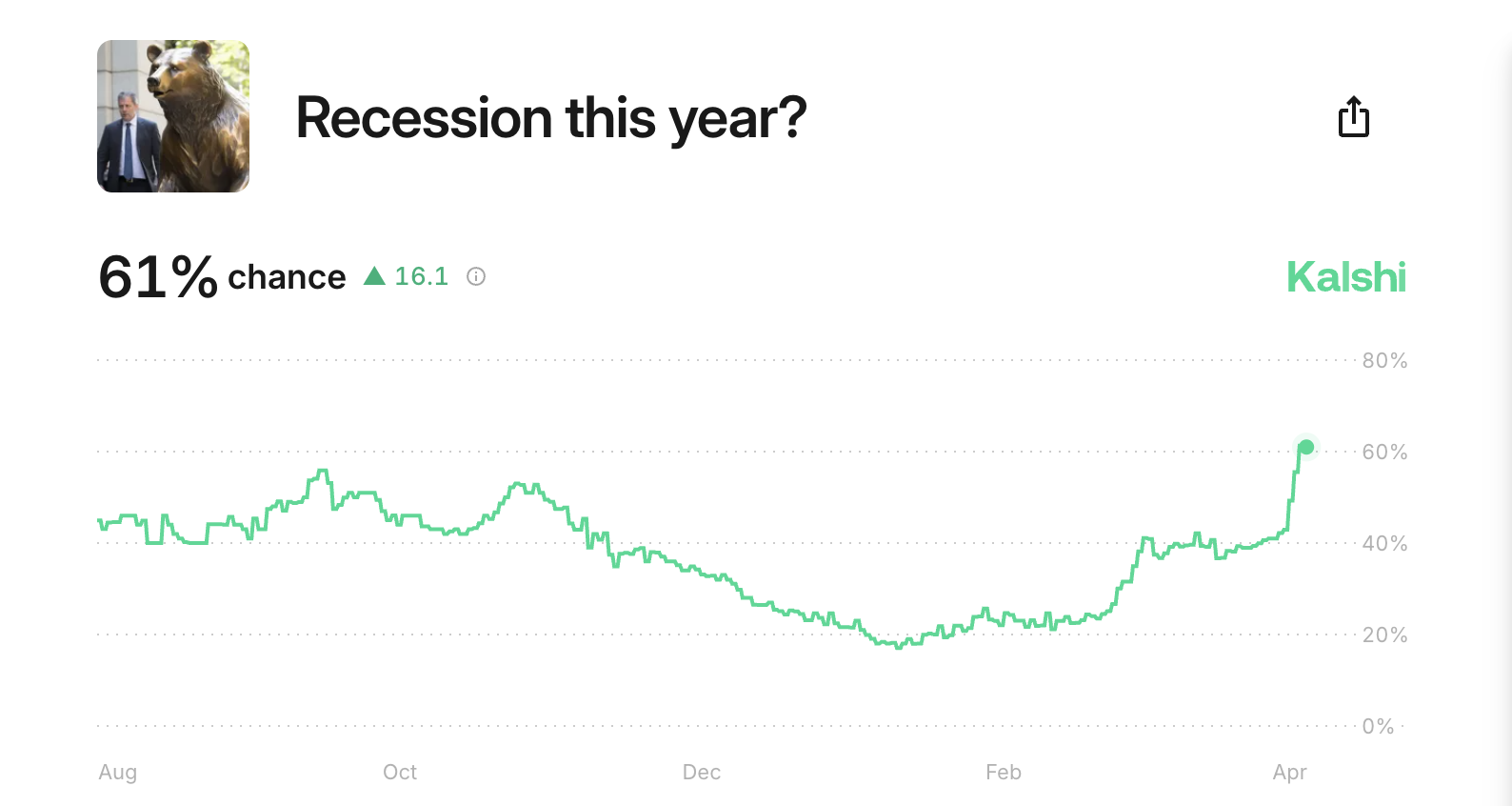

In 2021, after the altcoin market saw a significant surge, several altcoins tumbled sharply within a matter of months.

In November 2021, Solana (SOL) reached $248.36 before crashing 64% to $89 by January 2022. XRP (XRP) also faced a steep decline, losing about 51% in the same period.

Contrasting opinions from other traders

However, other crypto traders believe it is just the beginning for altcoin season.

Pseudonymous crypto trader MilkyBull Crypto said in a Dec. 6 X post “from this month till March seems logical.”

“Lasts about 90 days,” he added.

“Altseason has just started,” Sensei told his 72,900 X followers.

Related: Altcoin funding rates hit 9-month high — Bullish for altseason or a red flag?

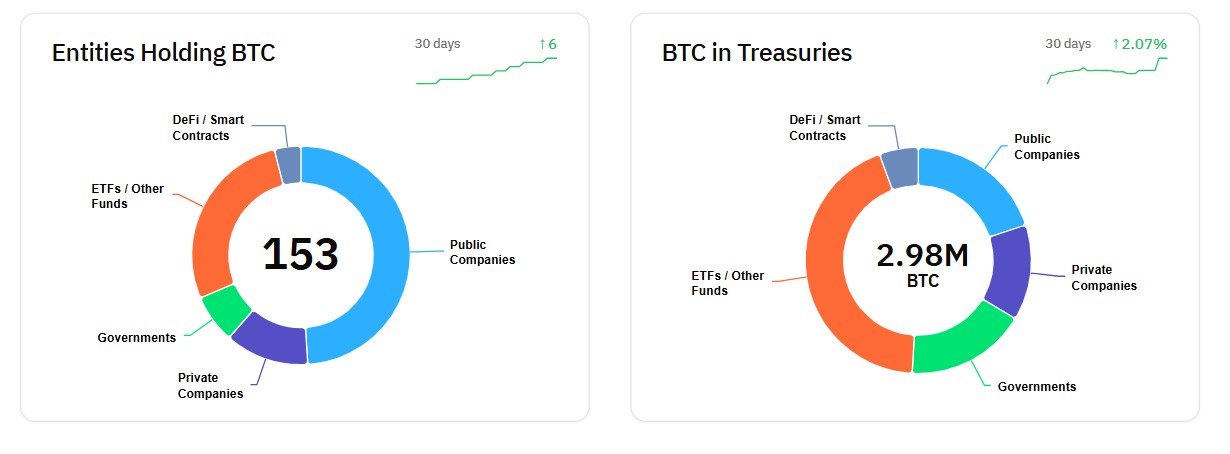

Traders often monitor Bitcoin dominance as a key indicator for the onset of altcoin season. At the time of publication, Bitcoin dominance is 55.11%, having dropped 7.88% over the past 30 days, according to TradingView data.

On Dec. 4, Cointelegraph reported that the 30-day funding rate for perpetual futures has risen significantly, with bulls paying between 4% and 6% per month to maintain leveraged positions, according to data from CoinGlass.

While such costs may seem manageable during strong uptrends, they can quickly erode traders’ margins if prices stagnate or dip.

Magazine: ‘Normie degens’ go all in on sports fan crypto tokens for the rewards